Goldco is one of the best gold IRA providers on the market today. Founded by Joe Montana and a group of financial advisors, the company has won several awards for its services and has some of the highest customer satisfaction ratings in the industry. Customers can choose from a variety of investment options, including cash purchases and gold IRAs, and rollover their existing IRAs without any hassle.

Cost of a gold co ira

There are many advantages to joining a Goldco IRA. For starters, it offers a wealth of information regarding gold and silver. The company also offers a wide variety of coins from certified government mints. Another perk is its commitment to customer service. The investment specialists at Goldco are knowledgeable and passionate about their industry.

Goldco has a proven track record and an A+ Better Business Bureau rating. Its precious metals IRAs will help you ensure that your retirement savings will grow. The company has also won numerous awards, including one by Inc. magazine and the Los Angeles Business Journal. Its work to educate Americans about precious metals has even won praises from Sean Hannity, the host of Fox News.

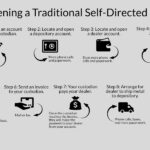

To get started with a Goldco IRA, visit their website and complete the online application form. Once you've filled out the form, an account executive will contact you and walk you through the rollover process. The company requires a minimum investment of $50,000 for the precious metals IRA. They also have a transparent fee structure. You'll be charged $100 for non-segregated options and $150 for segregated options. The minimum non-IRA transaction is $3500.

Rules and regulations for setting up a gold co ira

To start setting up a gold co IRA, you'll need to choose an administrator who is approved by the IRS. There are many administrators across the country, and some specialize in precious metals IRAs. Some will only allow self-directed IRAs, and others will require a new account.

It may be daunting to set up an IRA, especially for first-time investors. However, the need for such accounts is growing steadily. With Goldco, the process of establishing and maintaining an IRA can be easier and more convenient than ever. The company's customer service representatives are friendly and willing to help their clients.

In addition to a self-directed IRA, a gold co IRA can be funded with assets that you already have in a retirement account. Rollovers are possible without any tax penalties. Alternatively, you can set up a new precious metals IRA and purchase physical gold or silver. The company will ship your precious metals to a depository or directly to your home. Free storage is also available.

Frequently Asked Questions

How much gold can you keep in your portfolio

The amount you make will depend on the amount of capital you have. You can start small by investing $5k-10k. You could then rent out desks and office space as your business grows. This way, you don't have to worry about paying rent all at once. You only pay one month.

It is also important to decide what kind of business you want to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. So you might only get paid once every 6 months or so.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Should You Invest in Gold for Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

Not only is it a safe investment but gold can also provide potential returns. This makes it a worthwhile choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. As a result, its value changes over time.

However, this does not mean that gold should be avoided. This just means you need to account for fluctuations in your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is much easier to store than bonds and stocks. It's also portable.

You can always access your gold as long as it is kept safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold rises in the face of a falling stock market.

Another benefit to investing in gold? You can always sell it. As with stocks, your position can be liquidated whenever you require cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start small, buying only a few ounces. Add more as you're able.

It's not about getting rich fast. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Can I have a gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP is a tax-saving tool because employees have a share of company stock as well as the profits that the business generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

An Individual Retirement Annuity (IRA) is also available. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs don't have to be taxable

How can you withdraw from an IRA of Precious Metals?

First decide if your IRA account allows you to withdraw funds. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars are easier to store than individual coins. You will need to count each coin individually. However, individual coins can be stored to make it easy to track their value.

Some prefer to keep their money in a vault. Others prefer to store them in a safe deposit box. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Who holds the gold in a gold IRA?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you are planning to sell your gold someday, it is necessary that you report its value. This can affect the capital gains taxes that you owe when cashing in on investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

How is gold taxed by Roth IRA?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

The rules that govern these accounts differ from one state to the next. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to wait until April 1. New York allows you to wait until age 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads and Example. Risk Metrics

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor