Hey there, crypto enthusiasts! Today, I'm diving into the exciting world of Bitcoin price movements, especially with the looming FOMC rate cuts. Let's uncover the recent rollercoaster ride of Bitcoin's value and explore where it might head next.

Bitcoin's Recent Performance

The Ups and Downs

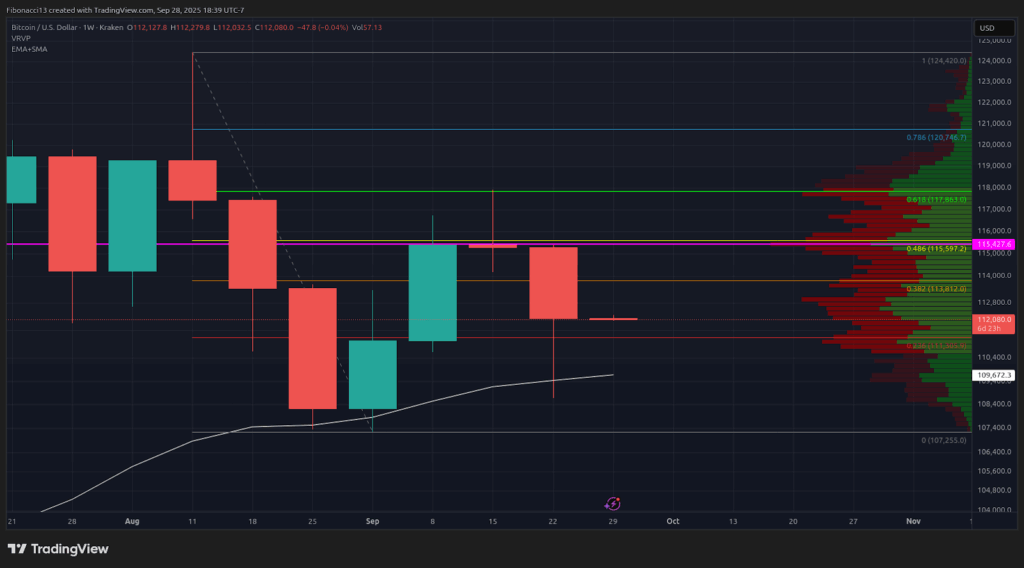

Last week, Bitcoin experienced a significant drop down to $111,800, only to bounce back and test the $113,800 resistance and the 21-day EMA at $114,000. However, the bulls faced rejection, leading to a dip below the $109,500 support level. Despite this, the price managed to recover and closed the week at $112,225.

Key Support and Resistance Levels

Navigating the Terrain

- Support Levels: The crucial $109,500 support must hold for a bullish momentum. Further support lies at $105,000 and a potential reversal point around $102,000.

- Resistance Levels: Bulls aim to surpass the $115,500 barrier to resume the uptrend. A breakthrough could propel Bitcoin towards $118,000 and beyond to reach new highs.

Outlook for the Week

Predicting the Future

This week, watch for a retest of the $109,500 support, with a possible uptrend to $113,800. Breaking the $115,500 resistance might require strong buying pressure, indicating a bullish trajectory. However, caution is advised as the bias remains bearish.

- Weekly Chart Analysis: A bearish bias persists, with the $113,800 resistance likely to hold short term. Losing $109,500 could trigger a substantial price drop towards lower support levels.

Market Sentiment

Current Mood

The market mood leans bearish, with a dominant red candle signaling bear control. Bulls need to defend the 21-week EMA support vigorously to shift the narrative.

Looking ahead, the coming weeks will be crucial. Bulls must regain control to steer the price positively. As markets anticipate more rate cuts, investors eye upcoming financial reports for cues. Any obstacles to rate cuts could lead to further bearish trends.

Remember, in this crypto realm, bulls expect prices to rise, bears anticipate falls, support levels can weaken, and resistance levels can break. Keep an eye on those moving averages for insights!

Frequently Asked Questions

Do you need to open a Precious Metal IRA

This depends on what your investment goal is and how risk-tolerant you are.

If you plan to use the money for retirement, you should open an account now.

This is because precious metals are more likely to appreciate in the future. They offer diversification advantages.

Additionally, silver and gold prices tend to move in tandem. They are therefore a better option for investing in both assets.

Precious metal IRAs are not recommended for anyone who isn't planning to use their money for retirement and doesn't want any risk.

How do I Withdraw from an IRA of Precious Metals?

If your account is with a precious metal IRA firm such as Goldco International Inc., you may want to consider withdrawing funds. If you decide to sell your metals this way, they will be much more valuable than if they were inside the account.

This article will help you understand how to withdraw funds from an IRA that holds precious metals.

First, find out whether your precious metal IRA provider allows withdrawals. Some companies offer this option while others do not.

Second, you should determine if your metals are tax-deferred. Many IRA providers provide this benefit. Some providers do not offer this benefit.

Third, you should check with the provider of your precious metal IRA to determine if there are fees for these steps. Extra fees may apply for withdrawals.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. You should therefore wait until January each year to calculate capital losses on your investment portfolio. You will then need to file Form 8949 which contains instructions on how to calculate the amount of gain that you have realized.

