As 2024 unfolds, the crypto community is abuzz with excitement, awaiting the upcoming Bitcoin halving event. This highly anticipated event has the potential to reshape the market landscape, drawing parallels to past halvings that have had a profound impact on the crypto scene. With insights gained from previous halvings guiding our path forward, it is essential to delve into the specifics of the 2024 halving and its implications.

Bitcoin's Journey from Digital Gold to Rare Platinum

At the core of Bitcoin's design is the concept of increasing scarcity to maintain value and curb inflation. With a fixed cap of 21 million Bitcoins, the supply is steadily dwindling, having already surpassed 19.62 million. This scarcity, coupled with the controlled release of new coins, has earned Bitcoin the moniker of "digital gold," owing to its intrinsic rarity akin to precious metals.

Viewing the Bitcoin blockchain as a ticking clock, the halving event occurs approximately every four years or every 210,000 blocks, leading to a halving of mining rewards. Since Bitcoin's inception in 2009, this mechanism has reduced block rewards from 50 BTC to 3.125 BTC in 2024.

The Stock-to-Flow ratio, a key metric comparing existing supply to new coins entering circulation, indicates that Bitcoin is set to become even scarcer than platinum by 2032, following the halvings in 2024 and 2030.

Post-Halving Growth Trends of Bitcoin

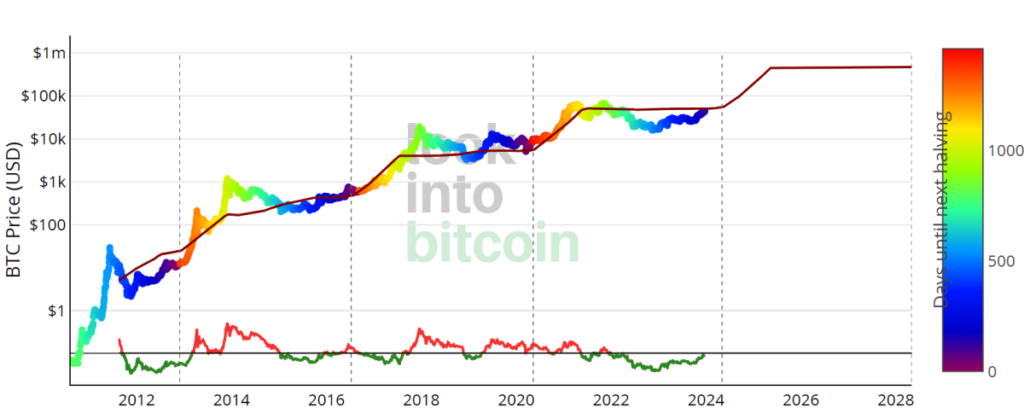

A retrospective analysis of Bitcoin's price performance post-halving reveals a consistent pattern of significant growth. Following the 2012 halving, Bitcoin's market cap surged by 342% within 100 days, with the price peaking at $1,152 the subsequent year, marking an 8,761% increase. Similarly, the 2016 halving precipitated a price surge to $17,760 after rewards halved from 25 to 12.5 BTC, reflecting a 2,572% jump. The most recent halving in 2020, reducing rewards to 6.25 BTC, propelled Bitcoin's price to $67,549 the following year, indicating a robust 594% growth.

By extrapolating historical growth rates post-halving, we estimate a potential growth rate of 155.79% after the 2024 halving, suggesting a Bitcoin price target of around $111,807 within one to one and a half years post-event. However, it is crucial to note that such projections are speculative and should not form the sole basis for investment decisions.

