Are you eager to anticipate where Bitcoin is headed next? While Global Liquidity has been a trusted guide in previous cycles, there are new, even more reliable signals to consider. Let's delve into the latest data points that can unveil whether Bitcoin's current plateau is temporary or the start of a more extended consolidation phase.

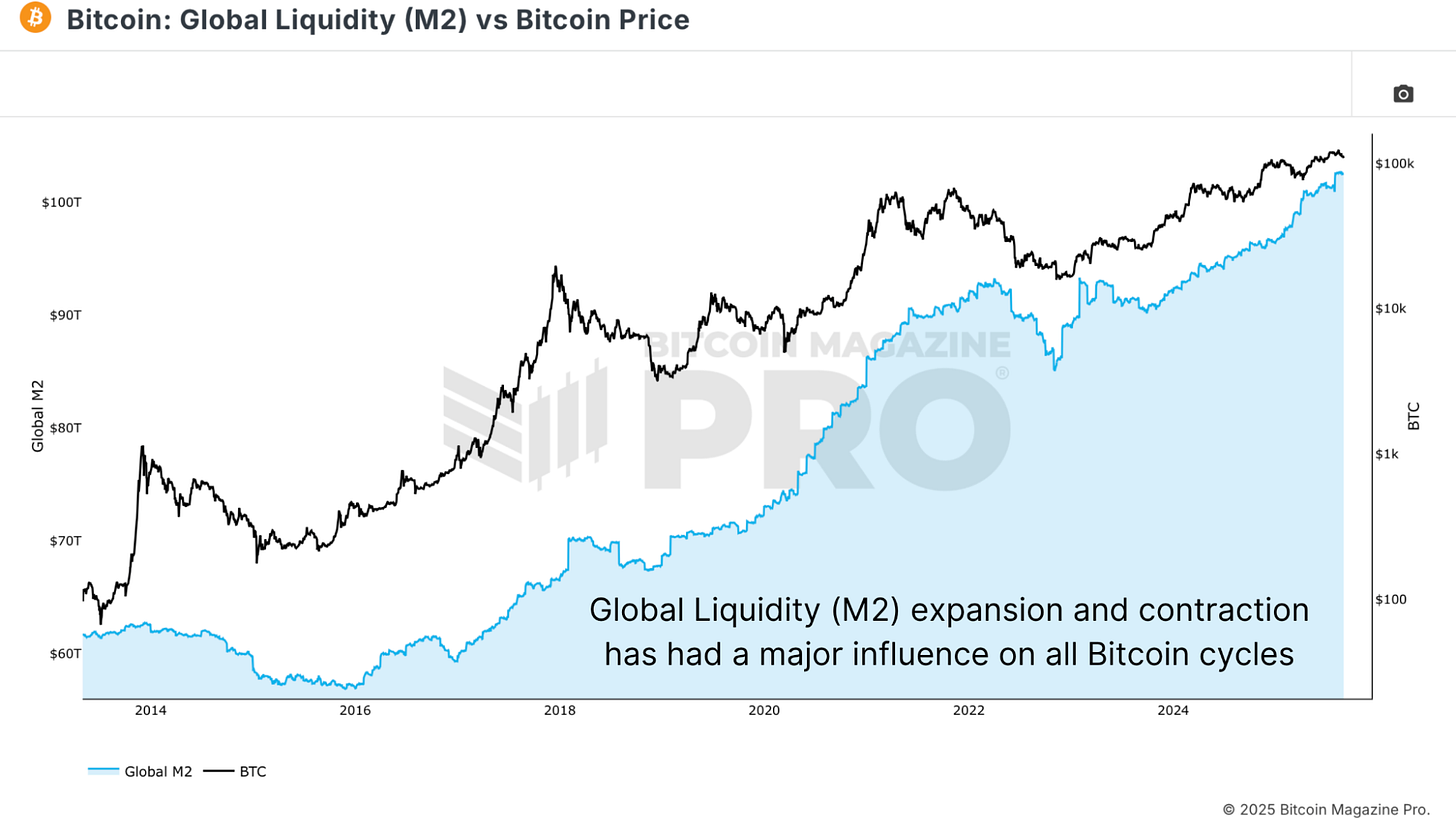

Decoding Bitcoin Price Trends Through Global Liquidity Shifts

Imagine Global Liquidity as the conductor orchestrating Bitcoin's price movements. When liquidity expands, Bitcoin thrives; when it contracts, Bitcoin falters. This cycle, the correlation between liquidity, especially M2 money supply, and Bitcoin's price has been a remarkable 88.44%. By introducing a 70-day offset, this correlation skyrockets to 91.23%, indicating that liquidity changes foreshadow Bitcoin's direction over two months in advance. This framework excels at capturing the overarching trend, aligning cycle dips with liquidity constraints and recoveries with renewed expansion.

