There are several advantages of investing in gold and silver. First, it is easy to move and store. Second, it does not require high security during transport. And third, you can easily sell it. These are just some of the benefits of investing in gold and silver through an IRA.

Investing in gold

Investing in gold with an IRA is one of the smartest tax-saving investments you can make. The tax benefits of owning gold are tax-deferred and you can enjoy capital gains tax-free without ever having to sell the gold itself. However, there are certain things you need to consider before making your investment. The primary one is to make sure your investment is not considered a collectible. The internal revenue service will not allow you to invest in antiques or collectibles through your IRA.

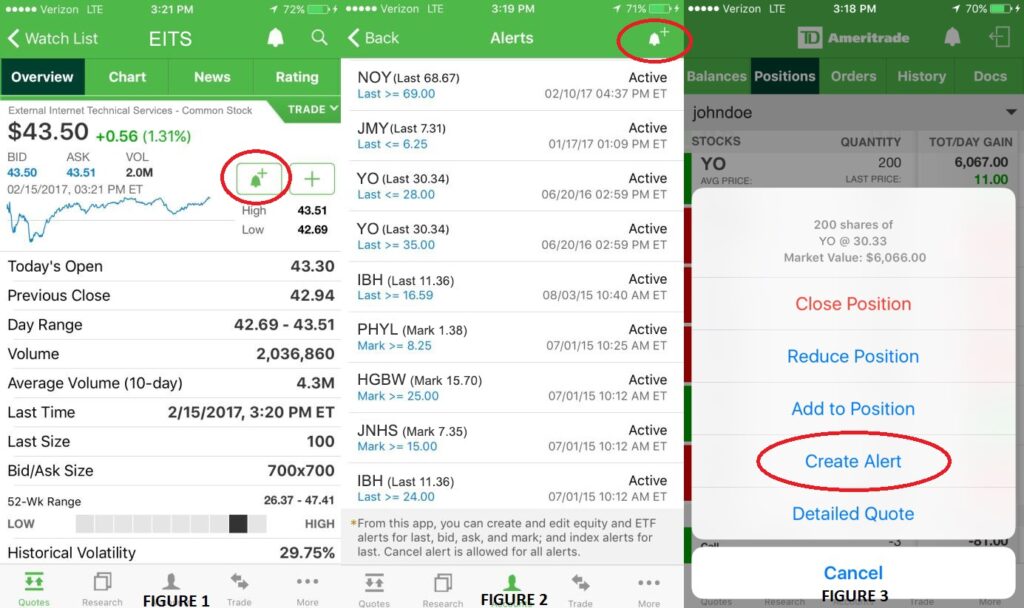

TD Ameritrade offers a variety of gold and precious metals investments. The company has a large selection of gold and silver coins and bars, as well as precious metals mutual funds. TD also has foreign exchange centers where you can purchase physical precious metals.

Investing in gold in an IRA

Investing in gold in an IRA is an excellent way to diversify your investment portfolio. The value of gold fluctuates each day, and tends to go up in times of upheaval and uncertainty. The gold price is a reliable form of security, and can provide you with peace of mind when you are planning your retirement.

Gold has historically increased in value during periods of inflation. As a result, gold in an IRA offers investors a great hedge against inflation and can be profitable. Over the past five years, gold prices have increased dramatically, from a low of about $1,000 per ounce in early 2016 to over $1,700 per ounce on March 25, 2021. You can start investing in gold in an IRA by choosing a gold IRA company that will help you set up an account, transfer funds, and store precious metals.

Investing in gold with TD Ameritrade

TD Ameritrade offers a variety of investment opportunities. Customers may choose to invest in physical gold and silver or invest in ETFs, which are similar to mutual funds. These funds trade on the open market like stocks but usually come with lower costs. TD Ameritrade also offers individual shares of precious metal mining companies. When choosing which company to invest in, investors typically consider the type of precious metal the company mines as well as its region of operations.

While physical gold is an attractive investment option for some people, it is not for everyone. In addition to dealing with brokers, physical investors must pay for storage and insurance. There are many types of physical gold available to investors, including bullion, coins, and jewelry. Bullion is what most people think of when they hear the term “gold”; big shiny bars locked away in a vault.

Investing in gold with Augusta Precious Metals

Augusta Precious Metals offers a gold buy-back program. You can sell your gold to them, and they will buy it back for you at a competitive price. The company is not obligated to buy back your gold, but it's a good option if you need to sell quickly. When selling gold, you have to find a buyer and compare prices. Augusta will pay you the best price for your gold, and they don't charge you any shipping or asset handling fees.

Augusta Precious Metals also offers gold IRAs. To open one, you must fill out a legal transaction agreement, choose an IRA custodian, and then purchase your gold and silver. If you want to start a gold IRA with Augusta Precious Metals, you will have to fund it with a minimum of $50,000. That's double what most gold IRA providers require.

Investing in gold with American Hartford Gold

When you're considering investing in gold, there are several companies to choose from. American Hartford Gold is one of those companies. With an easy onboarding process and knowledgeable staff, this precious metals investment firm is a good choice for novice investors. In addition, they have a wide variety of products to choose from, including a 1 oz. gold bar, a 1 gram gold bar, and a Valcambi CombiBar.

The company's reputation has been built on trust, communication, and customer service. Its account opening process is stress-free, and all you need to do is talk to a knowledgeable account specialist. Account representatives are there to answer questions and explain various options, including gold IRAs. Customers can choose to invest in physical gold bars or in ETFs that focus on the gold industry.

Frequently Asked Questions

What are the fees associated with an IRA for gold?

