Hey there, crypto enthusiasts! Ready to dive into the latest rollercoaster ride in the world of Bitcoin? Buckle up as we explore the recent plunge below the crucial $96,000 support level, erasing gains from 2025 amid a wave of extreme bearish sentiment.

The Fall of the Bulls: A Gloomy Picture

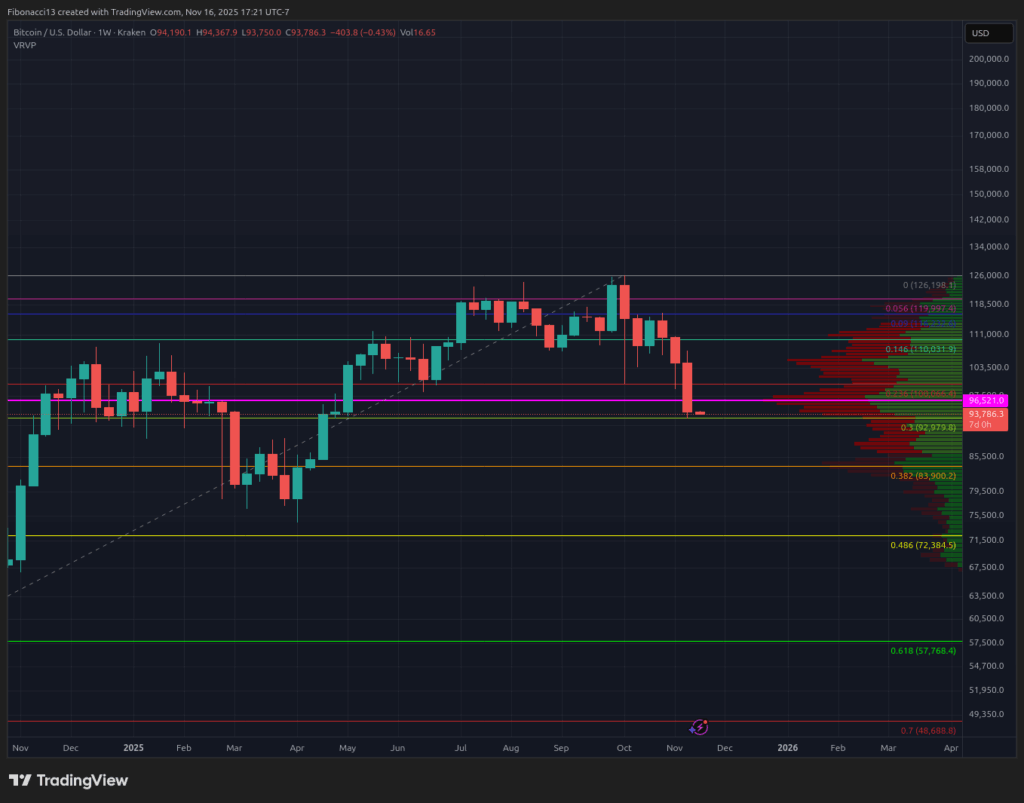

Picture this: Bitcoin bids farewell to the $96K support level, leaving the bulls in dismay as it closes the week at $94,290. Brace yourselves for more bearish moves ahead, with key support levels vanishing into thin air. While there might be occasional bounces, don't hold your breath for any significant price recoveries.

The Battle of Support and Resistance

Let's talk numbers. Bitcoin's price has nosedived below the $96,000 mark, signaling rough waters ahead. The next major support beckons at the 0.382 Fibonacci Retracement level, with a high volume node between $83,000 and $84,000. Eyes are also on the 2024 consolidation zone, ranging from $69,000 to $72,000. On the flip side, resistance looms large above $94,000, making any upward bounce an uphill battle.

A Glimmer of Hope or Wishful Thinking?

Do you believe in miracles? Well, Bitcoin enthusiasts might need one this week to witness a substantial rally. Despite a faint hope in the broadening wedge pattern, the bears seem to hold the reins firmly. Bulls might aim for a bounce to $106,000, but the path ahead looks rough, with new lows a looming possibility.

Market Sentiment: The Bearish Reign

The mood in the market? Think extreme bearish vibes. With Bitcoin sulking around $94,000, the bulls are on the back foot, facing a harsh reality of a 25% drop from the October peaks. Hope for a miraculous rally seems bleak, given the shattered support levels.

Peering into the Crystal Ball: The Road Ahead

Let's peek into the future. Considering the 4-year Bitcoin cycle theory, the peak might be a distant memory. With resistance casting a shadow over any potential rally, hopes for new highs this year fade. Could a late-cycle high in Q1 2026 turn the tides? The odds are slim, given Bitcoin's recent struggles amidst a strong stock market. Brace yourselves for a bumpy ride ahead!

