Introduction

Gold mining has a long history of environmental degradation and pollution. However, there is a growing belief that Bitcoin mining is even more harmful to the environment. In this article, we will examine the environmental impact of both gold mining and Bitcoin mining and compare their carbon footprints and other ecological consequences.

The Reality of Gold Mining

Contrary to popular belief, gold mining is far from a clean and pure industry. It ranks second in land coverage after coal mining and covers more land than copper, iron, and aluminum mining combined. As many high-yield gold mines have been exhausted, chemical processes involving toxic chemicals like cyanide-leaching and amalgamation are being used. The contaminated water from gold mining, known as acid mine drainage, is toxic to aquatic life and enters the food chain.

Environmental Consequences

Gold mining has caused significant environmental damage. In 2015, the Gold King Mine spill in the US resulted in 3 million gallons of toxic waste water entering the Animas River, turning it yellow and causing harm to aquatic life. Cyanide, a highly toxic substance, is extensively used in gold mining and is directly linked to the gold market. It is estimated that gold mines use over 100,000 tons of cyanide annually, posing a significant risk to human and environmental health.

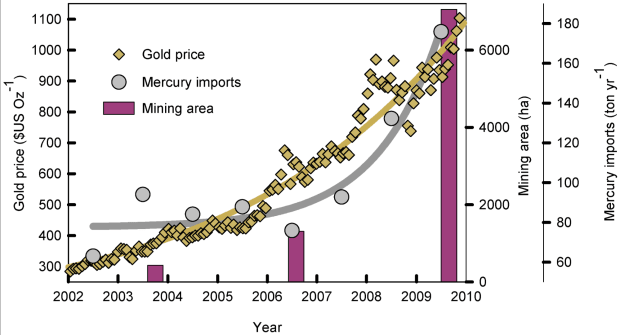

Mercury waste is another consequence of gold mining, particularly in artisanal and small-scale mines in the global South. These mines account for 38% of global mercury emissions. Mercury poisoning among mine workers and downstream communities has severe neurological effects and has led to vision and hearing loss, seizures, and memory problems. Additionally, gold mining has resulted in deforestation and habitat destruction in regions like the Amazon and Northeast Russia.

The Environmental Impact of Bitcoin Mining

While Bitcoin mining has been criticized for its energy consumption, research suggests that it can have positive environmental effects. Studies indicate that Bitcoin mining can incentivize the expansion of renewable energy and contribute to methane emission reduction. Additionally, Bitcoin mining has been found to have a carbon footprint that is half the size of gold mining.

Comparing Carbon Footprints

The carbon footprint of gold mining is estimated to be 126 Mt CO2e, while Bitcoin mining emits approximately 70 Mt CO2e. This means that Bitcoin mining has a lower carbon footprint and contributes less to climate change than gold mining.

A Sustainable Store of Value

Many investors argue that gold is a more environmentally friendly store of value compared to Bitcoin. However, the reality is that gold mining causes widespread ecological and social harm. Instead, a 21st-century store of value should prioritize sustainability and renewable energy. Bitcoin mining, with its lower carbon footprint and potential to incentivize renewable energy expansion, offers a more sustainable alternative.

Conclusion

Gold mining has a long history of environmental degradation, while Bitcoin mining has been criticized for its energy consumption. However, when comparing their environmental impacts, Bitcoin mining appears to have a lower carbon footprint and the potential to promote renewable energy. As we move towards a more sustainable future, it is essential to consider the environmental consequences of different industries and choose alternatives that prioritize ecological preservation.

Disclaimer: The opinions expressed in this article are solely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Is it a good idea to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. There is no way to recover money that you have invested in precious metals. This includes any loss of investments from theft, fire, flood or other circumstances.

Protect yourself against this type of loss by investing in physical gold or silver coins. These items have been around for thousands of years and represent real value that cannot be lost. They are likely to fetch more today than the price you paid for them in their original form.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

If you decide to open an account, remember that you won't see any returns until after you retire. Keep your eyes open for the future.

Who is the owner of the gold in a gold IRA

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What are the pros & cons of a Gold IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are also disadvantages to this type of investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

You can purchase insurance if you want to keep your money out of a bank. Insurance companies will usually require that you have at least $500,000. You might be required to buy insurance that covers losses up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers restrict the amount you can own in gold. Some providers allow you to choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Futures contracts for gold are less expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They enable you to establish a contract with an expiration date.

You will also have to decide which type of insurance coverage is best for you. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does provide coverage for damage from natural disasters, however. Additional coverage may be necessary if you reside in high-risk areas.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

You must first contact a qualified custodian before you open a gold IRA. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must keep your assets for as long you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Also, you should specify how much each month you plan to invest.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

You should consult a financial planner before opening a Gold IRA. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

How much should I contribute to my Roth IRA account?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you cannot touch your principal (the original amount deposited). This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. If you take out more than the initial contribution, you must pay tax.

You cannot withhold your earnings from income taxes. When you withdraw, you will have to pay income tax. Let's take, for example, $5,000 in annual Roth IRA contributions. In addition, let's assume you earn $10,000 per year after contributing. The federal income tax on your earnings would amount to $3,500. This leaves you with $6,500 remaining. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs are not allowed to allow you deductions for contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Lawful – WSJ

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

Investing In Gold vs. Investing In Stocks

These days, it might seem quite risky to invest your money in gold. This is because many people believe gold is no longer financially profitable. This belief stems from the fact that most people see gold prices being driven down by the global economy. They think that they would lose money if they invested in gold. There are many benefits to investing in gold. Below are some of them.

The oldest form of currency known to mankind is gold. It has been used for thousands of years. It is a valuable store of value that has been used by many people throughout the world. It is still used as a payment method by South Africa and other countries.

The first point to consider when deciding whether or not you should invest in gold is what price you want to pay per gram. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. Although gold's price has fallen, its production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. It is sensible to avoid buying gold if you are only looking to cover the wedding rings. It is worth considering if you intend to use it for long-term investment. Selling your gold at a higher value than what you bought can help you make money.

We hope you have gained a better understanding about gold as an investment tool. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]