Are you worried about your retirement savings and the uncertainty of traditional pension plans? Well, you're not alone. With people living longer and inadequate savings, the future of retirement can seem daunting. But what if there was a solution that involved Bitcoin, offering a secure and lasting savings option? That's where the concept of the Bitcoin Tontine comes in, providing a unique approach to retirement planning that could change the game.

The Rise of the Bitcoin Tontine

Exploring the Concept of Tontine for Crypto Enthusiasts

Let's delve into the world of Tontines and how they operate. A Tontine is an investment structure where individuals contribute to a trust and receive income for life based on their longevity. Upon a member's passing, the remaining funds are redistributed among the surviving members, boosting their retirement income. The innovative approach of the Bitcoin Tontine by Tontine Trust takes this concept to a new level, offering a transparent and potentially higher-yield alternative to traditional annuities.

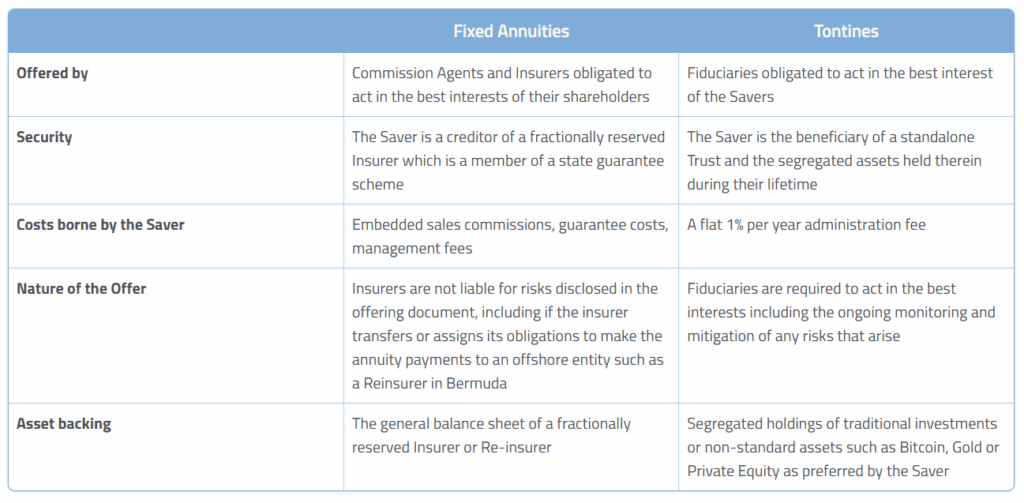

Distinguishing Features of Tontines versus Annuities

While annuities provide fixed income throughout life, Tontines offer flexibility and transparency in investment choices. With the Bitcoin Tontine, participants can benefit from a range of trustee-approved asset classes, including Bitcoin, gold, index funds, and more. This dynamic investment strategy coupled with the longevity pooling aspect ensures a potentially higher income stream for retirees, albeit with some variability based on investment returns.

Potential Drawbacks and Mitigation Strategies

One concern with Tontines is the impact of member longevity on payouts, raising fraud risks. However, Tontine Trust has introduced innovative solutions such as a proof-of-life mechanism through the Tontine Trust app to prevent fraud. Additionally, the use of blockchain technology enhances transparency, making the process secure and trustworthy for all participants.

Regulatory Landscape and Future Outlook

Adapting Tontines to Modern Regulations and Market Trends

Recent regulatory developments, including OECD recommendations and executive orders, signal a favorable environment for Tontines as retirement products. The shift towards democratizing access to alternative assets, including Bitcoin-backed Tontines, highlights the potential for this model to revolutionize retirement planning. National Tontines supported by Bitcoin could offer governments a sustainable and inflation-proof income solution for aging populations, paving the way for a secure retirement future.

Embracing the Future with Bitcoin Tontines

As we stand on the brink of a new era in retirement planning, the Bitcoin Tontine emerges as a promising option for crypto enthusiasts. Offering the potential for guaranteed lifetime income and higher returns than traditional annuities, the Bitcoin Tontine represents a significant advancement in retirement finance. The choice between fixed annuities and Bitcoin-powered Tontines presents a compelling decision for individuals seeking financial security in their later years.

It's time to embrace innovation and secure your financial future with the Bitcoin Tontine. Join the revolution today!

Frequently Asked Questions

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers simply to the physical metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. You'll get dividends each year.

Precious metal IRAs have no paperwork or annual fees. Instead, you pay a small percentage tax on the gains. Plus, you can access your funds whenever you like.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. This type of investment has its downsides.

You may lose all your accumulated savings if you take too much out of your IRA. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

A disadvantage to managing your IRA is the fact that fees must be paid. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

Insurance will be required if you would like to keep your cash out of banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. You may be limited in the amount of gold you can have by some providers. Others let you pick your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Futures contracts for gold are less expensive than physical gold. Futures contracts offer flexibility for buying gold. They allow you to set up a contract with a specific expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does offer coverage for natural disasters. You may consider adding additional coverage if you live in an area at high risk.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs will not be covered by insurance. For safekeeping, banks typically charge $25-40 per month.

You must first contact a qualified custodian before you open a gold IRA. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians can't sell assets. Instead, they must maintain them for as long a time as you request.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. You should also specify how much you want to invest each month.

After filling in the forms, please send them to the provider. After receiving your application, the company will review it and mail you a confirmation letter.

A financial planner is a good idea when opening a gold IRA. Financial planners are experts at investing and can help you determine which type of IRA is best for you. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

What's the advantage of a Gold IRA?

A gold IRA has many benefits. It can be used to diversify portfolios and is an investment vehicle. You decide how much money is put in each account and when it is withdrawn.

Another option is to rollover funds from another retirement account into a IRA with gold. This allows you to easily transition if your retirement is early.

The best part is that you don't need special skills to invest in gold IRAs. They're readily available at almost all banks and brokerage firms. You don't have to worry about penalties or fees when withdrawing money.

However, there are still some drawbacks. The volatility of gold has been a hallmark of its history. It's important to understand the reasons you're considering investing in gold. Are you looking for growth or safety? Is it for insurance purposes or a long-term strategy? Only by knowing the answer, you will be able to make an informed choice.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. One ounce won't be enough to meet all your needs. You could need several ounces depending on what you plan to do with your gold.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even get by with less than one ounce. However, you will not be able buy any other items with those funds.

Can I have physical gold in my IRA

Gold is money, not just paper currency or coinage. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold historically performs better than other assets during financial panics. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, the liquidity that gold provides is unmatched. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. You can buy gold in small amounts because it is so liquid. This allows one to take advantage short-term fluctuations within the gold price.

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Some experts think that this could change in the near future. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

Consider these things if you are thinking of investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It's possible to save for retirement without putting your savings into gold. However, when you retire at age 65, gold can provide additional protection.

- Second, be sure to understand your obligations before you purchase gold. Each type offers varying levels and levels of security.

- Don't forget that gold does not offer the same safety level as a bank accounts. Your gold coins may be lost and you might never get them back.

If you are thinking of buying gold, do your research. You should also ensure that you do everything you can to protect your gold.

What is a gold IRA account?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

Owning gold as an IRA has the advantage of allowing you to keep it forever. Your gold holdings will not be subject to tax when you are gone.

Your gold is passed to your heirs without capital gains tax. Your gold is not part of your estate and you don't have to include it in the final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you have done this, an IRA custodian will be assigned to you. This company acts as an intermediary between you and IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit is $1,000. The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

You'll have to pay taxes if you take your gold out of your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

A small percentage may mean that you don't have to pay taxes. There are some exceptions, though. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)