Merchant Loyalty Competitive Advantage – Reimagined Through Bitcoin

The Evolution of the Loyalty Business

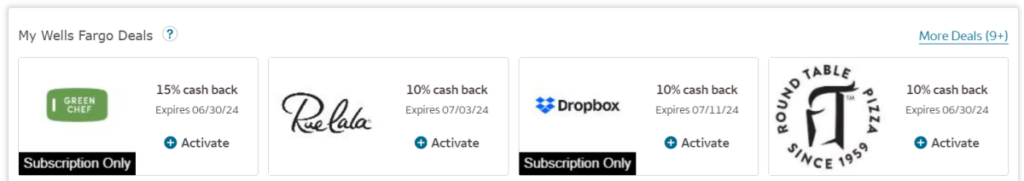

Having spent the last decade at Mastercard's San Francisco office, I have been intricately involved in developing card-linked offer solutions to enhance merchant loyalty. This dynamic sector involves cardholders receiving exclusive merchant offers through their banks, enticing them with discounts upon meeting specified spending thresholds. To illustrate, I have personally benefited from such offers in my Wells Fargo bank account.

The Impact of Bitcoin on Loyalty Programs

While traditional loyalty programs primarily operate on fiat currencies, the emergence of Bitcoin introduces a paradigm shift. Unlike the conventional approach where card-based transactions dominate, Bitcoin offers a revolutionary alternative with unparalleled efficiency and potential benefits.

Cost-Efficiency of Bitcoin Rails

Compared to fiat-based programs, Bitcoin significantly streamlines the process by eliminating various intermediary steps. Through a self-service portal resembling Google Adwords, merchants can seamlessly participate by committing Bitcoin for real-time marketing budgets. This eliminates the need for banks and card processors, thereby reducing associated costs and fees. Furthermore, transactions carried out on the Lightning Network incur minimal fees, minimizing both direct charges and potential risks like chargebacks.

Redefining Consumer Experience

Unlike traditional methods where consumers often receive discounts post-purchase, Bitcoin offers the advantage of real-time notifications and instant discounts. Technologies like LN Bits and Bolt 12 enable split payments and real-time transactions, thereby enhancing the overall consumer experience. With the ability to modify offers and budgets instantly, Bitcoin offers a level of flexibility and efficiency that fiat channels struggle to match.

Overcoming Challenges and Maximizing Opportunities

While Bitcoin presents certain challenges in terms of audience reach and targeting capabilities compared to fiat-based programs, its unique value proposition attracts a niche yet influential segment of consumers. By leveraging the inherent advantages of Bitcoin, merchants can unlock higher margins and cultivate a loyal customer base.

Ultimately, Bitcoin-native merchant offers offer unmatched benefits that traditional loyalty programs cannot replicate. As the industry continues to evolve, embracing Bitcoin presents a transformative opportunity for merchants to enhance profitability and consumer satisfaction.

Michael Saylor's advice to "Buy bitcoin, and wait" resonates with many Bitcoin enthusiasts, urging them to actively contribute to the rise of Bitcoin. By harnessing the potential of Bitcoin in loyalty programs, individuals can drive innovation and unlock new possibilities in the digital landscape.

This insightful perspective is shared by John McCabe, shedding light on the immense potential of Bitcoin-native offers in revolutionizing merchant loyalty. His experiences and expertise exemplify the transformative power of Bitcoin in reshaping traditional business models.

Frequently Asked Questions

What precious metals can you invest in for retirement?

First, you need to understand what you have and where you are spending your money. Start by listing everything you have. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. To determine how much money is available to invest, add all these items.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. However, you will not be able take tax deductions on future earnings.

If you decide you need more money, you will likely need to open another investment account. Start with a regular brokerage account.

Can I have physical possession of gold within my IRA?

Many people are curious if they can possess physical gold in an IRA. This is a fair question because there isn't any legal way to do it.

If you take a closer look at the law, there is nothing that can stop you from having gold in your IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It is easy to toss gold coins, but it's not easy to place them in an IRA. If you decide to keep your gold in your own home, you'll pay taxes on it twice. Once for the IRS and once for the state where you live.

It is possible to lose your gold and pay twice as much tax. Why would you want it to stay in your home?

You might argue that it is important to know that your gold remains safe in your house. To protect yourself from theft, store your gold somewhere that is more secure.

