When choosing a gold IRA company, there are many factors to consider. The best option is one with a proven track record and outstanding service. Furthermore, the company should offer a variety of rare-earth elements so you can diversify your portfolio. Read on to discover how to invest in gold through TD Ameritrade.

Investing in gold through TD Ameritrade

TD Ameritrade clients can access a range of resources to invest in gold, including mining companies, gold ETFs, and gold ETNs. The service also provides clients with research tools that help them find the right gold investment. These tools include a Morningstar category and a screen for potential ETF ideas.

Gold is a defensive investment that offers many benefits. However, it is also not without its risks. It is not always clear when it's the right time to buy, and it doesn't produce cash flow. Additionally, it is important to understand that it is a good hedge against inflation. Many people believe that the Fed and the government have contributed to recent inflation, so gold is a good way to mitigate this risk.

Investing in precious metals through Augusta Precious Metals

Investing in precious metals through Augustanta Precious Metals is easy, convenient, and fast. The company's customer service representatives provide extensive knowledge and are readily available for questions and assistance. They have a no-fee management program and offer free advice on the investment process.

Augusta Precious Metals is a highly-rated company with a great track record. They have received no negative reviews from the Business Consumer Alliance, and have been rated “Best in Business” by TrustLink for six consecutive years. They are also highly rated on Google My Business, and have received a top score from the Better Business Bureau.

Investing in precious metals through TD Ameritrade

TD Ameritrade offers a variety of investment options, including precious metals. You can invest in individual stocks and precious metals ETFs, which are similar to mutual funds but usually have lower costs. TD Ameritrade also offers gold and silver funds, as well as physical-backed gold and silver coins.

TD Ameritrade also offers self-directed IRAs, which give you more flexibility and control. The self-directed IRA offers the added benefit of physical gold bullion ownership.