Challenges for Miners Post the 2024 Halving

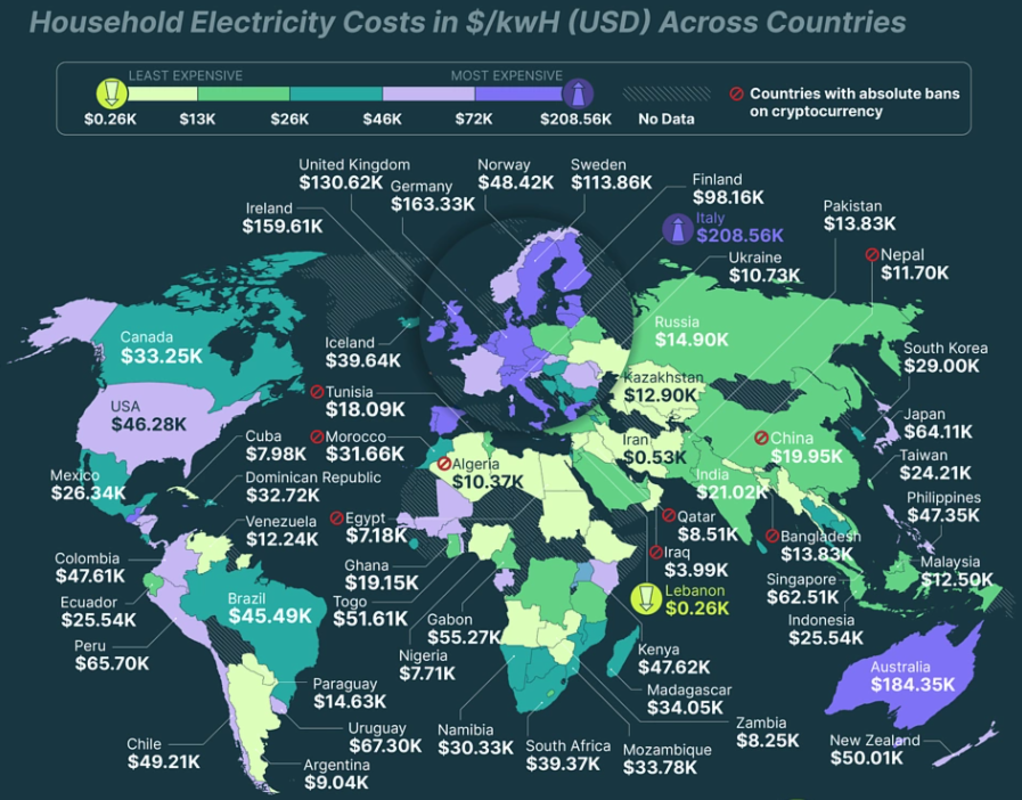

For Bitcoin miners, the 2024 halving poses a formidable challenge, with rewards halved and operational costs escalating. Miners using outdated equipment and facing exorbitant electricity expenses may find themselves in a precarious position. In some regions like Italy, mining a single Bitcoin could cost as much as a luxury sports car, reaching up to $208,560.

The post-2024 mining landscape is envisioned as a competitive arena akin to 'The Hunger Games,' where only the most efficient and cost-effective miners equipped with cutting-edge technology and access to affordable energy sources will thrive. Adaptability and strategic acumen will be crucial for miners to navigate this evolving terrain successfully.

Final Thoughts on the 2024 Bitcoin Halving

The 2024 Bitcoin halving is poised to usher in significant changes, impacting both mining operations and Bitcoin's price trajectory. This impending event blends economic theories with technological advancements, encapsulating the essence of the crypto realm's allure. Whether you are actively involved in mining, holding Bitcoin assets, or observing from the sidelines, the 2024 halving promises to be a pivotal moment in the crypto chronicles.

Frequently Asked Questions

Which type of IRA works best?

It is crucial to find the right IRA for your needs. Consider whether you are looking to maximize tax-deferred growth, minimize taxes and pay penalties later, avoid taxes, or both.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. The Roth option is also a smart choice if you work beyond the age of 59 1/2 and plan to pay income tax on any withdrawals.

Traditional IRAs might be more beneficial if you are looking to retire early. You'll likely owe income taxes. The Roth IRA is a better option if you plan to continue working well beyond age 65. It allows you to withdraw any or all of your earnings and not pay taxes.

Are precious metals allowed in an IRA?

This depends on the IRA's owner's desire to diversify or keep his holdings in silver and gold.

If he does want to diversify, then there are two options available to him. He could either buy physical bars of silver and gold from a dealer, or he could sell the items to the dealer at year's end. However, suppose he isn't interested in selling back his precious metal investments. He should keep them, as they are perfectly safe to be stored in an IRA account.

Are precious metal IRAs a smart investment?