Anticipating Bitcoin's Moves

While liquidity rise supports higher Bitcoin values, recent stagnation post-new all-time highs raises eyebrows. But fear not, this divergence doesn't nullify the broader relationship. It might simply signify Bitcoin trailing behind liquidity conditions, a scenario seen in previous cycles.

Stablecoin Supply: A Gateway to Bitcoin Market Surges

Unlike Global Liquidity's macro view, stablecoin supply offers a direct peek into capital poised to enter digital assets. The surge in USDT, USDC, and other stablecoins indicates potential capital waiting to flow into Bitcoin and other altcoins. With an impressive 95.24% correlation, stablecoin liquidity influxes typically precede Bitcoin price surges.

Understanding Market Dynamics

Despite Bitcoin's consolidation amidst booming stablecoin supply, history shows such divergences are short-lived. Ultimately, this capital seeks returns, gravitating towards risk assets. Tracking stablecoin supply is crucial for short to medium-term insights.

Gold's Hidden Clues: Predicting Bitcoin's Trajectory

Initially, Bitcoin and Gold's correlation may seem sporadic. But aligning Gold's data with a 70-day offset reveals a surprising 92.42% correlation with Bitcoin, surpassing even Global M2. Their synchronized peaks and troughs suggest a shared destiny. As Gold enters a consolidation phase, Bitcoin mirrors this behavior. If this trend persists, Bitcoin might remain range-bound until mid-November, awaiting a potential breakout alongside Gold.

Unveiling Bitcoin's Future

Combining Global Liquidity, stablecoin supply, and Gold metrics offers a reliable compass for predicting Bitcoin's trajectory. While Global M2 acts as a macro anchor with a 10-week lag, stablecoin growth signals imminent crypto demand. Gold's delayed correlation hints at consolidation before a promising upswing.

As we navigate the short term, Bitcoin's sideways movement may echo Gold's inertia despite expanding liquidity. However, a breakthrough in Gold's value coupled with stablecoin issuance momentum could set the stage for a robust end-of-year Bitcoin rally. Patience is key, but the data indicates favorable conditions for Bitcoin's future growth.

Frequently Asked Questions

What are the pros & con's of a golden IRA?

A gold IRA is an excellent investment vehicle for those who want to diversify their holdings but don't have access to traditional banking services. It allows you to invest in precious metals such as gold, silver, and platinum without paying taxes on any gains until they're withdrawn from the account.

The downside is that withdrawing money early will pay ordinary income tax on the earnings. However, creditors will not be able to seize these funds if you default on your loan.

So if you like owning gold without worrying about taxes, a gold IRA may be right for you.

How much should precious metals make up your portfolio?

Protect yourself against inflation by investing in physical gold. Because you are buying into the future value of precious metals and not the current price, when you invest in them, it is a way to protect yourself from inflation. You can expect your investment to increase in value with the rise of metal prices.

Tax benefits will accrue if your investments are kept for at most five years. Capital gains taxes will apply if you sell the investments within this time period. Visit our website to find out more about buying gold coins.

What are the fees for an IRA that holds gold?

An average annual fee for an individual retirement plan (IRA) is $1,000. However, there are many different types of IRAs, such as traditional, Roth, SEP-IRAs, and SIMPLE IRAs. Each type has its own set requirements and rules. For example, you may have to pay taxes on any earnings from your investments if they're not tax-deferred. Also, consider how long the money will be kept. If you have a long-term goal of holding on to your money, you'll be able to save more money if you open a Traditional IRA.

A traditional IRA allows for contributions up to $5500 ($6,500 if older than 50). A Roth IRA lets you contribute unlimited amounts each year. The difference between them? With a traditional IRA, the money can be withdrawn at your retirement without tax. However, Roth IRA withdrawals are subject to tax.

What is the most valuable precious metal?

Investments in gold offer high returns on their capital. It can also protect against inflation and other risks. As people worry about inflation, the price of gold tends increase.

