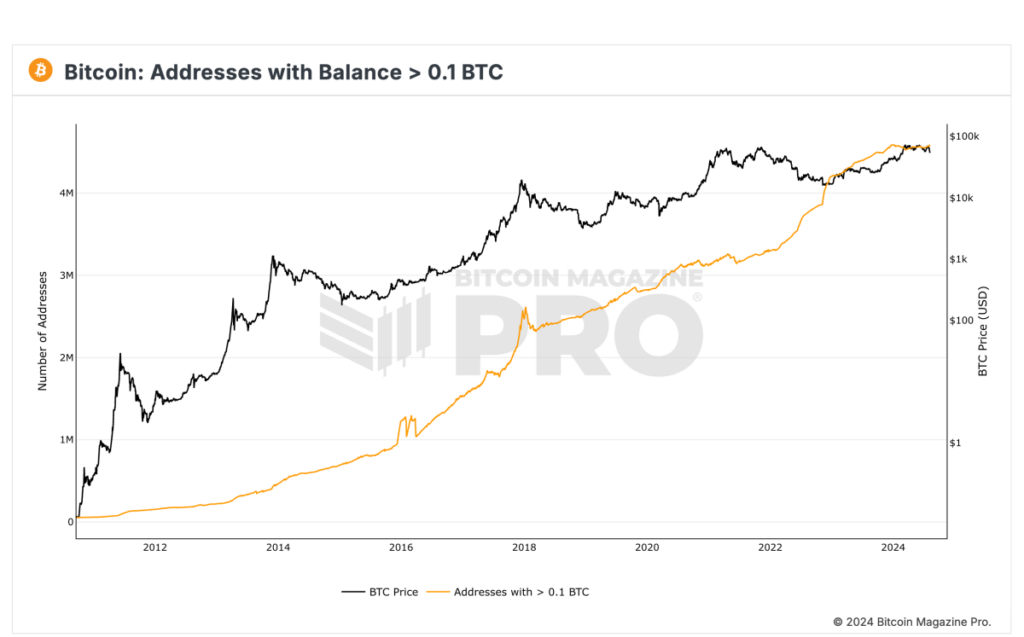

Recent data from Bitcoin Magazine Pro reveals that the number of Bitcoin addresses holding a balance of over 0.1 BTC is approaching a record high. Currently, there are 4,580,424 such addresses, which is just slightly below the peak of 4,586,540. This marks a substantial monthly increase of 27,939 addresses.

Unique Buying Opportunity Created by Price Drop

The recent decline in Bitcoin's price, dropping from $67,500 to $49,000, has presented investors with a unique chance to acquire Bitcoin at prices below $50,000. Despite the current trading range of $50,000-$60,000, which is 24% lower than its all-time high, buyers are actively accumulating Bitcoin. This trend could potentially lead to a new record in the number of addresses holding over 0.1 BTC.

Tracking Bitcoin Adoption Through Address Data

An essential metric for monitoring Bitcoin adoption and usage is the number of unique addresses holding at least 0.1 BTC. An increase in addresses with small Bitcoin amounts signifies a rise in adoption among new users over time.

Understanding Bitcoin Addresses and Wallets

A Bitcoin address is a string of 26-35 alphanumeric characters that enables individuals to send and receive Bitcoin. Each wallet can consist of multiple addresses, serving as the public-facing component necessary for conducting transactions.

Projected Growth Amid Limited Supply

With Bitcoin's total supply capped at 21 million, approximately 19 million coins have been mined to date. Estimates suggest that around 3 million of these coins may have been lost. As Bitcoin gains momentum, the number of addresses holding at least 0.1 BTC is expected to increase, reflecting broader adoption and enhanced usage across different user groups.

For more in-depth insights, information, and to register for a complimentary trial to access Bitcoin Magazine Pro's comprehensive data and analytics, please visit the official website.

Frequently Asked Questions

What kind of IRA can you use to hold precious metals in?

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. An IRA lets you contribute money that will grow tax-deferred to the time it is withdrawn.