Costs of investing in gold through TD Ameritrade

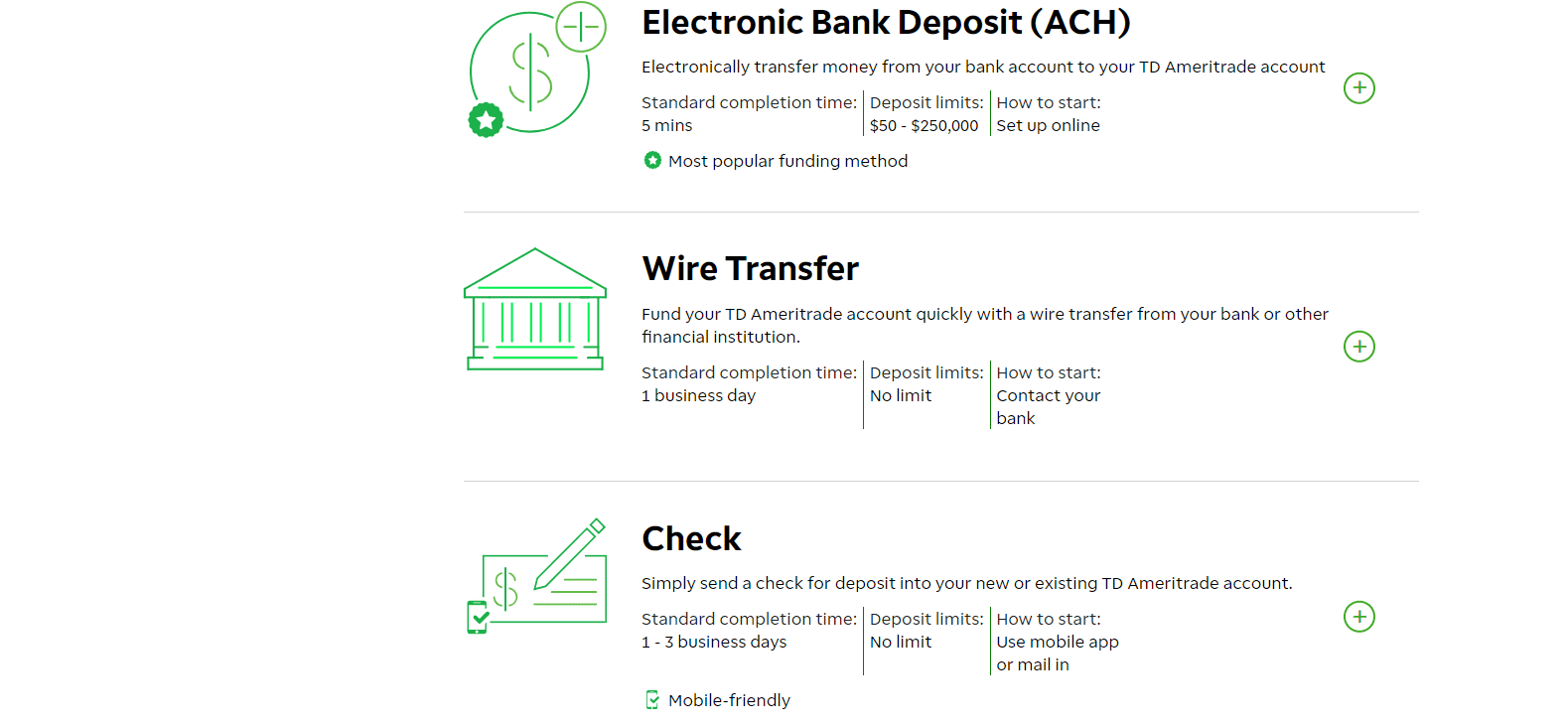

There are several costs associated with investing in gold through TD Ameri trade. First of all, if you purchase physical gold bullion, you will have to pay the current bid and ask prices for it. These prices are calculated by factoring in manufacturing and transportation costs. However, if you pay through a TD bank account, you can receive special pricing.

Another important cost to consider when investing in gold is fees. TD charges about $2.25 per contract and does not control regulatory or exchange fees. Additionally, if you choose to trade in futures contracts, you are creating leverage, which can increase your risks. Additionally, TD Ameritrade is owned by the Charles Schwab Corporation. Investors interested in learning more about the company can read more about their fees and other information on the company's website.

Frequently Asked Questions

What are the benefits of a gold IRA

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You decide how much money is put in each account and when it is withdrawn.

Another option is to rollover funds from another retirement account into a IRA with gold. This will allow you to transition easily if it is your decision to retire early.

The best thing is that investing in gold IRAs doesn't require any special skills. They are readily available at most banks and brokerages. Withdrawals can be made instantly without the need to pay fees or penalties.

But there are downsides. Gold has historically been volatile. Understanding why you want to invest in gold is essential. Are you looking for safety or growth? Are you trying to find safety or growth? Only then will you be able make informed decisions.

You might want to buy more gold if you intend to keep your gold IRA for a long time. A single ounce isn't enough to cover all of your needs. Depending on the purpose of your gold, you might need more than one ounce.

A small amount is sufficient if you plan to sell your gold. Even a single ounce can suffice. These funds won't allow you to purchase anything else.

What are the pros and disadvantages of a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. But, this type of investment comes with its own set of disadvantages.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. If you do withdraw funds, you'll need to pay a penalty.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5% and 2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. Insurance that covers losses upto $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. Some providers limit how many ounces you can keep. Others let you pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. The price of physical gold is higher than that of gold futures. Futures contracts provide flexibility for purchasing gold. You can set up futures contracts with a fixed expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy does NOT include theft protection and loss due to fire or flood. It does offer coverage for natural disasters. You might consider purchasing additional coverage if your area is at high risk.

Apart from insurance, you should consider the costs of storing your precious metals. Storage costs are not covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians cannot sell your assets. Instead, they must keep your assets for as long you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

After filling in the forms, please send them to the provider. After reviewing your application, the company will send you a confirmation mail.

A financial planner is a good idea when opening a gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

How much gold can you keep in your portfolio

The amount of capital that you require will determine how much money you can make. Start small with $5k-10k. As you grow, you can move into an office and rent out desks. Renting out desks and other equipment is a great way to save money on rent. It's only one monthly payment.

You also need to consider what type of business you will run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. So you might only get paid once every 6 months or so.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

What is the cost of gold IRA fees

$6 per month is the Individual Retirement Account Fee (IRA). This fee includes account maintenance fees as well as any investment costs related to your selected investments.

Diversifying your portfolio may require you to pay additional fees. The fees you pay will vary depending on the type of IRA that you choose. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Most providers also charge an annual management fee. These fees can range from 0% up to 1%. The average rate for a year is.25%. These rates are usually waived if you use a broker such as TD Ameritrade.

What should I pay into my Roth IRA

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, your principal (the deposit amount originally made) is not transferable. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you take out more than the initial contribution, you must pay tax.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's say you earn $10,000 each year after contributing. You would owe $3,500 in federal income taxes on the earnings. So you would only have $6,500 left. Since you're limited to taking out only what you initially contributed, that's all you could take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. Your traditional IRA allows you to withdraw your entire contribution plus any interest. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs don't allow you deduct contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Can I buy gold with my self-directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contract are financial instruments that depend on the gold price. They allow you to speculate on future prices without owning the metal itself. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

How does a gold IRA work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can purchase physical bullion gold coins at any point in time. You don’t have to wait to begin investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold assets will not be subjected tax upon your death.

Your heirs inherit your gold without paying capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've done that, you'll receive an IRA custody. This company acts as an intermediary between you and IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit required for gold bullion coins purchase is $1,000 However, you'll receive a higher interest rate if you put in more.

Taxes will apply to gold that you take out of an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

Avoid taking out more that 50% of your total IRA assets each year. Otherwise, you'll face steep financial consequences.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)