Decoding the Terms:

Frequently Asked Questions

How does an IRA for gold and/or silver work?

You can make investments in precious metals (such as gold or silver) without having to pay tax. This makes them an attractive investment for people who want to diversify their portfolios.

If you are above 59 1/2 years old, you do not have income tax to pay on the interest earned. Any appreciation in the account's worth does not attract capital gains tax. You have to limit the amount you can deposit into this type account. Minimum amount allowed is $10,000 You cannot invest at all if you are under age 59 1/2. The maximum annual contribution allowed is $5,500

If you die prior to retirement, your beneficiaries may not receive the full amount. After you have paid all your expenses, your estate should include sufficient assets to cover the balance of your account.

Some banks offer a gold or silver IRA option, while others require that you open a regular brokerage account where you can buy certificates or shares.

Which is better: sterling silver or 14k-gold?

Although gold and silver can be strong metals, sterling silver is far less expensive as it contains 92% silver instead of 24%.

Sterling silver is also called fine silver. It is made from a combination silver and other metals, such as zinc and copper.

Gold is generally considered to be very strong. It can only be broken apart by extreme pressure. If you drop something on top of a chunk of gold it will shatter into thousands of pieces rather than breaking into two halves.

But silver isn’t nearly as sturdy as gold. If you dropped an object onto a sheet silver, it would bend and fold with no damage.

Silver is usually used in jewelry and coins. The price of silver can fluctuate according to supply and demande.

Are silver and gold IRAs a good idea for you?

This could be a good option for anyone looking to quickly invest in both silver or gold. There are other options as well. Contact us anytime if you have questions about these types investment options. We are always here to help!

How can I choose an IRA?

Understanding the type of account you have is the first step towards finding an IRA that suits your needs. This is whether you want a Roth IRA, a traditional IRA, or both. Also, you should know how much money is available for investment.

The next step is determining which provider fits your situation best. While some providers offer both accounts, others specialize in only one.

Last, consider the fees associated to each option. Fees vary widely between providers and may include annual maintenance fees and other charges. A monthly fee may be charged by some providers depending on how many shares your company holds. Others charge only once per quarter.

What precious metals are permitted in an IRA

Gold is the most widely used precious metal for IRA account accounts. You can also invest in gold bullion bars and coins.

Precious metals can be considered safe investments as they don't lose their value over time. They're also considered a great way to diversify an investment portfolio.

Precious metals are silver, palladium, and platinum. These three metals all have similar properties. However, each one has its unique uses.

For example, platinum is used in making jewelry. To create catalysts, palladium is used. It is used for producing coins.

Think about how much you can afford to purchase your gold, before you make a decision on the precious metal. You might be better off buying gold that costs less per ounce.

It is also important to consider whether you would like to keep your investment confidential. If you are unsure, palladium is the right choice.

Palladium is more expensive than gold. However, it is also rarer. You'll probably have to pay more.

Another important factor when choosing between gold and silver is their storage fees. Gold is stored by weight. You will pay more if you store larger amounts.

Silver is measured in volume. Silver is priced by volume. You will pay less to store smaller amounts.

All IRS rules concerning gold and silver should be followed if your precious metals are stored in an IRA. This includes keeping track of transactions and reporting them to the IRS.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

kitco.com

How To

Things to Remember: Best Precious Metals Ira, 2022

Precious Metals Ira ranks high among investors as one of their most popular investment options. This article will provide information on how to understand the appeal of precious metals ira and make sound investment decisions.

The main attraction of these assets is their long-term growth potential. Looking back at historical data, we see that gold prices have shown incredible returns. In the last 200 years, gold prices have risen from $20 to $1900 an ounce over the past 200. The S&P 500 Index grew only by about 50%.

When economic uncertainty is high, gold can be considered a reliable financial asset. When the stock markets is down, people tend not to hold onto their stocks but rather move into the safety and security of gold. Inflation is also a hedge, so gold can be used as a security measure. Many economists believe in inflation. They believe that physical gold can be used to protect your savings against future price rises.

Before you buy any precious metal, such as silver, gold, palladium or platinum, there are some things you should consider. First, determine whether you are interested in investing in bullion bar coins or coins. Bullion bars can be bought in large quantities (like 100-ounces) and kept aside until required. The coins are smaller versions than bullion bars and can be used to purchase small quantities of bullion.

Second, consider where you want to store your precious materials. Some countries are safer then others. If you are in the US, it might be a good idea to store your precious metals abroad. However, if you plan on keeping them in Switzerland you may want to think about why.

Finally, you should decide whether you want to invest directly in precious metals or through “precious metals exchange-traded funds” (ETFs). ETFs are financial instruments that track the performance of different commodities, such as gold. These can be used to gain exposure to precious metals, without the need to own them.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]