NFT Market Faces Sharp Decline

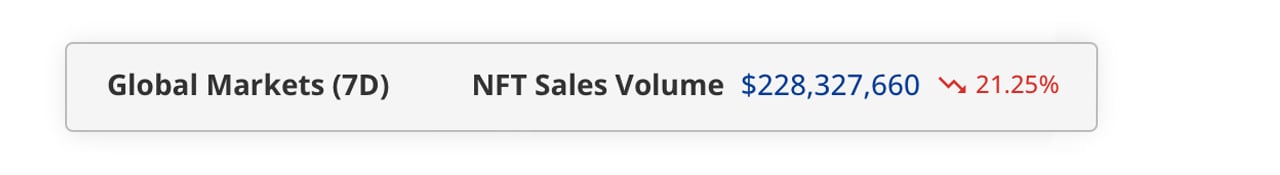

In the span between Jan. 20 to Jan. 27, 2024, there was a notable decline in the sales volume stemming from non-fungible tokens (NFTs), plunging 21.25% from the week before. The leading blockchains in seven-day sales, Ethereum and Bitcoin, experienced substantial decreases, ranging from 28.78% to 12.62%, respectively.

Steepest Decline in 2024

This week marked the steepest decline in 2024, with sales plunging over 21% compared to the previous seven days. According to metrics from cryptoslam.io, the total amounted to $228,327,660.

Double-Digit Losses for Top Blockchains

All five of the top blockchains leading the week’s sales saw double-digit losses. Bitcoin experienced a 12.62% week-over-week drop, with $55.92 million in sales over the same seven-day period. Solana secured the third rank, recording $53.69 million in sales, which is a decrease of 11.85%. Polygon’s NFT sales claimed the fourth position, amounting to $15.66 million, yet experienced a 36.40% drop. In the fifth spot, Avalanche garnered $7.98 million in sales, with a notable 41.25% decline in its NFT market.

High-Ranking NFT Collections and Top Sales

In the realm of unique digital collectible collections, the Cryptopunks series clinched the highest position in sales this week. Cryptopunks amassed $13.67 million in sales during the past seven days, marking an increase of 32.23% from the previous week. Bitcoin’s Uncategorized Ordinals experienced $9 million in sales, witnessing a 3.75% decline from the week prior. In the third spot, Solana’s Froganas reported $7.04 million in sales, a significant increase of 420.77% compared to last week. Occupying the fourth rank, Solana’s Cryptoundeads achieved $6.75 million in sales, yet faced a 58.82% decrease. In the fifth position, Avalanche’s Dokyo NFT collection registered $5.85 million in sales, experiencing a 33.70% drop in sales volume from the previous week.

Challenging Period for NFT Sales

Sales of blockchain-based digital collectibles faced a challenging period throughout 2022, and most of 2023 also witnessed a downturn in NFT sales until the year’s end. Bitcoin’s entry into the NFT sales arena initially boosted overall sales, but BTC-focused NFT sales not only decreased this week but also experienced a 28.15% drop the week before. NFTs based on Solana and Polygon showed an increase in the latter part of 2023, yet they have recently encountered modest falls in their overall digital collectible sales volume. Whether this downward trend in NFT sales continues or a resurgence occurs remains to be seen.

What do you think about this week’s NFT sales action? Share your thoughts and opinions about this subject in the comments section below.

Frequently Asked Questions

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Some experts think that this could change in the near future. They believe gold prices could increase dramatically if there is another global financial crises.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

These are some things you should consider when considering gold investing.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It is possible to save enough money to retire without investing in gold. However, when you retire at age 65, gold can provide additional protection.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each one offers different levels security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. You may lose your gold coins and never be able to recover them.

Don't buy gold unless you have done your research. Protect your gold if you already have it.

What tax is gold subject in an IRA

The fair market value at the time of sale is what determines how much tax you pay on gold sales. If you buy gold, there are no taxes. It is not considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Loans can be secured with gold. Lenders try to maximize the return on loans that you take against your assets. For gold, this means selling it. The lender might not do this. They might just hold onto it. They might decide that they want to resell it. In either case, you risk losing potential profits.

If you plan on using your gold as collateral, then you shouldn't lend against it. It's better to keep it alone.

What does gold do as an investment?

The price of gold fluctuates based on supply and demand. Interest rates are also a factor.

Gold prices are volatile due to their limited supply. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

irs.gov

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

How To

The best way online to buy gold or silver

First, understand the basics of gold. The precious metal gold is similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They are not exchangeable in any currency exchange system. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. The buyer receives 1 gram of gold for every dollar spent.

When you are looking to purchase gold, the next thing to know is where to get it. There are several options available if your goal is to purchase gold from a dealer. You can start by visiting your local coin shop. You can also try going through a reputable website like eBay. You may also be interested in buying gold through private sellers online.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers typically charge 10% to 15% commission on each transaction. You would receive less money from a private buyer than you would from a coin store or eBay. This is a great option for gold investing because you have more control over the item’s price.

Another option for buying gold is to invest in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks usually charge higher interest rates that pawn shops.

The final option is to ask someone to buy your gold! Selling gold is easy too. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]