Introduction

We live in a highly digitalized world, but most of humanity still uses physical goods to store value. The most used store of value in the world is real estate. It is estimated that approximately 67% of global wealth is held in property. Recently, however, macroeconomic and geopolitical headwinds have highlighted the weaknesses of real estate as a physical store of value. What to do if a war breaks out? What happens if a home that was used as a store of value is destroyed?

Real Estate: Vulnerabilities in Times of Conflict

In German, real estate translates to "Immobilie," which literally means "to be immobile." Owning real estate creates a local dependency that can pose a problem in a world of ever-increasing conflict and radicalization. In the event of war, you cannot take real estate with you and it can be easily destroyed.

This may sound like a dystopia, but I believe that if you are serious about long-term wealth management, you should consider the worst-case scenario and the possible global impact.

War And Destruction Of Wealth

Since the beginning of the 21st century, war has never cost humanity so much. Over 238,000 people were killed in conflict last year. Syria, Sudan, Ukraine, Palestine, Israel, Lebanon – the global sources of conflict are increasing. Some of these areas have already suffered massive destruction. There are no more properties there and the value stored in them has literally evaporated. It's hard to imagine the financial setbacks people have had to endure, apart from the suffering and grief that war brings.

Real estate is used as a store of value around the world, although there are some exceptions, such as Japan. With the threat of destruction increasing, the fruits of the labor of millions, possibly billions, of people are at stake. Alongside inflation and taxation, physical wealth destruction has historically been one of the greatest threats to overall prosperity. Already in ancient times, armies ruthlessly plundered cities and destroyed the residents' belongings.

Physical vs. Digital Store Of Value

Fortunately, with Bitcoin there is a solution to the threat of destruction of wealth stored in physical assets. As a digital, near-perfect mobile store of value, it is difficult to destroy and easy to move.

The introduction of Bitcoin in 2009 challenged the role of real estate as humanity's preferred store of value, as it represents a better alternative that allows people worldwide to protect their wealth with relative ease.

You can buy very small denominations of bitcoin, the smallest being 1 satoshi (1/100,000,000 of a bitcoin) for as little as ≈ $ 0.0002616 (on 2/12/2024). All you need to store it safely is a basic computer without internet access and a BIP39 Key generator — or just buy a hardware wallet for $50. In case you need to relocate, you can memorize 12 words, the backup (seed phrase) for your wallet, and "take" your bitcoin with you.

Digitalization: The Advantages of Bitcoin

Digitization optimizes almost all value-preserving functions. Bitcoin is rarer, more accessible, cheaper to maintain, more liquid, and most importantly, it allows you to move your wealth in times of crisis.

Bitcoin is wealth that truly belongs to you. With the threat of war looming around the world, I believe it is better to hold wealth in a digital asset like bitcoin than in physical assets like real estate, gold, or art, which can easily be taxed, destroyed, or confiscated.

Property Confiscation: Lessons from History

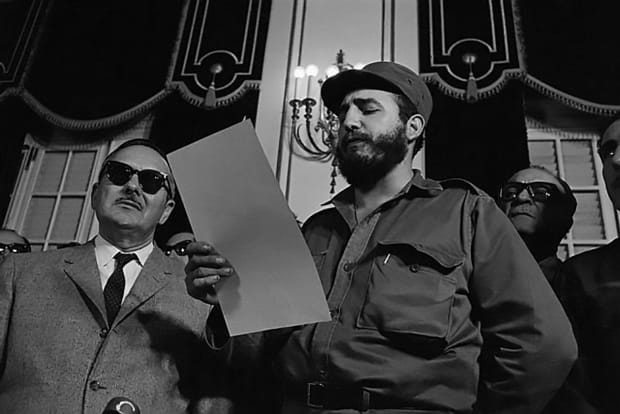

If we look at history, it is clear that physical stores of value have left people vulnerable to government overreach. A historical example is the expropriation of Jews in Nazi Germany. Unfortunately, these repressions were not an isolated case in history. It happens all the time. Many lost their property in Cuba when Fidel Castro took over, as Michael Saylor likes to point out.

These painful history lessons underscore the significance of safeguarding wealth in a digital asset such as bitcoin, which proves challenging to confiscate, tax, or destroy and easy to move.