If you're planning on visiting frequently, it is best to keep your gold safe at home. Thieves can easily steal your gold if you don't keep it safe.

Better yet, store your gold inside an insured vault. Then, your gold will be protected from fire, flood, earthquake, and robbery.

One advantage of storing your gold safely in a vault is the fact that you don't have to worry too much about property tax. Instead, you will have to pay income tax for any gains you make selling your gold.

If you prefer not to pay tax on your precious metals, an IRA may be a good option. With an IRA, you won't have to pay income tax even though you earn interest on your gold.

Capital gains tax is not required on gold. If you decide to cash it out, you will have full access to its value.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

The bottom line is: You can own gold in an IRA. Fear of losing it is the only thing that will hold you back.

Are silver and gold IRAs a good idea for you?

If you are looking for an easy way to invest in both gold and silver at once, then this could be an excellent option for you. There are also many other options. Please feel free to reach out to us with any questions. We're always happy to help!

Can I put gold in my IRA?

Yes, it is possible! You can add gold to your retirement plan. Because gold doesn't lose its value over time, it is an excellent investment. It protects against inflation. And you don't have to pay taxes on it either.

Before investing in gold, you need to know that it's not like other investments. Unlike stocks or bonds, you can't buy shares of gold companies. Nor can you sell them.

You must instead convert your gold into cash. This means you will need to get rid. It's not enough to hold on to it.

This makes gold different from other investments. Like other investments, you can always dispose of them later. With gold, this isn't true.

Worse, the gold cannot be used as collateral for loans. To cover a mortgage, you may need to give up some gold.

What does that mean? You can't hold onto your gold forever. You'll eventually need to convert it into cash.

There's no need to be concerned about this right now. All you have to do is open an IRA account. Then, you can invest in gold.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

takemetothesite.com

investopedia.com

kitco.com

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to buy silver with your IRA

How to purchase silver with your IRA – The best way of investing in silver and gold is to directly own physical bullion. The most popular investment form is silver bars and coins. This is because it offers diversification and liquidity.

There are many options available if you wish to purchase precious metals such as gold and silver. You can either buy them directly from their producers like mining companies or refiners. If you don't want the hassle of dealing with a producer directly, you can purchase them from a dealer that buys and trades bullion products.

This article will explain how to invest in silver with an IRA.

- Investing Directly in Gold & Silver – This is the first way to get precious metals directly from their source. This allows you to get the bullion directly and have it delivered directly to your home. Some investors decide to keep their bullion at their home while others prefer to store it in an insured storage facility. When you hold onto your precious metal, ensure you're storing it properly. Many storage facilities offer insurance coverage for fire, theft, damage, and other risks. But even with insurance, you risk losing your investments due to natural disasters or human error. You should always store your precious metals safely in a bank safe deposit box or credit union.

- Online Precious Metals Buying – If you prefer not to transport heavy boxes of precious metal around, then buying bullion online is an option. Bullion dealers can sell bullion in various forms, including bars or coins. Coins come in different sizes, shapes, and designs. Coins are generally more convenient to carry than bars. Bars come in different weights and sizes. Some bars are heavy and weigh hundreds of pounds while others only weigh a few grams. The best rule of thumb for choosing the right type of bar is to consider your intended use. If you plan to use it as a gift, you might want to consider something smaller. You might spend more money if you plan to display it and add it to your collection.

- Dealers for Precious Metal – The third option is to buy bullion direct from dealers. Most dealers specialize in one area of the market, whether gold or silver. Some dealers specialize in particular types of bullion like rounds or minted currency. Others are specialists in specific regions. Some specialize in bulk purchasing. No matter which dealer you choose to work with, you will likely find they offer affordable prices and easy payment options.

- Investment in Retirement Accounts: Buying precious metallics through retirement accounts – Although not technically an investment, this is another way to get exposure to precious metals. For Section 219 to receive tax benefits, you must have a qualified retirement fund that invests in precious metallics. These include IRAs as well 403(b), 401(k), and 403 (b) plans. These accounts can offer better returns than other investment options because they are specifically designed to help you save money for retirement. In addition, most of these accounts allow you to diversify your holdings across multiple metals. The downside? Retirement accounts don't allow everyone to invest. Only employees who have been sponsored by an employer can invest in retirement accounts.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]