You can save taxes and pay them later with an IRA. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA is a great investment because your earnings and contributions are tax-free. You can withdraw funds at any time. You can face penalties if you withdraw funds before the deadline.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals before age 59 1/2 will be subject to a 5% IRS penal. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

Withdrawal amounts exceeding $10,000 per year are subject to a 6.2% IRS penalty.

Can I take physical possession of gold in my IRA?

Many people ask themselves whether it is possible to physically own gold in an IRA. This is a valid question as there is no legal route to it.

If you take a closer look at the law, there is nothing that can stop you from having gold in your IRA.

Most people don't realize the cost savings they could make by putting their gold into an IRA rather than keeping it in their homes.

It's easy for gold coins to be thrown away, but it's much more difficult to keep them in an IRA. If you decide to keep your precious metal in your own home you will have to pay two taxes. One for the IRS, and one for your state.

It is possible to lose your gold and pay twice as much tax. Why would you want it to stay in your home?

You might argue that you need the security of knowing that your gold is safe in your home. You can protect your gold from theft by storing it somewhere more secure.

You shouldn't even leave your gold in your home unless you plan to visit often. If you leave your precious gold unattended thieves will easily steal it.

An insured vault is a better choice for gold storage. Your gold will be safe from fire, flood and earthquake as well as robbery.

You won't be responsible for paying any property tax if you store your gold in a vault. Instead, you'll have to pay income tax on any gains you make from selling your gold.

If you prefer not to pay tax on your precious metals, an IRA may be a good option. An IRA allows you to keep your gold free from income taxes, even though it earns interest.

Capital gains tax is not required on gold. If you decide to cash it out, you will have full access to its value.

You won't have to move your gold because IRAs are federally regulated.

Bottom line: You can have gold in an IRA. Your fear of it being stolen is what holds you back.

How much should precious metals be included in your portfolio?

Investing in physical gold is the best way to protect yourself from inflation. Because you are buying into the future value of precious metals and not the current price, when you invest in them, it is a way to protect yourself from inflation. You can expect your investment to increase in value with the rise of metal prices.

If you hold on to your investments for at least five years, you will receive tax benefits on any gains. Capital gains taxes will apply if you sell the investments within this time period. Visit our website to find out more about buying gold coins.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

forbes.com

wsj.com

kitco.com

regalassets.com

How To

How to convert your IRA into a Gold IRA

Are you looking to transfer your retirement savings out of a traditional IRA in favor of a gold IRA. This article will show you how to do it. Here's how to make the switch.

“Rolling over” is the act of transferring money from one type (traditional) to another type (gold). This is done because tax advantages go along with rolling over an account. In addition, some people prefer investing in physical assets like precious metals.

There are two types IRAs – Traditional IRAs and Roth IRAs. The difference between these two accounts is simple: Traditional IRAs allow investors to deduct taxes when they withdraw their earnings, while Roth IRAs don't. This means that if a Traditional IRA is invested $5,000 today, it will be able to withdraw $4,850 over five years. You would still be able to keep all your money if you had the same amount invested in a Roth IRA.

These are the things you need to know if your goal is to convert from a traditional IRA or a gold IRA.

First, you must decide whether to move your balance into a new bank account or transfer funds from your existing account to the new one. You will pay income tax on earnings above $10,000 when you transfer money. However, if your IRA is rolled over, these earnings will not be subjected to income tax until age 59 1/2.

Once you've made up your mind, you'll need to open up a new account. It is likely that you will be asked to prove your identity by providing proof such as a Social Security card or passport. Then, you'll fill out paperwork showing that you own the IRA. After you have completed the forms, submit them to your bank. They will verify your identity as well as give instructions on how to send wire transfers and checks.

Now comes the fun part. Now, deposit money into your account and wait for approval from the IRS. After approval is granted, you will receive a letter saying that you are now allowed to withdraw funds.

That's it! All you need to do now is watch your money grow. Remember that if you are unsure whether you want to convert your IRA, it is possible to close it and roll the balance over into a new IRA.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]