Introduction

This article presents a heuristic analysis of the outflows from the Grayscale Bitcoin Trust (GBTC) and provides insights into the current state of GBTC selling. It also estimates the scale of future outflows that may occur. The analysis aims to help readers understand the impact of GBTC outflows on the market and the potential for future selling pressure.

The GBTC Hangover: Paying For It

The GBTC premium played a pivotal role in driving the Bitcoin bull run from 2020 to 2021. Market participants took advantage of the premium by acquiring GBTC shares at net asset value and marking up their book value. However, when the GBTC premium disappeared and the Trust started trading below NAV, a wave of liquidations followed. This led to a chain reaction of GBTC share liquidations, ultimately affecting the entire industry. The recent bankruptcy estate liquidations, such as the FTX estate, further contributed to the GBTC sell-off.

Optimal Strategy For Different Segments Of GBTC Owners

To understand the future outflows from GBTC, it is crucial to analyze different segments of GBTC shareholders and their financial strategies. Bankruptcy estates, estimated to hold around 15% of GBTC shares, are expected to sell their shares to repay their creditors. Retail brokerage and retirement accounts, accounting for approximately 50% of GBTC shares, have different incentives based on the price of Bitcoin and their tax status. It is likely that some retail investors will stay put, while others may exit GBTC. Institutional shareholders, holding around 35% of GBTC shares, are expected to have a net-neutral impact on Bitcoin price as they rotate their sold GBTC shares back into Bitcoin or other Bitcoin products.

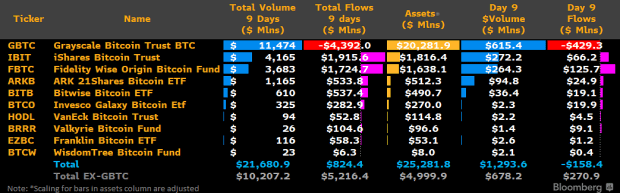

Total GBTC Outflows & Net Bitcoin Impact

Based on the analysis of different shareholder segments, it is projected that total GBTC outflows will range from 250,000 to 350,000 BTC. Of these outflows, approximately 100,000 to 150,000 BTC are expected to be converted into cash, while 150,000 to 200,000 BTC may rotate into other trusts or products. This leaves approximately 250,000 to 350,000 BTC remaining in GBTC. The net selling pressure on Bitcoin is estimated to be around 100,000 to 150,000 BTC.

Gradually, Then Suddenly: A Farewell To Bears

It is estimated that the market has already absorbed around 30-45% of the projected GBTC outflows. The remaining 55-70% of expected outflows are anticipated to occur over the next 20-30 trading days. This suggests that there may be a net selling pressure of 150,000 – 200,000 BTC resulting from GBTC sales. However, a significant proportion of GBTC outflows may rotate into other Spot ETF products or be stored in cold storage Bitcoin. This will free up Bitcoin markets from the influence of the GBTC discount and potential future firesales, allowing Bitcoin to thrive. It is important to note that these estimates are based on market conditions and should not be interpreted as financial advice.

Frequently Asked Questions

Which type of IRA could be used for precious metals

Employers and financial institutions often offer Individual Retirement Accounts (IRA) as an investment vehicle. A IRA is a way to make money and allow it to grow tax-deferred, until you withdraw it.

An IRA allows for you to save taxes while still paying taxes when you retire. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. Early withdrawals are subject to penalties.

After 50 you can still make contributions to your IRA. There is no penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals that are made prior to the age of 60 1/2 are subjected to a 5% IRS tax penalty. There is a 3.4% penalty for withdrawals between the ages 70 1/2 and 59 1/2.

There is a 6.2% penalty for withdrawals over $10,000 per calendar year.

Can I have physical possession of gold within my IRA?

Many people are curious if they can possess physical gold in an IRA. This is a legitimate concern because it is illegal.

But when you look closely at the law, nothing stops you from owning gold in an IRA.

Most people don’t realize just how much they could save by putting your gold in an IRA, rather than keeping it at home.

It's easy for gold coins to be thrown away, but it's much more difficult to keep them in an IRA. If you decide not to keep your golden in your home, you'll need to pay twice tax. You will pay taxes twice: once to the IRS and one for the state in which you live.