It is a smart move to purchase gold futures. These contracts assure you that you will receive a specified amount of precious metal at a fixed price.

However, futures on gold aren't for everyone. Some people prefer to own physical gold instead.

They can easily trade their gold with others. They can also trade it anytime they like.

Some people choose to not pay taxes on gold. They buy gold directly from government to do this.

This will require you to make multiple trips to your local postal office. First, convert any gold you have into coins or bars.

You will then need to obtain a stamp for the coins and bars. You then send them to US Mint. They melt the bars and coins into new coins.

These new coins, bars, and bars have the original stamps stamped onto them. These new coins and bars are legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

Decide what precious metal do you want to invest?

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

takemetothesite.com

en.wikipedia.org

investopedia.com

regalassets.com

How To

IRA-Approved Precious Metals

IRA-approved precious metallics are great investments, whether you want to save for retirement and invest in your next venture. Diversifying your portfolio can protect you from inflation with a variety of options, including silver coins and gold bars.

Precious metal investments products can be purchased in two forms. Physical bullion products such as bars and coins are considered physical assets because they exist in tangible form. ETFs, on the other hand are financial instruments that track price movements of an underlying asset such as gold. ETFs can be purchased directly from the company issuing them, and trade in the same way as stocks on stock exchanges.

There are various types of precious metals available for purchase. While gold and silver are used in jewelry making and decoration, platinum and palladium are most commonly associated with luxury products. Palladium is more stable than platinum and therefore better suited for industrial purposes. Silver is also useful for industrial purposes, although it is usually preferred for decorative applications.

Due to the high cost of refining and mining raw materials, physical bullion products are more expensive. But they are generally safer than traditional paper currencies and provide buyers with more security. For example, consumers can lose confidence in the currency or look for alternative currencies when the U.S. dollars loses its purchasing power. Contrary to this, physical bullion does not rely on trust among countries or between companies. Instead, they are backed up by central banks and governments giving customers peace-of-mind.

According to supply and demand, gold prices can fluctuate. Demand rises, and the price goes up. On the other hand, supply falls when demand exceeds demand. This dynamic creates opportunities for investors to profit from fluctuations in the price of gold. These fluctuations are good for investors who have physical bullion products as they get a better return on their investment.

Precious metals are not affected by interest rate changes or economic recessions, unlike traditional investments. The price of gold is likely to continue rising as long the demand for it remains strong. Because of this, precious metals are considered safe havens during times of uncertainty.

The most well-known precious metals are:

- Gold – Gold is the oldest type of precious metal and is often called “yellow metal.” Gold is a common name, but it's a rare element that can be found underground. Most of the world’s remaining gold reserves are found in South Africa.

- Silver – Silver is second most valuable precious metal, after gold. Like gold, silver is mined from natural deposits. Silver is extracted from ore, not rock formations, unlike gold. Silver is widely used in industry and commerce because of its durability, conductivity, malleability, and resistance to tarnishing. The United States is responsible for 98% worldwide silver production.

- Platinum – The third most valuable precious metallic is platinum. It is used in many industries, such as fuel cells, catalytic converters and high-end medical equipment. In dentistry, platinum is used to make bridges, crowns, and fillings.

- Palladium: Palladium is the 4th most valuable precious metallic. Because of its strength as well as stability, its popularity is increasing rapidly among manufacturers. Palladium is also used for electronics, aerospace, military technology and automobiles.

- Rhodium: Rhodium ranks fifth in the most valuable precious metals. Rhodium is an extremely rare metal. However, its use for automotive catalysts makes it highly desirable.

- Ruthenium – Ruthenium ranks sixth in the list of most valuable precious metals. Although there is a limited supply of palladium and platinum, ruthenium can be found in abundance. It is used in the manufacture of steel, aircraft engines, as well as chemical manufacturing.

- Iridium – Iridium is the seventh most valuable precious metal. Iridium is an important component in satellite technology. It is used to build satellites orbiting that transmit television signals, phone calls, and other communications.

- Osmium – Osmium is the eighth most valuable precious metal. Because of its extreme temperature resistance, Osmium is often used in nuclear reactors. Osmium is also used to make jewelry, medicine, and cutting tools.

- Rhenium – Rhenium is the 9th most valuable precious metal. Rhenium can also be used in rocketry, oil refinement, and semiconductor manufacturing.

- Iodine – Iodine is the tenth most valuable precious metal. Iodine is used for photography, radiography and pharmaceuticals.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]