Answers will depend on the amount of risk you are willing and able to take in order for your IRA account to lose value. If you have $10,000 cash, they make sense as long as you don’t expect your IRA account to grow rapidly. These are not the best investments if there is a long-term plan for saving money (like gold) or if you want to invest more in assets that will rise in value over time. These investments can also be subject to fees that could reduce any gains.

What precious metals may I allow in my IRA?

Gold is the most popular precious metal for IRA accounts. Investments in gold bullion coins or bars can be made as well.

Precious metals are considered safe investments because they don't lose value over time. They're also considered a great way to diversify an investment portfolio.

Precious metals include palladium and platinum. These three metals all have similar properties. However, each one has its unique uses.

Platinum is used to make jewelry, for example. You can create catalysts with palladium. The production of coins is done with silver.

It is important to consider how much money you are willing to spend on your precious metals when making a decision about which precious material to choose. It might be cheaper to buy gold at a lower price per ounce.

You need to decide if you want your investment to remain private. If you have the desire to keep your investment private, palladium might be the best choice.

Palladium is more expensive than gold. It is also more rare. It's likely that you will have to pay more.

Storage fees are another important consideration when choosing between silver and gold. Gold is measured by weight. For larger quantities of gold, you will be charged a higher storage fee.

Silver is best stored in volumes. You'll be charged less for smaller amounts.

You should follow all IRS rules if you plan to store precious metals in an IRA. You must keep track of all transactions and report them to the IRS.

How much should precious metals make up your portfolio?

Investing in physical gold is the best way to protect yourself from inflation. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. So as prices rise, so does the value of your investment.

If you hold on to your investments for at least five years, you will receive tax benefits on any gains. Capital gains taxes will apply if you sell the investments within this time period. Our website has more information about how to purchase gold coins.

Do You Need to Open a Precious Metal IRA

The answer depends on whether you have an investment goal and how much risk tolerance you are willing to take.

If you plan to use the money for retirement, you should open an account now.

The reason is that precious metals are likely to appreciate over time. You also get diversification benefits.

In addition, gold and silver prices tend to move together. They make a good choice for both assets and are a better investment.

Do not invest in precious metals IRAs if your goal is to save money or take on any risk.

Statistics

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

investopedia.com

regalassets.com

How To

How to Buy Gold For Your Gold IRA

The term precious metal refers to gold, silver, palladium and rhodium. It refers to any naturally occurring element with atomic numbers 79 through 110 (excluding helium), which is considered valuable because of its rarity and beauty. Precious metals that are most commonly used include silver and gold. Precious metals are often used as money, jewelry, industrial goods, and art objects.

Gold's price fluctuates each day due to supply/demand. In the past decade, there has been a huge demand for precious metals as investors seek safe havens from unstable economies. Prices have increased significantly because of this demand. Some are concerned about the increased cost of production and have resisted investing in precious materials.

Because gold is rare and durable, it makes a good investment. Contrary to other investments, gold does not lose its value. Additionally, you can sell and buy gold without any taxes. There are two ways that you can invest your gold. You can buy bars and gold coins, or invest into gold futures contracts.

The physical gold bars and coins provide immediate liquidity. They are easy to trade and keep. They do not offer any protection against inflation. If you want to protect yourself from rising prices, consider purchasing gold bullion. Bullion is physical gold that comes in different sizes and shapes. Some billions come in one-ounce pieces, while others come in larger sizes like kilo bars. Bullion is stored in vaults that are protected against theft and fire.

You might prefer to own shares of gold than actual gold. If so, then you should look into buying futures gold. Futures let investors speculate on the future price of gold. Gold futures allow you to be exposed to its price without owning any physical commodity.

A gold contract could be purchased if you wanted to speculate on the future price of gold. My position when the contract expires is either “long”, or “short”. A long contract indicates that I believe the price for gold will rise. Therefore, I'm willing give money to someone now in exchange of the promise that I will get more money after the contract ends. A shorter contract would mean that I believe the gold price will fall. I'm willing now to accept the money in exchange for the promise of making less later.

When the contract expires, I'll receive the amount of gold specified in the contract plus interest. That way, I've gained exposure to the price of the gold without actually having to hold the gold myself.

Precious metals can be a great investment because they are very hard to counterfeit. Precious metals can't be counterfeited like paper currency. However, new bills can be printed to make them look more authentic. Because of this, precious metals have traditionally held their value well over time.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]