Hey there, crypto enthusiasts! If you've been marveling at Bitcoin's meteoric journey, you're not alone. Back in 2010, when it was a mere $0.07, who could have predicted its soaring value surpassing $100,000 by 2025? This digital goldrush has reshaped financial strategies, minted fortunes, and firmly established Bitcoin as a linchpin in the upcoming financial landscape.

The Bitcoin Phenomenon Unveiled

Unveiling Bitcoin's Profitable Streak

Let's dive into the numbers. According to Bitcoin Magazine Pro's meticulous data, out of approximately 5,442 trading days, a staggering 5,441 days have yielded profits, boasting a mind-blowing success rate of 99.98%. This unprecedented consistency has rewarded early believers handsomely.

The Hodl Culture: A Testament to Reliability

Furthermore, over 80% of Bitcoin's trading days have been in the green, underscoring its unwavering upward trajectory. This remarkable track record is a beacon of hope for long-term investors who continue to "hodl" with unwavering confidence.

Bitcoin's Role in the Financial Landscape

Bitcoin: The Inflation Hedge

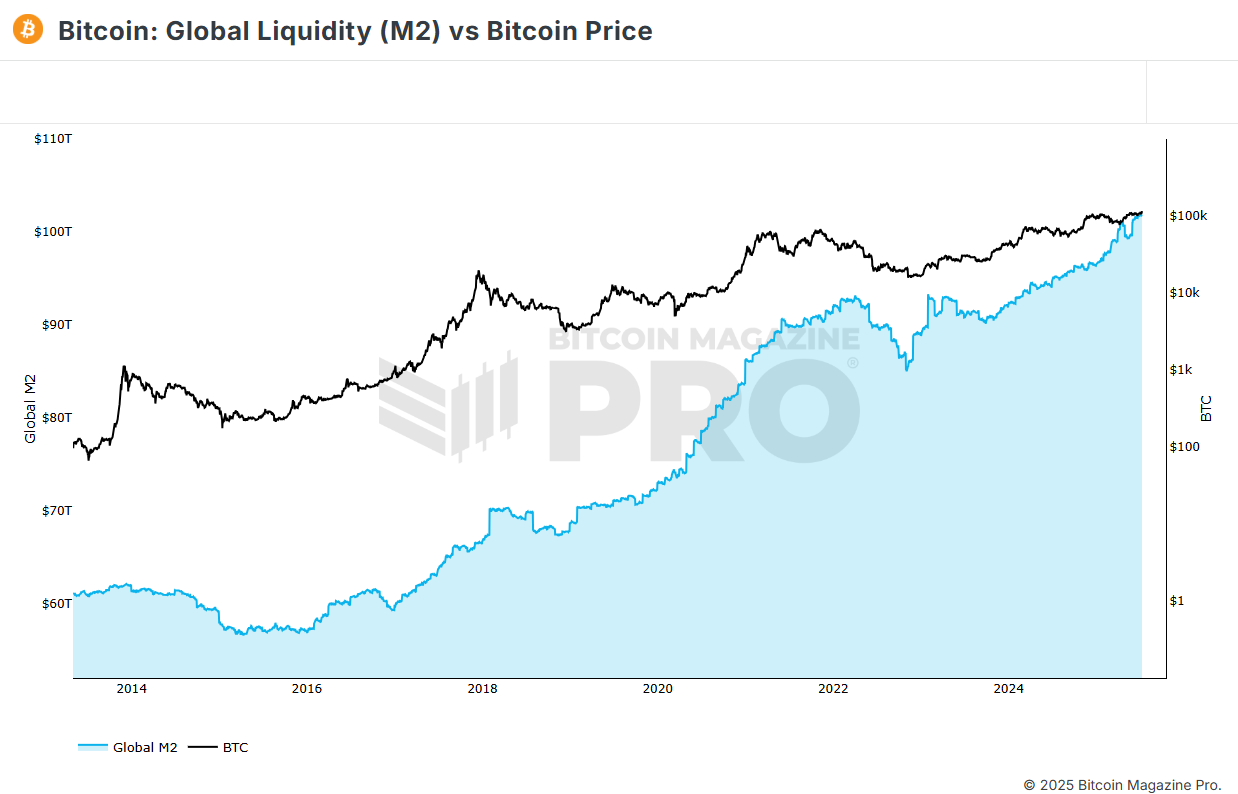

As the global money supply (M2) swelled from $61 trillion to over $102 trillion since 2013, Bitcoin's value surged from $113 to a peak of $118,000. This correlation underscores Bitcoin's dual role as a hedge against inflation and a steadfast store of value.

The Power of Dollar-Cost Averaging

Imagine this: by dollar-cost averaging $100 monthly into Bitcoin for nine years, your modest $10,900 investment would have blossomed into a remarkable $230,670 today, delivering an impressive 2,016% return. In comparison, traditional assets like gold, Apple stock, or the DJI pale in comparison to Bitcoin's exponential growth.

Exploring Investment Strategies

Bitcoin's Comparative Advantage

The Dollar Cost Average Strategies tool from Bitcoin Magazine Pro empowers users to contrast Bitcoin's performance against assets like the US dollar, gold, Apple stock, and the DJI. This tool underscores Bitcoin's potential as a premier store of value within a diversified investment portfolio. Curious to explore more? Dive into Bitcoin Magazine Pro's data here.

Embark on your Bitcoin investment journey armed with insights and strategies that could potentially reshape your financial future. The world of cryptocurrency awaits, offering unparalleled opportunities for those bold enough to seize them. So, are you ready to ride the Bitcoin wave to financial prosperity? Let's dive in together!

Frequently Asked Questions

What is the Performance of Gold as an Investment?

The price of gold fluctuates based on supply and demand. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. There is also a risk in owning gold, as you must store it somewhere.

Is buying gold a good way to save money for retirement?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion is the most popular method of investing in gold. There are many ways to invest your gold. Research all options carefully and make an informed decision about what you desire from your investments.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you require cash flow, gold stocks can work well.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

Are gold investments a good idea for an IRA?

Any person looking to save money is well-served by gold. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It is sometimes called the “oldest currency in the world”.

But gold is mined from the earth, unlike paper currencies that governments create. That makes it very valuable because it's rare and hard to create.

Gold prices fluctuate based on demand and supply. The economy that is strong tends to be more affluent, which means there are less gold miners. The result is that gold's value increases.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

investopedia.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

cftc.gov

- Fraud Advisory: Precious Metals Fraud

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]