Are you ready to dive into the fascinating world of Bitcoin investments? Hold on tight as we explore Abu Dhabi's strategic move that shook the crypto market! The Abu Dhabi Investment Council (ADIC) made a daring leap, significantly increasing its stake in BlackRock's iShares Bitcoin Trust (IBIT) right before the crypto rollercoaster took a wild turn.

ADIC's Bitcoin Expansion

Picture this: ADIC, nestled within Mubadala Investment Co., decided to triple its holdings to nearly 8 million IBIT shares by the end of September. That's a whopping increase from 2.4 million shares just three months prior! This move wasn't just a random bet — it was part of a broader, long-term diversification strategy, positioning Bitcoin as a modern-day gold equivalent.

The Market Dynamics

Now, let's zoom in on the timeline. Abu Dhabi's strategic maneuver coincided with a pivotal moment in Bitcoin's journey. Just as the council was upping the ante, Bitcoin soared to new heights in early October, only to nosedive below $92,000 shortly after due to market dynamics and leveraged positions unwinding.

Abu Dhabi's Strategic Vision

Why did Abu Dhabi take such a bold step? Well, beyond the financials, Abu Dhabi is on a mission to solidify its position as a global crypto hub. With its vast resources and ambitious goals, the emirate is navigating the digital asset landscape with finesse, showcasing its readiness to embrace the future.

Global Expansion and Crypto Integration

Abu Dhabi's journey into Bitcoin is more than just a financial move. It's a strategic play towards global expansion and market influence. The council's recent leadership additions, coupled with its visionary investment strategies, highlight a calculated approach to embracing crypto's potential despite its volatile nature.

The Rising Trend

Abu Dhabi isn't alone in this crypto journey. Countries like El Salvador, the Czech Republic, and Kazakhstan are also stepping up their game, indicating a broader global shift towards crypto adoption. This trend signals a new era where Bitcoin isn't just a speculative asset but a strategic long-term investment for sovereign funds and governments alike.

