Bitcoin Ownership Surges Among Americans, Finds Unchained Study

A new report released by Unchained, a prominent Bitcoin financial services provider, reveals an intriguing surge in bitcoin ownership among Americans. The study, which surveyed 402 US investors, found that one in four Americans and 55% of surveyed investors currently own bitcoin. Unchained defines surveyed investors as individuals between the ages of 18 and 78 with at least one investment account.

Increasing Interest in Bitcoin Investment

The study also highlights a growing interest in bitcoin investment, with 95% of current BTC owners considering increasing their holdings in 2024. Moreover, nearly half of non-BTC owners expressed a strong inclination towards purchasing bitcoin within the upcoming year.

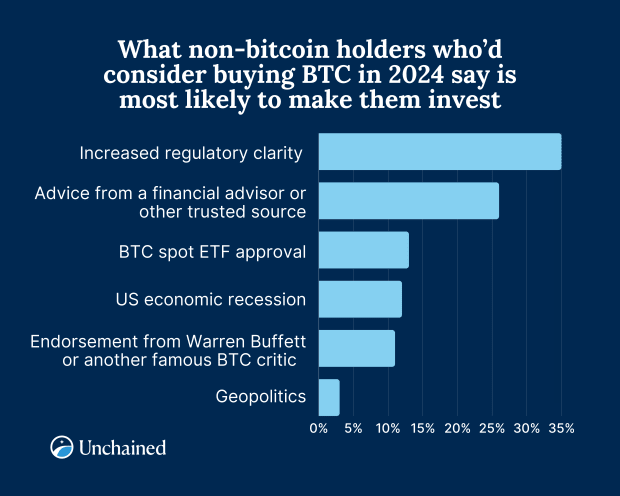

Key Drivers Influencing Bitcoin Purchases

Increased regulatory clarity around digital assets emerges as a key driver for potential BTC purchases in 2024. Approximately 42% of current BTC owners and 35% of non-owners identified this factor as influential. Additionally, the potential approval of a bitcoin spot Exchange-Traded Fund (ETF) by the Securities and Exchange Commission (SEC) and the anticipation of a US economic recession were also recognized as influential elements.

Positive Outlook for Bitcoin's Future

Despite the current price decline of over 50% from its peak, 79% of investors believe that BTC will surpass its all-time high of $69,000. Furthermore, more than half of the surveyed investors (55%) predict a new all-time high for BTC in 2024. Additionally, a third of investors believe that BTC will outperform cash, gold, and the S&P 500.

Bitcoin's Increasing Presence in Retirement Portfolios

Unchained's survey also indicates a significant rise in bitcoin allocation within retirement portfolios. Nearly half of current BTC owners already have BTC in their retirement accounts, and an additional 35% are considering adding it in 2024. Among non-BTC owners open to investing in the asset, 23% expressed interest in including BTC in their retirement accounts.

"With an estimated 158 million Americans owning investment accounts, Unchained's survey provides valuable insights into the sentiments and expectations of the US investor population. The survey, conducted digitally from October 26 to 28, 2023, during a period when the price of bitcoin ranged from $33,610 to $34,977, offers a compelling outlook on BTC sentiment and expectations for 2024," said a spokesperson from Unchained.

CFTC

How To

3 Ways to Invest Gold for Retirement

It's essential to understand how gold fits into your retirement plan. If you have a 401(k) account at work, there are several ways you can invest in gold. You might also be interested to invest in gold outside the workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, put cash into your accounts. This will protect your against inflation and increase your purchasing power.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio. – Do not put all your eggs into one basket. This means that you should diversify your wealth by investing in different assets. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]