You can also lose your gold and have to pay twice the taxes. So why would anyone want to keep their gold in their home?

Some might argue that gold should be safe at home. However, to guard yourself against theft, it is worth considering storing your gold in a more secure location.

If you plan on visiting often, you shouldn't leave your precious gold at home. If your gold is left unattended, thieves could easily steal it when you're away from home.

Better yet, store your gold inside an insured vault. This will ensure that your gold is protected against fire, flood, earthquake and robbery.

Another benefit to keeping your gold in vaults is that you won’t have to pay any property taxes. You will have to pay income taxes on any gains from the sale of your gold.

You may be interested in an IRA if you don't want to pay taxes on your gold. An IRA will allow you to avoid income tax while earning interest on your gold.

Since you aren't required to pay capital gains tax on your gold, you'll have access to the full value of your investment whenever you want to cash it out.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

Bottom line: An IRA can allow you to own gold. Fear of losing it is the only thing that will hold you back.

What precious metals do you have that you can invest in for your retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. Start by listing everything you have. This should include all stocks, bonds, mutual fund, certificates of deposits (CDs), insurance policies, life insurance policies and annuities. Add all these items together to calculate how much money you have for investment.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. However, you can't take tax deductions from future earnings.

You may need additional money if you decide you want more. You can start with a regular brokerage account.

How does a gold IRA generate interest?

It depends on how many dollars you put into it. If your income is $100,000, then yes. If your net worth is less than 100,000, no.

How much money you place in an IRA will determine how it earns interest.

If you are putting in more than $100,000 annually for retirement savings, you should open a regular brokerage account.

You will likely earn more interest there, but you'll also be exposed to riskier investments. If the stock market crashes you don't wish to lose your entire investment.

An IRA is better if you have $100,000 to invest per year. At least until the market starts growing again.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

kitco.com

investopedia.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

takemetothesite.com

How To

How to Buy Gold For Your Gold IRA

Precious metal is a term used to describe gold, silver, platinum, palladium, rhodium, iridium, osmium, ruthenium, rhenium, and others. It refers to any naturally occurring element with atomic numbers 79 through 110 (excluding helium), which is considered valuable because of its rarity and beauty. Precious metals that are most commonly used include silver and gold. Precious metals can be used to make money, jewelry, industrial products, and art objects.

Gold prices fluctuate daily because of supply and demande. The demand for precious materials has increased dramatically over the last decade as investors seek to find safe havens in volatile economies. The increased demand has led to a significant rise in prices. However, some are hesitant to invest in precious metals because of the rising costs of production.

Because it is rare and long-lasting, gold makes a great investment. Like many investments, gold doesn't lose value. You can also buy and sell gold, without having to pay taxes. You have two options to invest in gold. You can purchase gold coins and bars or invest in gold futures contracts.

The physical gold bars and coins provide immediate liquidity. They are easy to trade and keep. However, they are not very inflation-proof. Consider purchasing gold bullion if you want to be protected from rising prices. Bullion, also known as physical gold and available in different sizes, is physical. Many billions come as one-ounce pieces while others are larger like kilobars. Bullion is stored in vaults that are protected against theft and fire.

Buy gold futures to own shares and not actual gold. Futures let investors speculate on the future price of gold. Gold futures allow you to be exposed to its price without owning any physical commodity.

If I wanted to speculate about whether gold's price would rise or fall, I could buy a gold contract. My position when the contract expires is either “long”, or “short”. A long contract indicates that I believe the price for gold will rise. Therefore, I'm willing give money to someone now in exchange of the promise that I will get more money after the contract ends. A shorter contract would mean that I believe the gold price will fall. So, I'm willing to take the money now in exchange for the promise that I'll make less money later.

I will be paid the specified amount of the contract plus interest after the contract expires. By doing this, I can get exposure to the market price for gold without actually owning it.

Precious Metals are great investments as they are difficult to counterfeit. Precious metals can't be counterfeited like paper currency. However, new bills can be printed to make them look more authentic. Precious metals have remained stable over time because of this.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]