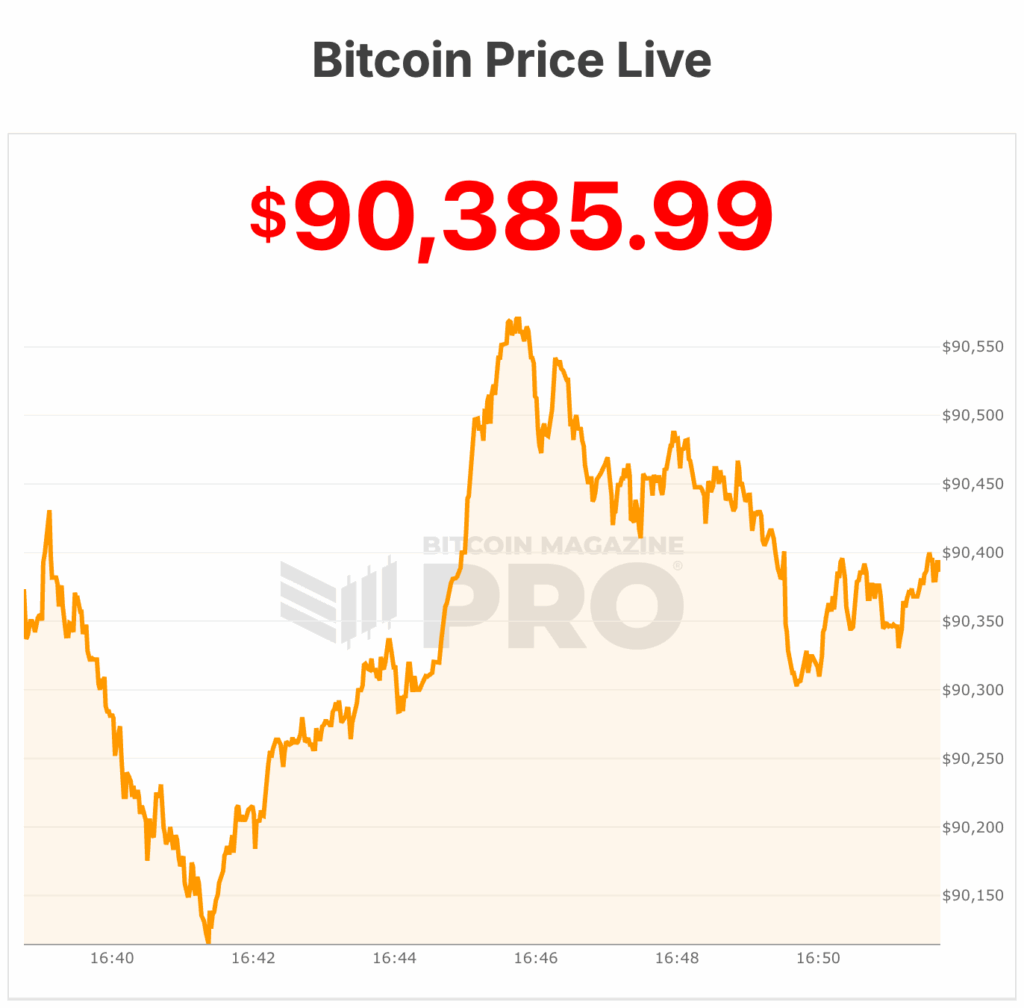

As Bitcoin's price hovers around $90,300, the world watches in anticipation of what the future holds for this digital currency.

The Call to Action

Excited to explore the world of crypto investments further? Stay tuned for more insightful updates and take a cue from Abu Dhabi's bold moves in the ever-evolving realm of Bitcoin investments!

Frequently Asked Questions

How much are gold IRA fees?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This fee includes account maintenance fees as well as any investment costs related to your selected investments.

To diversify your portfolio you might need to pay additional charges. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% per year. These rates can be waived if the broker is TD Ameritrade.

What precious metals could you invest in to retire?

The best precious metal investments are gold and silver. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: Gold is one of man's oldest forms of currency. It is also extremely safe and stable. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver has always been popular among investors. It's an ideal choice for those who prefer to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinium is another precious metal that is becoming increasingly popular. It is very durable and resistant against corrosion, much like silver and gold. It is, however, more expensive than its competitors.

Rhodium. Rhodium is used as a catalyst. It is also used as a jewelry material. It is also very affordable in comparison to other types.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also less expensive. This is why it has become a favourite among investors looking for precious metals.

How to Open a Precious Metal IRA?

First, you must decide if your Individual Retirement Account (IRA) is what you want. Open the account by filling out Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form must be submitted within 60 days of the account opening. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS states that you must be at least 18 and have earned income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. And, you have to make contributions regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA may also be used to invest in precious-metal companies. This option may be offered by some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they're not as liquid as stocks or bonds. It is therefore harder to sell them when required. Second, they don't generate dividends like stocks and bonds. You'll lose your money over time, rather than making it.

Should You Purchase Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

This could be changing, according to some experts. They believe gold prices could increase dramatically if there is another global financial crises.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Consider these things if you are thinking of investing in gold.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It's possible to save for retirement without putting your savings into gold. However, you can still save for retirement without putting your savings into gold.

- Second, be sure to understand your obligations before you purchase gold. Each one offers different levels security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. Losing your gold coins could result in you never being able to retrieve them.

If you are thinking of buying gold, do your research. Make sure to protect any gold you already own.

How much gold do you need in your portfolio?

The amount of capital that you require will determine how much money you can make. If you want to start small, then $5k-$10k would be great. Then as you grow, you could move into an office space and rent out desks, etc. This way, you don't have to worry about paying rent all at once. Rent is only paid per month.

Consider what type of business your company will be running. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. This means that you may only be paid once every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k in gold and working my way up.

What precious metal should I invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. You might not want to invest in gold if you're looking for quick returns. Silver is a better investment if you have patience and the time to do it.

If you don’t desire to become rich quickly, gold may be your best option. Silver might be a better investment option if steady returns are desired over a long period of time.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)