Macroeconomic Changes: Real Estate vs. Bitcoin

Additionally, shifts in the macroeconomic landscape can swiftly devalue real estate. Typically, real estate is purchased through a loan. Therefore, elevated interest rates translate to diminished affordability for financing, resulting in a decreased demand and subsequently lowering property prices. We can see this scenario playing out globally right now, the conjunction of increased interest rates and reduced demand is contributing to the decline in property values around the globe.

Bitcoin is less affected by the problems of the traditional fiat financial system than real estate. Since it operates independently of the system, variables such as interest rates, central bank decisions, and arbitrary governmental actions have limited influence on bitcoin. The price is predominantly determined by its supply, issuance schedule, and adoption rate.

Bitcoin follows a disinflationary model that implies a gradual reduction in its supply over time until a hard limit is reached in 2140. Approximately every four years, the bitcoin awarded to miners for successfully ordering transactions (every 10 minutes) are halved.

The upcoming halving, set for Friday, April 19, 2024, is expected to halve the block reward from 6.25 bitcoin to 3.125, which translates to a daily issuance of 450 bitcoin instead of 900.

Currently, bitcoin has an annual inflation rate of around 1.8%, which is expected to drop to 0.9% after the upcoming halving. After that, the inflation rate will be almost negligible. In addition, a large number of bitcoin were lost and we can expect that many will be lost in the future. The continuous decline in finite supply increases the deflationary pressure of the Bitcoin network. As more and more people (and machines) are using bitcoin, increasing demand is countered by decreasing supply.

Absolute Scarcity: The Unique Value of Bitcoin

For most, it is difficult to imagine the impact of a fixed supply on the price of an asset. Prior to Bitcoin, there was no concept of an inherently scarce commodity. Even gold possesses an elastic supply. Increased demand prompts more intensive mining efforts, a flexibility not applicable to bitcoin.

Consequently, with each halving event, signifying a reduction in supply, the price of bitcoin ascends and continues to do so perpetually. This permanent increase persists as long as there is a corresponding demand, a likelihood attributed to bitcoin's exceptional monetary properties.

This dynamic is expected to continue even in the midst of a global economic crisis. The supply of bitcoin will continue to decrease, and the price will most likely continue to rise. Due to the expected continued demand in times of crisis, as explained. Even inflation can have a positive impact on the price of bitcoin as it leads to increased availability of fiat currencies that can be invested in Bitcoin.

Conclusion

In a world marked by growing radicalization and a financial system undergoing a profound crisis, bitcoin emerges as a superior choice for storing value, especially during periods of macroeconomic fluctuations. The significance of bitcoin is anticipated to rise during these turbulent times, potentially overtaking real estate as humanity's preferred store of value in the distant future.

The aspiration is that an increasing number of individuals will recognize the advantages of Bitcoin, not only for wealth preservation but, in extreme circumstances, for securing their livelihood.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

What are the advantages of a IRA with a gold component?

There are many advantages to a gold IRA. You can diversify your portfolio with this investment vehicle. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This makes for an easy transition if you decide to retire early.

The best part is that you don't need special skills to invest in gold IRAs. These IRAs are available at all banks and brokerage houses. You don't have to worry about penalties or fees when withdrawing money.

There are also drawbacks. Gold is historically volatile. So it's essential to understand why you're investing in gold. Is it for growth or safety? Are you looking for growth or insurance? Only once you know, that will you be able to make an informed decision.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even get by with less than one ounce. These funds won't allow you to purchase anything else.

Can the government take your gold

The government cannot take your gold because you own it. You earned it through hard work. It belongs to your. But, this rule is not universal. If you are convicted of fraud against the federal government, your gold can be forfeit. If you owe taxes, your precious metals could be taken away. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

Should You Invest in gold for Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. This makes it a worthwhile choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. This causes its value to fluctuate over time.

However, this does not mean that gold should be avoided. This just means you need to account for fluctuations in your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is less difficult to store than stocks or bonds. It can be easily transported.

As long as you keep your gold in a secure location, you can always access it. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. You can also liquidate your gold position at any time you need cash, just like stocks. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't buy too many at once. Begin by buying a few grams. Continue adding more as necessary.

Don't expect to be rich overnight. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Who is entitled to the gold in a IRA that holds gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

You should consult a financial planner or accountant to see what options are available to you.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)