Over the years, Bitcoin enthusiasts have eagerly awaited a shift in value driven by institutional investors. The idea was simple: with companies and large financial entities investing in Bitcoin, the market was expected to see explosive growth and a sustained period of price hikes. However, the actual outcome has proved to be more intricate. While institutions have indeed poured substantial capital into Bitcoin, the envisioned 'supercycle' has not materialized as anticipated.

Institutional Accumulation

Recent years have witnessed a significant rise in institutional involvement in Bitcoin, characterized by hefty purchases from major corporations and the introduction of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

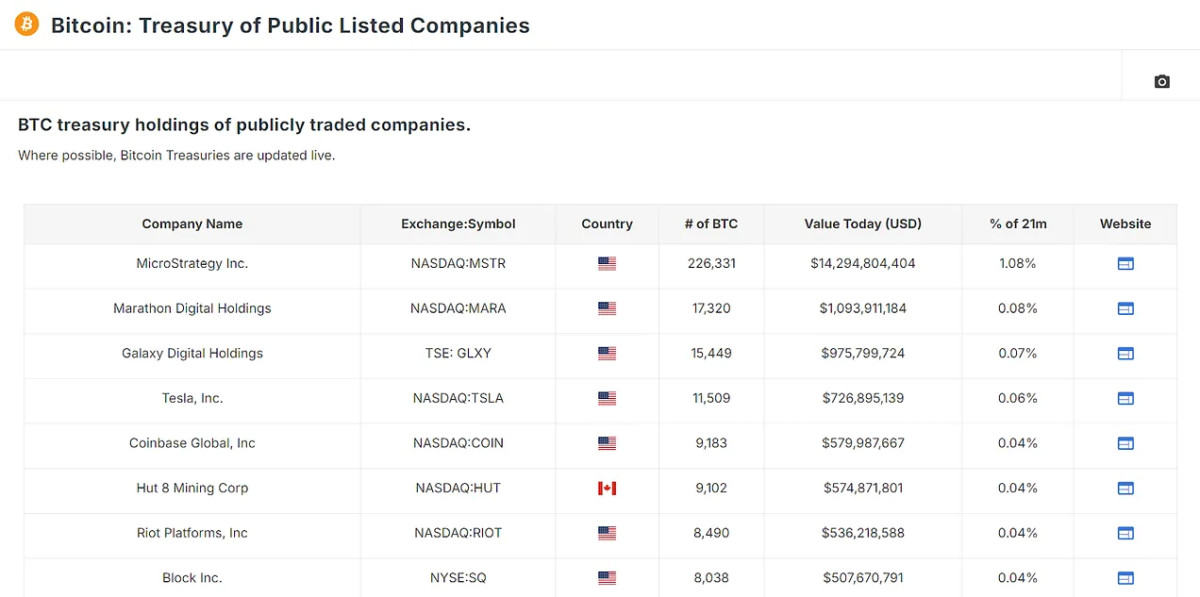

At the forefront of this movement is MicroStrategy, which alone possesses over 1% of the total Bitcoin supply. Following MicroStrategy, other key players include Marathon Digital, Galaxy Digital, and even Tesla. Noteworthy holdings are also present in Canadian firms like Hut 8 and Hive, as well as international companies such as Nexon in Japan and Phoenix Digital Assets in the UK. The total Bitcoin holdings of these companies exceed 340,000. However, the game-changer has been the advent of Bitcoin ETFs. Since their inception, these financial tools have attracted billions of dollars in investments, leading to the accumulation of over 91,000 bitcoin in a span of a few months. Combined, private companies and ETFs control roughly 1.24 million bitcoin, which represents about 6.29% of the total circulating supply.

A Look at Bitcoin's Recent Price Movements

To gauge the potential future impact of institutional investment, we can analyze recent Bitcoin price movements post the approval of Bitcoin ETFs in January. Initially trading around $46,000, Bitcoin experienced a temporary dip, a classic "buy the rumor, sell the news" scenario. However, the market swiftly rebounded, and within two months, Bitcoin's price soared by roughly 60%.

This surge aligns with institutional investors' accumulation of Bitcoin through ETFs. If this trend persists and institutions continue purchasing at the current or an escalated pace, we may witness a sustained bullish trend in Bitcoin prices. The key consideration here is the assumption that these institutional players are long-term holders, unlikely to divest their assets in the near future. This continuous accumulation would diminish the liquid supply of Bitcoin, necessitating less capital inflow to propel prices even higher.

The Money Multiplier Effect: Amplifying the Impact

The accumulation of assets by institutional players holds significant weight. Its potential influence on the market amplifies further when considering the money multiplier effect. The concept is simple: when a substantial portion of an asset's supply is withdrawn from active circulation, like the nearly 75% of supply that has remained stagnant for at least six months as per the HODL Waves, the price of the circulating supply left can be more volatile. Each dollar invested can have a magnified impact on the overall market cap.

For Bitcoin, with approximately 25% of its supply being liquid and actively traded, the money multiplier effect can be notably potent. Assuming this illiquidity results in a $1 market inflow increasing the market cap by $4 (4x money multiplier), institutional ownership of 6.29% of all bitcoin could effectively sway around 25% of the circulating supply.

If institutions were to start offloading their holdings, the market would likely witness a substantial decline, potentially prompting retail holders to follow suit. Conversely, if these institutions persist in buying, the BTC price could surge significantly, especially if they maintain their positions as long-term holders. This scenario underscores the dual nature of institutional involvement in Bitcoin, as it gradually then rapidly exerts a greater influence on the asset.

