Introduction

Renowned author Robert Kiyosaki, best known for his book "Rich Dad Poor Dad," has recently issued a stark warning about an impending financial crash. Kiyosaki emphasizes that the U.S. banking system is on the verge of bankruptcy and predicts that the S&P 500 will be the next casualty, resulting in devastating consequences for millions of Americans' retirement plans. In this article, we delve into Kiyosaki's warning and its potential implications.

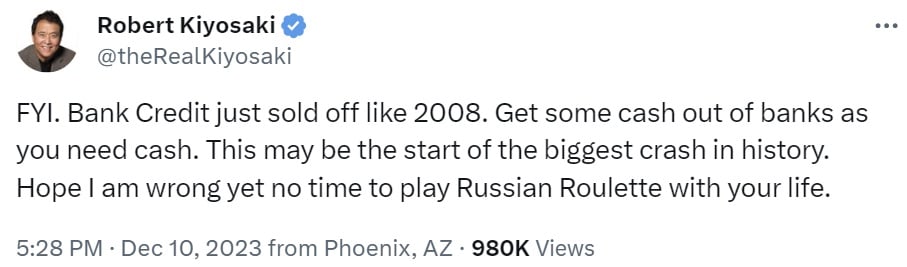

Kiyosaki's Warning

Kiyosaki took to social media to express his concerns, stating that the recent credit sell-off mirrors the events of the 2008 financial crisis. He believes that this could be the beginning of the most significant crash in history. Urging people not to take these warnings lightly, he compares the situation to playing Russian Roulette with one's life.

The Resilience of "Rich Dad Poor Dad"

"Rich Dad Poor Dad," co-authored by Kiyosaki and Sharon Lechter, has enjoyed immense success since its publication in 1997. The book has remained on the New York Times Best Seller List for over six years and has sold more than 32 million copies worldwide in over 51 languages. Its enduring popularity is a testament to the financial wisdom it imparts.

Preserving Wealth in Troubled Times

Kiyosaki encourages individuals to consider alternative investment options to safeguard their wealth. He recommends buying gold, silver, and bitcoin as a means of protecting against a potential global banking crisis. Despite the skepticism and mockery one may face for choosing these unconventional assets, Kiyosaki reminds us of his accurate predictions in "Rich Dad Poor Dad," particularly the 2008 financial crisis.

The Impending Threat to Retirement Plans

Kiyosaki's warning extends to retirement plans, as he predicts that the S&P 500's collapse will have severe consequences for millions of 401ks and IRAs. This dire prediction underscores the need for individuals to reevaluate their investment strategies and consider diversifying into assets that are less susceptible to market volatility.

Repeated Warnings

Kiyosaki has been consistent in his warnings about an impending financial crash. In addition to the potential for a depression-like scenario, he has also cautioned about the possibility of a significant market collapse and even another war. These warnings serve as a wake-up call for investors to take proactive measures to protect their financial well-being.

Embracing the Future

Despite the uncertainty and challenges ahead, Kiyosaki encourages individuals to embrace the opportunities that lie within the evolving financial landscape. He believes that investments in digital currencies like bitcoin can offer a lifeline amidst the turbulent times. By staying informed and proactive, individuals can position themselves to weather the storm and potentially thrive in the face of adversity.

Conclusion

Robert Kiyosaki's warnings about an impending financial crash and the potential collapse of the S&P 500 serve as a stark reminder to individuals to reassess their financial strategies. It is crucial to consider alternative investments, such as gold, silver, and bitcoin, to protect against the uncertainties of the banking system. By heeding these warnings and taking proactive measures, individuals can safeguard their wealth and retirement plans in the face of potential economic turmoil.

What are your thoughts on Robert Kiyosaki's warnings? Share your opinions in the comments below.

CFTC

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. Aside from its inherent value, it could be traded internationally. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. One pound sterling, for example, was equivalent in England to 24 carats, and one livre tournois, in France, to 25 carats. A mark, on the other hand, was equivalent in Germany to 28 carats.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. The result was a decrease in foreign currency demand, which led to an increase in their price. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. Due to the excessive amount of money flowing into the United States, they had to find a way for them to repay some of their debt. To do so, they decided to sell some of the excess gold back to Europe.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. Many European countries began to use paper money and stopped accepting gold as payment after World War I. The value of gold has significantly increased since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]

Related posts:

Rich Dad Poor Dad Author Robert Kiyosaki Reveals Why He Keeps Buying Bitcoin

Rich Dad Poor Dad Author Robert Kiyosaki Reveals Why He Keeps Buying Bitcoin

Robert Kiyosaki Recommends Bitcoin ETFs as Global Economy Slows Down

Robert Kiyosaki Recommends Bitcoin ETFs as Global Economy Slows Down

Robert Kiyosaki’s Advice: Embrace Bitcoin Now for Financial Success

Robert Kiyosaki’s Advice: Embrace Bitcoin Now for Financial Success

Robert Kiyosaki: Fiat Money Isn’t Safe, Investors Must Protect Themselves From Central Bankers

Robert Kiyosaki: Fiat Money Isn’t Safe, Investors Must Protect Themselves From Central Bankers