As we witness Bitcoin's price surge in the current bull market, it's crucial to also anticipate what lies ahead. Let's delve into the numbers and calculations that can guide us in estimating where Bitcoin might bottom out in the next bear market based on historical trends and fundamental valuations.

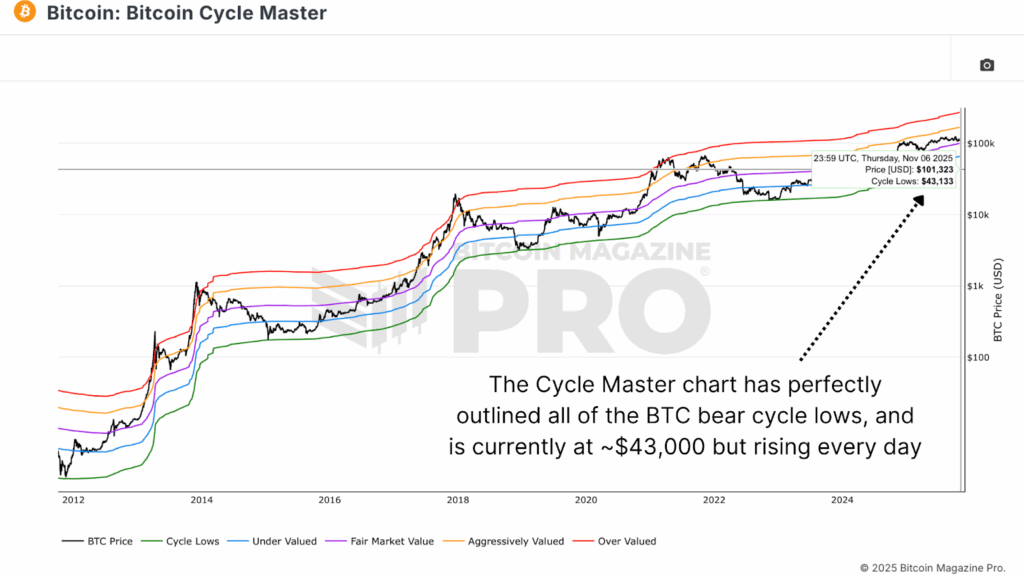

The Cycle Master Model: Decoding Bitcoin's Price Bottoms

Imagine having a crystal ball that accurately predicts Bitcoin's cycle bottoms. That's precisely what the Cycle Master chart offers by analyzing various on-chain metrics to create price bands. Historically, this chart has superbly identified Bitcoin's major bottoms, from $160 in 2015 to $3,200 in 2018, and $15,500 in late 2022. Currently, this band hovers around $43,000, providing a valuable reference point for estimating future declines.

The Power of Historical Data

By studying past cycles, we gain valuable insights into potential future scenarios. The green "Cycle Lows" line on the chart has consistently indicated Bitcoin's macro bottoms, offering a roadmap for what may lie ahead.

Diminishing Drawdowns: Understanding Bitcoin's Resilience

Let's talk about the MVRV Ratio, a metric comparing Bitcoin's market price to its realized price. During severe bear markets, Bitcoin has historically dropped to around 0.75x its realized price. This means the market price typically falls about 25% below the total cost basis of all coins in circulation.

Estimating Downside Potential

As Bitcoin's price behavior evolves, we observe a trend of diminishing drawdowns. While earlier cycles experienced significant declines of up to 88%, recent cycles have seen this decrease to 80% in 2018 and 75% in 2022. Projecting forward, this trend suggests that the next bear market could lead to a retracement of around 70% from peak levels.

Forecasting Bitcoin's Future: Price Targets and Market Trends

Before predicting the next low, we must first estimate where this bull run might culminate. Based on historical patterns, Bitcoin tends to peak at approximately 2.5x its realized price. If this trend continues, we could see Bitcoin hitting around $180,000 per BTC by late 2025.

Insights into Market Dynamics

By analyzing historical MVRV multiples and price growth trends, we can anticipate potential price tops and bottoms, providing a roadmap for navigating the volatile cryptocurrency market.

Bitcoin's Price and Production Costs: A Symbiotic Relationship

Bitcoin's production cost, reflecting the energy expenses needed to mine one BTC, serves as a reliable long-term valuation metric. This cost has consistently correlated with Bitcoin's major bear market bottoms, acting as a fundamental support level for prices over time.

The Role of Production Cost in Price Stability

When Bitcoin's price falls below its production cost, it signals challenges for miners and often presents attractive accumulation opportunities for investors. Monitoring this cost can offer valuable insights into potential market movements and entry points.

Looking Ahead: A More Mature Bitcoin Market

As we navigate through Bitcoin's cyclical nature, it's evident that each phase brings unique challenges and opportunities. The upcoming bear market is projected to be less severe, reflecting the market's increasing maturity and liquidity-driven dynamics.

Embracing Market Evolution

While price retracements are part of Bitcoin's journey, they signify growth and realignment rather than failure. A potential pullback to the $55,000–$70,000 range would align with historical patterns, highlighting the cyclical nature of Bitcoin's price movements.

