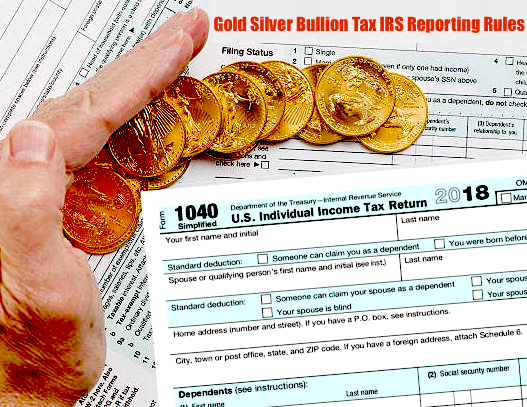

If you're under the age of 59 1/2, you might be wondering if you owe the IRS on your IRA gold. If so, you'll need to store it in an IRS-approved depository or pay penalties. In this article, we'll discuss the rules regarding storing IRA gold, as well as the penalties you'll face if you don't comply.

IRA gold must be stored in an IRS-approved depository

It's possible to own gold through your IRA, but you must store it in an IRS-approved depository. It can't be stored at home, even in a safe. If you store your gold at home, you'll likely have to pay a 10% penalty on the sale if you're under age 59.5. You'll also lose the benefit of tax-deferred growth and will be subject to taxation, which means a potential IRA audit and hefty fines.

In addition to gold bullion products, IRA owners can invest in other precious metals, including silver and platinum. It is important to keep in mind that gold IRAs must be stored in an IRS-approved deuteronomy, so make sure that you choose the right company to store your gold.

IRA gold owes irs if you're under 59 1/2

A gold-backed IRA will allow you to avoid paying taxes on its growth and distributions, but you'll have to keep your money in the account until you're 59 1/2. The IRS also has the right to pursue you for violating the rules.

However, there are some exceptions to the rule. In some cases, people can receive distributions before the age of 59 1/2 if they have medical expenses that exceed 7.5% of their adjusted gross income. Other exceptions include being totally and permanently disabled and incurring medical expenses while unemployed.

Before receiving distributions, you should determine if you're eligible for an early distribution recapture tax. This tax is triggered if you change your distribution method. This can happen if you're reemployed within 60 days of receiving the distributions.

Frequently Asked Questions

Can you make money on a gold IRA?

You must first understand the market and then know which products are available to make money.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

Find a broker that offers the best service to your account type.

You can choose from a variety of accounts, including Roth IRAs or standard IRAs.

A rollover is also an option for those who already own stocks and bonds.

What precious metals do you have that you can invest in for your retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. To find out how much money you have, take a inventory of everything that you own. You should list all savings accounts, stocks and bonds, mutual funds certificates of deposit (CDs), annuities, life insurance policies, annuities 401(k), real estate investments, and any other assets like precious metals. Add all these items together to calculate how much money you have for investment.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. You won't be allowed to deduct tax for future earnings.

If you decide to invest more, you will most likely need to open a second investment account. Begin with a regular brokerage.

What are the pros & con's of a golden IRA?

The gold IRA is a great way to diversify your portfolio, but you don't have access the traditional banking services. It allows you invest in precious metals like platinum, silver, and gold without any taxes, until they're withdrawn.

There is a downside to this: if you withdraw your earnings early, you'll be subject to normal income tax. However, these funds are kept outside the country and cannot be seized by creditors if you default.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

Statistics

- Silver must be 99.9% pure • (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

regalassets.com

kitco.com

takemetothesite.com

How To

How to transfer your IRA into a gold IRA

Are you looking to transfer your retirement savings out of a traditional IRA in favor of a gold IRA. This article can help you do exactly that. Here's how you can do it.

“Rolling over” is the act of transferring money from one type (traditional) to another type (gold). Rolling over an account has tax benefits. In addition, some people prefer investing in physical assets like precious metals.

There are two types IRAs – Traditional IRAs, and Roth IRAs. The difference between the two types is that Traditional IRAs let investors deduct taxes from earnings. Roth IRAs don’t allow this. If you put $5,000 into a Traditional IRA today, after five years you can only withdraw $4,850. If you invested the same amount in a Roth IRA, however, you'd be able to keep every penny.

Here's what you should know if you're looking to convert from a traditional IRA to a gold IRA.

First, you need to decide whether to roll over your current balance into a new account or simply transfer funds from your old account to your new one. If you transfer money, income tax will apply to any earnings exceeding $10,000. If you decide to roll over your IRA you will not be subject to income tax on these earnings until you turn 59 1/2.

Once you've made up your mind, you'll need to open up a new account. Most likely, you will need to present proof of identity such as a Social Security Card, passport, or birth certificate. After that, you'll need to sign paperwork proving you own an IRA. After you have completed the forms, submit them to your bank. You'll be verified and given instructions on where you can send your wire transfers and checks.

This is the fun part. Now, deposit money into your account and wait for approval from the IRS. After you receive approval, you'll get a letter stating that you can now begin withdrawing funds.

That's it! Now all you have to do is sit back and watch the money grow. If you decide to convert your IRA you can close it and transfer the remaining balance into a different IRA.