The average annual fee of an individual retirement account is $1,000. However, there are many different types of IRAs, such as traditional, Roth, SEP-IRAs, and SIMPLE IRAs. Each type has their own set of rules. If the earnings are not tax-deferred you could be subject to taxes. It is important to consider how long you plan on keeping the money. If you plan to keep your money longer, you can save more money by opening a Traditional IRA instead of a Roth IRA.

A traditional IRA lets you contribute up to $5,500 each year ($6,500 if your age is 50+). A Roth IRA allows you to contribute unlimited amounts every year. The difference between them? With a traditional IRA, the money can be withdrawn at your retirement without tax. With a Roth IRA, however, any withdrawals will be subject to taxes.

Are precious metal IRAs a smart investment?

How much risk you are willing to take for an IRA account's value loss will determine the answer. You can use them if your cash balance is $10,000, as long you don't expect it to grow quickly. They may not be the best investment option for you if your goal is to save money over many decades and to invest in assets with a high likelihood of increasing in value (gold). You may also have to pay fees, which can reduce your gains.

What precious metals can you invest in for retirement?

First, you need to understand what you have and where you are spending your money. Take a look at everything you own to determine how much you have left. This should include any savings accounts, stocks, bonds, mutual funds, certificates of deposit (CDs), life insurance policies, annuities, 401(k) plans, real estate investments, and other assets such as precious metals. To determine how much money is available to invest, add all these items.

If you are younger than 59 1/2, you might want to open a Roth IRA account. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. However, you can't take tax deductions from future earnings.

If you decide that you need more money you'll need another investment account. Start with a regular brokerage account.

Can I have gold in my IRA.

Yes, it is possible! Gold can be added to your retirement plan. Because gold doesn't lose its value over time, it is an excellent investment. It protects against inflation. And you don't have to pay taxes on it either.

Before investing in gold, you need to know that it's not like other investments. You can't purchase shares in gold companies, unlike stocks and bonds. These shares can also be not sold.

Instead, convert your gold to money. This means that it will be necessary to dispose of the gold. You cannot keep it.

This makes gold different from other investments. You can always sell other investments later. However, gold is different.

Even worse, you can't use the gold as collateral for loans. You may have to part with some of your gold if you take out mortgages.

What does all this mean? You can't hold onto your gold forever. You will have the need to make it cash someday.

You don't need to worry. To open an IRA, all you need is to create one. Then, you are able to invest in gold.

Can I store my Gold IRA at Home?

Investing in an online brokerage account is the best way to keep your money safe. You'll have access to all the same investment options as if you were working with a traditional broker, but you don't need special licenses or qualifications. You won't pay fees to invest.

A lot of online brokers offer tools for managing your portfolio. They will even let you download charts to see how your investments perform.

How much should precious metals make up your portfolio?

Investing in physical gold is the best way to protect yourself from inflation. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. As prices rise, so does your investment's value.

Any gains you make from investments that you hold onto for at least five year will be tax-free. Capital gains taxes will apply if you sell the investments within this time period. If you want to learn more about how to buy gold coins, visit our website.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

wsj.com

kitco.com

en.wikipedia.org

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Buy Silver With Your IRA

How to purchase silver with your IRA – The best way of investing in silver and gold is to directly own physical bullion. Silver bars and silver coins are a popular way to invest because of their liquidity, diversification, convenience, and ease.

There are several options for buying precious metals, such as silver and gold. You can purchase them directly through their producers, which include mining companies or refiners. You can also purchase them through a dealer, who buys and sellers bullion products, if you don’t want to deal directly with the producer.

This article will show you how to get started investing in silver using your IRA.

- Investing in Gold & Silver Through Direct Ownership – The first option for purchasing precious metals is to go straight to the source. This allows you to get the bullion directly and have it delivered directly to your home. Some investors decide to keep their bullion at their home while others prefer to store it in an insured storage facility. When you hold onto your precious metal, ensure you're storing it properly. Many storage facilities offer insurance coverage for fire, theft, damage, and other risks. You could lose your investments due either to natural disasters, human error, or even insurance. It is always a good idea to store precious metals in safe deposit boxes at banks or credit unions.

- Buying Precious Metals Online – If you'd rather avoid carrying around heavy boxes of precious metal, then one alternative is to buy bullion online. Bullion dealers sell bullion online in many forms, including coins or bars. You can find coins in many sizes, shapes, or designs. Generally speaking, coins are easier to carry around and less expensive than bars. Bars come in different weights and sizes. Some bars weigh hundreds of pounds, while others only weigh a few ounces. The best rule of thumb for choosing the right type of bar is to consider your intended use. You might consider a smaller bar if you intend to give it as a gift. If you are looking to add it as a gift, or to proudly display it, you may want to spend a bit more and buy something larger.

- Dealers for Precious Metal – The third option is to buy bullion direct from dealers. Most dealers have a specific area of expertise, usually in silver or gold. Some dealers are experts in specific types of bullion such as rounds and minted coins. Others are more skilled in certain regions. Others are specialists in bulk purchases. No matter what dealer you choose you will find that they offer great prices and flexible payment options.

- Purchase Precious Metals via Retirement Accounts – Although this is technically not an investment, it can be used as a way to increase exposure to precious materials. Investments in precious metals must be made through a qualified retirement plan to receive tax benefits as per Section 219 of IRS Code. These accounts include IRAs. These accounts offer higher returns because they are created to help you plan for retirement. In addition, most of these accounts allow you to diversify your holdings across multiple metals. The downside? You can't invest in retirement accounts. Only people who work for employers that sponsor them can invest in these accounts.