Introduction

Discreet Log Contracts (DLCs) are a concept that has been around for a while. Proposed by Thaddeus Dryja, the co-creator of the Lightning Network protocol, in 2017, DLCs are a type of smart contract designed to address several issues present in previous contract schemes. These issues include scalability, data integration, and user privacy.

The Basic Scheme

The basic scheme of a DLC is quite simple. Two parties create a multisig address and choose an oracle. The oracle is responsible for announcing the price of a specific asset, such as Bitcoin. The parties then create a set of Contract Execution Transactions (CETs) that interact with the oracle. Each CET includes an encrypted signature that can only be decrypted using information from the signed oracle message. This ensures the privacy of the users involved. Additionally, a timelocked refund transaction is included to refund the parties if the oracle fails to provide the necessary information within a specified time period.

Advantages of DLCs

DLCs offer several advantages over traditional contract schemes. They are scalable, requiring only a single transaction to fund and settle the contract. They allow for the integration of external data into the blockchain. And they provide privacy to the users, as the oracles have no insight into who is using them in a contract. Furthermore, DLCs prevent oracles from selectively harming a single user, as the oracle's signature is used to settle every DLC connected to that settlement message and time.

Shortcomings and Coordination Issues

Despite their advantages, DLCs have a few shortcomings. One major issue is the reliance on an oracle, which introduces an element of trust. Another issue is the coordination problem, especially when dealing with contracts that have a large number of potential outcomes. This can lead to network issues and potential free option problems, where one party can choose to fund the contract only if it is in their favor.

DLC Markets and Institutional Needs

LN Markets, a company specializing in DLCs, has introduced a new DLC specification tailored towards institutional actors. This specification addresses the issues faced by institutional customers, such as the free options problem, lack of margin calls, and inefficient use of capital.

The Role of the DLC Coordinator

To address these issues, LN Markets has introduced the concept of a DLC coordinator. The coordinator facilitates contract negotiations by handling the funding and negotiation process. This eliminates the free options problem, as the coordinator holds the necessary signatures for funding the contract. The coordinator also streamlines the coordination process by allowing users to register their information and offers with the coordinator, making it easier to set up a DLC.

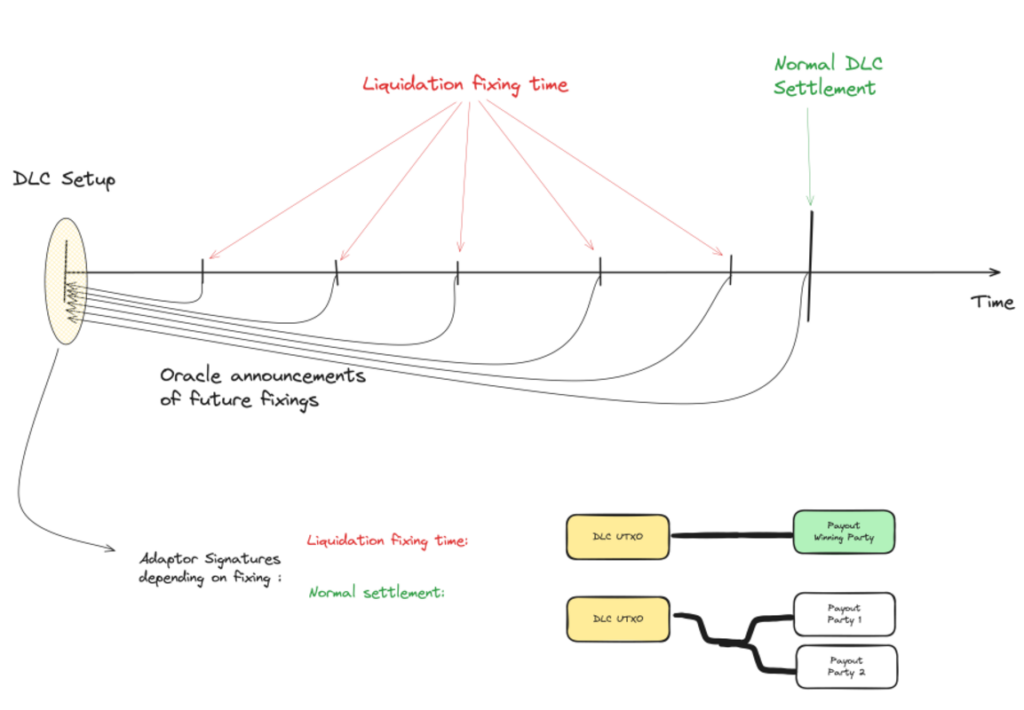

Liquidations and Margin Calls

The involvement of the coordinator also enables the addition of liquidations and margin calls in DLCs. Special settlement transactions are included at predetermined intervals before the contract expiry. If the price is outside the contract range at any of these liquidation points, either party can submit a transaction to settle the contract early. Furthermore, the coordinator facilitates the coordination of adding additional margin to the contract, allowing parties to manage liquidity more effectively.

The Potential of DLCs for Institutional Investors

While these changes may seem small, they have the potential to make DLCs more appealing to larger economic actors and pools of capital. This development could lead to DLCs being used in capital and financial markets, similar to how the Lightning Network revolutionized transactional use of Bitcoin.

Conclusion

Despite not being a primary use case for many people, the evolution of DLCs to meet institutional needs should not be overlooked. As an open system, Bitcoin allows for various use cases, and DLCs have the potential to become a significant one.

Frequently Asked Questions

How do I open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). Open the account by filling out Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should not be completed more than 60 days after the account is opened. Once this is done, you can start investing. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS states that you must be at least 18 and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Additionally, you must make regular contributions. These rules are applicable whether you contribute through your employer or directly from the paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. However, physical bullion will not be available for purchase. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option is available from some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they are not as liquid or as easy to sell as stocks and bonds. It's also more difficult to sell them when they are needed. They don't yield dividends like bonds and stocks. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. You can start small by investing $5k-10k. As you grow, it is possible to rent desks or office space. Renting out desks and other equipment is a great way to save money on rent. It's only one monthly payment.

It's also important to determine what type business you'll run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. This means that you may only be paid once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Is physical gold allowed in an IRA.

Not just paper money or coins, gold is money. It's an asset that people have used for thousands of years as a store of value, a way to keep wealth safe from inflation and economic uncertainty. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans now invest in precious metals. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold is liquid. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows for you to benefit from the short-term fluctuations of the gold market.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

cftc.gov

- Fraud Advisory: Precious Metals Fraud

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]

Related posts:

Sygnum Survey Shows Institutional Investors Embrace Crypto as Important in Global Finance

Sygnum Survey Shows Institutional Investors Embrace Crypto as Important in Global Finance

Evolution of Crypto Custodians: New Use Cases for Institutional Customers

Evolution of Crypto Custodians: New Use Cases for Institutional Customers

Kevin O’Leary Anticipates Strong Institutional Interest in Crypto Regardless of Spot Bitcoin ETF Outcome

Kevin O’Leary Anticipates Strong Institutional Interest in Crypto Regardless of Spot Bitcoin ETF Outcome

Ark Invest CEO Cathie Wood Foresees Widespread Institutional Involvement in Bitcoin ETFs

Ark Invest CEO Cathie Wood Foresees Widespread Institutional Involvement in Bitcoin ETFs