Conclusion

Institutional investment in Bitcoin presents both favorable and unfavorable aspects. It brings legitimacy and capital that could propel Bitcoin prices to unprecedented levels, particularly if these entities remain committed for the long haul. However, the consolidation of Bitcoin in the hands of a few institutions could lead to heightened volatility and substantial downside risk if these players opt to exit their positions.

For a more detailed exploration of this subject, consider watching a recent YouTube video on the topic.

Frequently Asked Questions

Can I add gold to my IRA?

Yes! You can add gold to your retirement plan. Because it doesn't lose any value over time, gold is a great investment. It is also immune to inflation. It also protects against inflation.

It's important to understand the differences between gold and other investments before investing in it. You can't buy shares in companies that make gold unlike bonds or stocks. You cannot also sell them.

Instead, convert your gold to money. This means that you must get rid of your gold. It is not possible to keep it.

This makes gold an investment that is different from other investments. Like other investments, you can always dispose of them later. However, gold is different.

Worse, the gold cannot be used as collateral for loans. You may have to part with some of your gold if you take out mortgages.

What does this translate to? Your gold can't be kept forever. You'll eventually need to convert it into cash.

You don't have to worry about this now. All you need to do is create an IRA. Then, you are able to invest in gold.

Which type or type of IRA would be best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. It is important to consider whether you want tax-deferred, maximized growth of your contributions, reduced taxes now and paid penalties later, or just avoid taxes.

If you're saving for retirement and don't have much money invested, the Roth option could make sense. It is also an option if you are still working after age 59 1/2. You can expect to pay income taxes for any accounts that are withdrawn.

Traditional IRAs might be more beneficial if you are looking to retire early. You'll likely owe income taxes. However, if your goal is to retire early, the traditional IRA might be more sensible. The Roth IRA allows you to withdraw some of your earnings or all without paying taxes.

What type of IRA is used for precious metals?

Many financial institutions and employers offer an individual retirement account (IRA) as an investment option. Through an IRA, you may contribute money to an account that grows tax-deferred until withdrawn.

An IRA allows for you to save taxes while still paying taxes when you retire. This allows you to save more money today and pay less taxes tomorrow.

The beauty of an IRA is that contributions and earnings grow tax-free until you withdraw the funds. You can face penalties if you withdraw funds before the deadline.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you take out of your IRA during retirement you will owe income and a 10% federal penal.

Withdrawals before age 59 1/2 will be subject to a 5% IRS penal. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

Withdrawal amounts exceeding $10,000 per year are subject to a 6.2% IRS penalty.

What precious metals do you have that you can invest in for your retirement?

It is important to know what you have already saved and where money you are saving for retirement. Take a look at everything you own to determine how much you have left. This includes all savings accounts and stocks, bonds or mutual funds. It also should include certificates of Deposit (CDs), life insurance policies. Annuities, 401k plans, real-estate investments, and other assets like precious metals. To determine how much money is available to invest, add all these items.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. You won't be allowed to deduct tax for future earnings.

You will need another investment account if you decide that you require more money. Start with a regular brokerage account.

Are gold and Silver IRAs a good idea or a bad idea?

If you are looking for an easy way to invest in both gold and silver at once, then this could be an excellent option for you. There are other options as well. You can contact us at any time with questions about these types investments. We are always available to assist you!

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

wsj.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

kitco.com

takemetothesite.com

How To

How to Start Buying Silver with Your IRA

How to get started buying silver with your IRA – Owning physical bullion directly is the best way for you to invest in silver and gold. Because they provide liquidity and diversification, silver bars and coins are the most preferred form of investment, however, many prefer to own physical bullion rather than paper certificates or electronic currencies.

There are several options to purchase precious metals, like gold or silver. You can purchase them directly from their producers, such as mining companies and refiners. You can also buy bullion products from dealers, but this will not save you the trouble of dealing with producers directly.

This article will discuss how to start investing in silver with your IRA.

- Investing Directly in Gold & Silver – This is the first way to get precious metals directly from their source. This means that you can get the bullion straight from the source, and it will be delivered directly to your front door. While some investors choose to keep their bullion in their homes, others opt to store it at a storage facility where it's insured and protected. Make sure you properly store your precious metal when you keep it. Many storage facilities offer insurance coverage for fire, theft, damage, and other risks. But, even with insurance, you can lose your investments because of natural disasters and human error. This is why it is a good idea for precious metals to be stored in a safe deposit container at a bank/credit union.

- Online Precious Metals Shopping – Bullion online can be a great alternative to carrying around heavy boxes. Bullion dealers sell bullion in different forms, including coins and bars. Coins come in different sizes, shapes, and designs. Coins are usually easier to carry than bars, and they tend to be less expensive. Bars come in different weights and sizes. Some bars are heavy and weigh hundreds of pounds while others only weigh a few grams. A good rule of thumb when selecting which type of bar you should get is to look at what you plan to use it for. You might consider a smaller bar if you intend to give it as a gift. If you are looking to add it as a gift, or to proudly display it, you may want to spend a bit more and buy something larger.

- Buying Precious Metal From Dealers – A third option is to buy bullion from a dealer. Dealers usually specialize in one market area, such as silver or gold. Some dealers specialize in certain types of bullion, such as rounds or minted coins. Some specialize in particular regions. Others are specialists in bulk purchases. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Investment in Retirement Accounts: Buying precious metallics through retirement accounts – Although not technically an investment, this is another way to get exposure to precious metals. A qualified retirement account is required to invest in precious metals in order to qualify for Section 219 IRS Code tax benefits. These include IRAs as well 403(b), 401(k), and 403 (b) plans. These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. Most accounts allow you the ability to diversify between different metals. What is the drawback? Retirement accounts don't allow everyone to invest. These accounts are only available to employees of employers who sponsor them.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]