Altcoins Garnering Attention from South Korean Investors

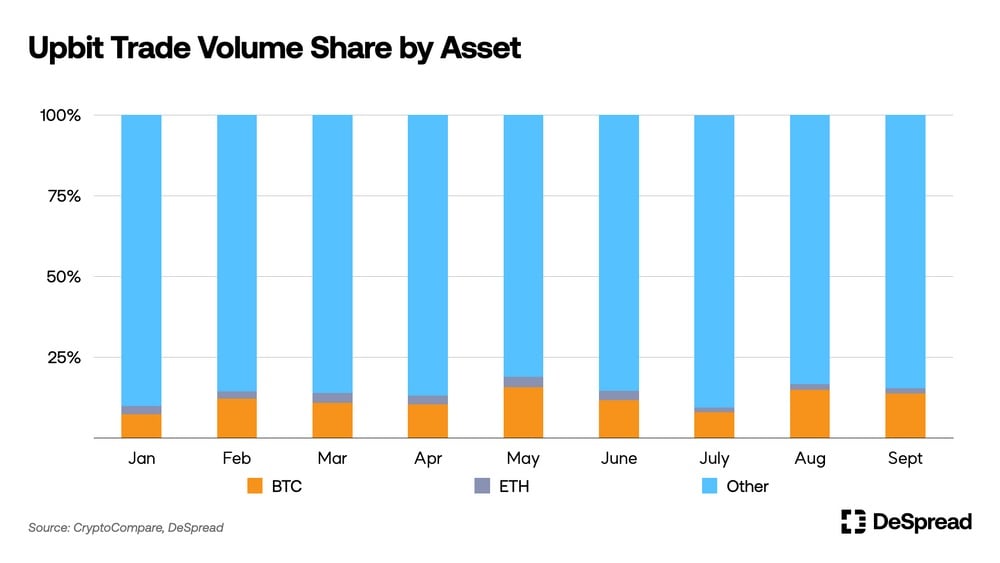

A recent report reveals that South Korean cryptocurrency traders have a higher inclination towards investing in high-risk altcoins, compared to their American counterparts. The study indicates that the trading volumes of major cryptocurrencies such as bitcoin and ethereum on the largest Korean exchange are significantly smaller than those on the leading U.S. exchange.

Despread, a web3 market strategy consulting firm, conducted a study focused on trading activities on major South Korean cryptocurrency exchanges and found that a majority of individual investors on Upbit, the largest crypto trading platform in the country, are particularly interested in altcoins with the potential for high profits. These investors are also more willing to accept the associated high risks, which contributes to the high proportion of altcoin trading in the Korean market.

Upbit has dominated the domestic exchange market in South Korea, accounting for between 70% and 80% of the market share this year. In February, the platform achieved its highest trading volume of $36 billion. Other notable exchanges in the country include Bithumb, Coinone, and Korbit.

Differences in Trading Behavior: South Korea and the U.S.

Trading behavior on America's leading cryptocurrency exchange, Coinbase, differs significantly from that on Upbit. While Upbit is primarily driven by individual investors, Coinbase's trading volume is heavily influenced by institutional players.

According to Coinbase's Q2 shareholder letter, institutions account for about 85% of the exchange's total trading volume. These investors typically prioritize portfolio stability, resulting in a larger share of trading volume for bitcoin (BTC) and ethereum (ETH), which are the cryptocurrencies with the largest market capitalization.

Top Altcoins Actively Traded in South Korea

Among the altcoins that are actively traded in South Korea, Despread's report highlights the following rankings:

- Loom Network (LOOM) claimed the top spot last week with the highest trading volume ratio of 62%.

- Ecash (XEC) followed closely with a ratio of 55%.

- Flow (FLOW) recorded a trading volume ratio of 43%.

- Stacks (STX) and Bitcoin SV (BSV) also made it to the rankings with ratios of 37% and 34% respectively.

The researchers pointed out that while some cryptocurrencies receive temporary attention, such as Loom Network and Flow, others like Stacks and Ecash continue to attract consistent interest on Korean exchanges regardless of temporary events. This ongoing attention in the Korean market, independent of global trends, is noteworthy.

The Fascination with Altcoins in South Korea

The reasons behind South Koreans' greater inclination towards investing in altcoins are multifaceted. Cultural factors, a high-risk appetite, and the potential for significant returns are some of the key influencers. Additionally, the presence of a thriving crypto community and the country's tech-savvy population contribute to the fascination with altcoin investments.

What are your thoughts on the greater interest in altcoins among South Korean investors? Share your opinions in the comments section below.

Frequently Asked Questions

Should You Get Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

This could be changing, according to some experts. According to them, gold prices could soar if there is another financial crisis.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

These are some things you should consider when considering gold investing.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save enough money to retire without investing in gold. However, when you retire at age 65, gold can provide additional protection.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each account offers different levels of security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

So, if you're thinking about buying gold, make sure you do your research first. If you already have gold, make sure you protect it.

What Does Gold Do as an Investment Option?

The supply and demand for gold affect the price of gold. Interest rates also have an impact on the price of gold.

Because of their limited supply, gold prices can fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This fee includes account maintenance fees as well as any investment costs related to your selected investments.

Diversifying your portfolio may require you to pay additional fees. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% per year. These rates can be waived if the broker is TD Ameritrade.

What are the pros & con's of a golden IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. There are some disadvantages to this investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

If you prefer your money to be kept out of a bank, then you will need insurance. In order to make a claim, most insurers will require that you have a minimum amount in gold. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers restrict the amount you can own in gold. Others let you choose your weight.

You will also have to decide whether to purchase futures or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They enable you to establish a contract with an expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does include coverage for damage due to natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Insurance is not enough. You also need to think about the cost of gold storage. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians can't sell assets. Instead, they must hold them as long as you request.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. You should also specify how much you want to invest each month.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. Once the company has received your application, they will review it and send you a confirmation email.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can help you find cheaper insurance options to lower your costs.

Is the government allowed to take your gold

Your gold is yours, so the government cannot confiscate it. You have earned it by working hard for it. It is yours. This rule could be broken by exceptions. If you are convicted of fraud against the federal government, your gold can be forfeit. Your precious metals can also be lost if you owe tax to the IRS. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

How much of your portfolio should be in precious metals?

To answer this question we need to first define precious metals. Precious metals have elements with an extremely high worth relative to other commodity. This makes them highly valuable for both investment and trading. Gold is today the most popular precious metal.

There are however many other types, including silver, and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors expect lower interest rate, making bonds less appealing investments.

When the economy is healthy, however, the opposite effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

What does a gold IRA look like?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase gold bullion coins in physical form at any moment. To start investing in gold, it doesn't matter if you are retired.

An IRA lets you keep your gold for life. Your gold holdings won't be subject to taxes when you pass away.

Your heirs can inherit your gold and avoid capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done so, you'll be given an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

You will pay taxes when you withdraw your gold from your IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

You may not be required to pay taxes if you take out only a small amount. However, there are some exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. A violation of this rule can lead to severe financial consequences.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement plans