Frequently Asked Questions

Can I take physical possession of gold in my IRA?

Many people ask themselves whether it is possible to physically own gold in an IRA. This is a valid question as there is no legal route to it.

If you take a closer look at the law, there is nothing that can stop you from having gold in your IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It is easy to toss gold coins, but it's not easy to place them in an IRA. If you decide to keep your precious metal in your own home you will have to pay two taxes. One for the IRS, and one for your state.

There are two ways to lose your gold: pay taxes twice and keep it in your house. Why would you want it to stay in your home?

It might seem that you want the security of knowing your gold is safe inside your home. You can protect your gold from theft by storing it somewhere more secure.

If you are planning to visit frequently, your gold should not be left at home. If you leave your precious gold unattended thieves will easily steal it.

It is better to keep your gold in an insured vault. Your gold will be protected against fire, floods, earthquakes, and robbery.

Another advantage to storing your gold in a vault is that you won't have to worry about paying property tax. Instead, income tax will be charged on any gains made from the sale of your precious metal.

A IRA can be a great option if you want to avoid paying tax on your gold. With an IRA, you won't have to pay income tax even though you earn interest on your gold.

Capital gains tax is not required on gold. If you decide to cash it out, you will have full access to its value.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

Bottom line: You can have gold in an IRA. Your fear of it being stolen is what holds you back.

Are gold- and silver-IRAs a good idea.

This could be a good option for anyone looking to quickly invest in both silver or gold. There are other options as well. Please feel free to reach out to us with any questions. We are always happy to assist!

Can you make a profit on a Gold IRA?

It is important to first understand the market in order to be able to invest and secondly to identify what products are currently available.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

Also, you should find the broker that provides the best service possible for your account type.

You can choose from a variety of accounts, including Roth IRAs or standard IRAs.

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

What is the most valuable precious metal?

Investments in gold offer high returns on their capital. It protects against inflation as well as other risks. As inflation worries increase, gold prices tend to rise.

It's a good idea to purchase gold futures. These contracts will guarantee that you will receive a specific amount of gold at an agreed price.

Gold futures are not for everyone. Some people prefer to own physical gold instead.

They can trade their gold with other people. They can also trade it anytime they like.

Some people would rather not pay tax on their gold. To do that, they buy gold directly from the government.

This requires that you make multiple trips to the local post office. You will first need to convert any existing gold in coins or bars.

Then you will need a stamp to attach the coins or bars. Finally, send them off to the US Mint. There they will melt the coins or bars into new ones.

These new coins and bars are stamped with the original stamps. These new coins and bars are legal tender.

But if you buy gold directly from the US Mint, you won't have to pay taxes.

Which precious metal would you prefer to invest in?

Does a gold IRA earn interest?

It all depends on how much you invest in it. If you have $100,000 then yes. If your assets are less than $100,000, it is no.

How much money you place in an IRA will determine how it earns interest.

If your annual retirement savings contributions exceed $100,000, you might want to open a brokerage account.

Although you'll likely earn higher interest, there are greater risks. It's not a good idea to lose all of the money you have invested in the stock exchange.

However, if you only put in $100,000 per annum, you'll probably be better off with an IRA. At least until the market starts growing again.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

regalassets.com

wsj.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

How To

How to convert your IRA into a Gold IRA

So you want to move your retirement savings from a traditional IRA into a gold IRA? This article will assist you in that endeavor. Here's how you can do it.

“Rolling Over” refers to the process of transferring money between two types of IRAs (traditional and gold). This is done because tax advantages go along with rolling over an account. Others prefer to invest in tangible assets, such as precious metals.

There are two types of IRAs — Traditional IRAs and Roth IRAs. The difference between these two accounts is simple: Traditional IRAs allow investors to deduct taxes when they withdraw their earnings, while Roth IRAs don't. If you put $5,000 into a Traditional IRA today, after five years you can only withdraw $4,850. The Roth IRA would allow you to keep every cent if you invested the same amount.

This is what you need to know if you want to convert an IRA from a conventional to a IRA to a IRA with gold.

First, you will need to decide whether your current balance should be transferred to a new account. When transferring money, you'll pay income tax at your regular rate on any earnings that exceed $10,000. But if you choose to roll over your IRA, you won't be taxed on those earnings until you reach age 59 1/2.

Once you've made up your mind, you'll need to open up a new account. You'll likely be required to provide proof of identities, such as a Social Security card, passport, and birth certificate. Then, you'll fill out paperwork showing that you own the IRA. After you have completed the forms, submit them to your bank. They will verify your identity as well as give instructions on how to send wire transfers and checks.

Now comes the fun part. Now, deposit money into your account and wait for approval from the IRS. You will be notified by mail that your request has been approved.

That's it! You can now relax and watch your money grow. And remember, if you ever change your mind about converting your IRA, you can always close it out and roll over the remaining balance into a new IRA.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]