The IRS requires that you report your sale of precious metals. This is a step that ensures that all sales are taxed.

Finally, consult a trusted accountant or attorney before selling your precious metals. They can help ensure you follow all necessary procedures and avoid costly mistakes.

How do I open a Precious Metal IRA

You can open an IRA in precious metals by opening a Roth Individual Retirement Account (IRA), which you can self-direct.

This type of account is better than other types of IRAs because you don't have to pay any taxes on the interest you earn from your investments until you withdraw them.

This makes it very attractive to people who want to save money but also need a tax break.

You are not limited to investing in gold or silver. You can invest anywhere you wish, as long as it is within the IRS guidelines.

While most people associate precious metals with silver and gold, there are many types of precious metals.

These include palladium, platinum, rhodium,osmium,iridium, andruthenium.

There are many ways that you can invest precious metals. You can buy bullion coins or bars, or shares in mining businesses.

Bullion Coins & Bars

One of your easiest ways to get into precious metals is to purchase bullion coins. Bullion refers to physical ounces (or grams) of gold and/or silver.

Bullion bars and bullion coins are actual pieces of the metal.

While you might not see any change in your pocket after you purchase bullion coins and bars at a store, you will notice some benefits over time.

For example, you'll get a piece of history in a tangible form. Each coin or bar has its own story.

When you look at face value of the coin, you'll often find that it's worth far less than its nominal value. In 1986, the American Eagle Silver Coin was $1.00 per ounce. Today, however, the price of an American eagle is closer to $40.00 per ounce.

Bullion has seen a dramatic rise in value since its introduction. Many investors would rather buy bullion coins or bullion bars than futures contracts.

Mining Companies

Investing in shares of mining companies is another great option for those looking to buy precious metals. You are investing in the ability of mining companies to produce gold or silver.

In return, you will receive dividends based on the company's profits. These dividends can then be used to pay out shareholders.

Furthermore, the company has the potential to grow. The company's share prices should also increase as demand increases for the product.

You should diversify because these stocks have a tendency to fluctuate in their prices. This means you can spread your risk to multiple companies.

But, remember that mining companies, like all stock market investments, are susceptible to financial loss.

If gold prices plummet significantly, ownership of your shares could be worthless.

The bottom line

Precious metals, such as silver and gold, can be a refuge during economic uncertainty.

But, silver and gold can be subject to price swings. If you're looking to make a long-term, profitable investment in precious metallics, then consider opening a precious precious metals IRA Account with a reputable business.

You will be able to take advantage of tax incentives while also benefiting from physical assets.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

en.wikipedia.org

regalassets.com

forbes.com

takemetothesite.com

How To

How to Start Buying Silver with Your IRA

How to buy silver with an IRA – Direct ownership of physical bullion is the best way to invest. The most popular investment form is silver bars and coins. This is because it offers diversification and liquidity.

There are several options to purchase precious metals, like gold or silver. You can either buy them directly from their producers like mining companies or refiners. If you don't want the hassle of dealing with a producer directly, you can purchase them from a dealer that buys and trades bullion products.

This article will discuss how to start investing in silver with your IRA.

- Investing in Gold & Silver Through Direct Ownership – The first option for purchasing precious metals is to go straight to the source. This means getting the bullion itself and having it delivered right to your door. Some investors keep their bullion at home, while others store it in a secure storage unit. Protect your precious metal by storing it correctly. Most storage facilities offer insurance coverage that protects against theft, fire, or damage. Even with insurance, your investments could be damaged by natural disasters or human error. For these reasons, storing your precious metals in a safe deposit box at a bank or credit union is always recommended.

- Online Precious Metals Purchase – You can buy bullion online if you want to avoid having precious metals in heavy boxes. Bullion dealers offer bullion in a variety of forms, including bars and coins. Coins come in different sizes, shapes, and designs. Generally speaking, coins are easier to carry around and less expensive than bars. There are many different sizes and weights available for bars. Bars can weigh hundreds of lbs, while others weigh only a few ounces. The best rule of thumb for choosing the right type of bar is to consider your intended use. It might be a good idea to choose something smaller if it is intended to be given as a gift. It might not be the best choice if you're looking to add it in your collection or display it proudly.

- Buy Precious Metals from Dealers – Another option is to purchase bullion directly from a dealer. Most dealers specialize in one area of the market, whether gold or silver. Some dealers are experts in specific types of bullion such as rounds and minted coins. Some specialize in particular regions. And yet others specialize in bulk purchases. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Buy Precious Metals Through Retirement Accounts. Although it is not considered an “investment”, investing in retirement accounts can provide exposure to precious metals. To qualify for tax benefits under Section 219 of the IRS Code, you must invest in precious metals through a qualified retirement account. These accounts include IRAs. These accounts are often set up to help you save more for retirement. They offer higher returns than most other investment vehicles. Most accounts allow you the ability to diversify between different metals. What is the drawback? Investments in retirement accounts aren't available to everyone. These accounts can only be opened by employees who are sponsored by their employers.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]