If you're looking to diversify your investment portfolio and prepare for retirement, investing in precious metals is a practical strategy. There are various options available in the market, including IRA-eligible gold items, silver bullion, and platinum bars. However, choosing the best precious metal to invest in can be overwhelming, especially for beginners.

At Learn About Gold, our team of experts is here to guide you through the investment process using language that is easy to understand. We provide valuable insights on how to invest in precious metals and discuss the options that are worth considering.

Start supplementing your retirement savings with precious metal investments today by connecting with a reputable gold IRA partner.

Types of Precious Metals

Precious metals, such as gold, silver, and platinum, are high-value commodities that have been used as currency and for manufacturing jewelry and technology for thousands of years.

There are different types of precious metal products available in the market, each with its own characteristics and considerations for investment. Here is a list of these products and what you should know when investing in them:

Bullion Bars

Bullion bars are high-grade precious metal bars that are refined by government-authorized mints. These bars are valued based on their weight and purity.

Available for purchase through online brokers and collectors, bullion bars are backed by paper currency. The most common option in the market is the 400-troy-ounce (12.4-kilogram) bar, which is traded by central banks to authorized dealers. You can identify the origin of the gold bars by checking the stamp on the surface, and each bar has a serial number for security purposes.

Bullion Coins

Similar to bullion bars, bullion coins can be bought and sold through online brokers and central banks. However, these coins weigh significantly less than standard bars, making them more affordable and accessible for investors.

When buying and selling precious metal coins, it's important to ensure that they meet the IRS requirement of being at least 99.5% pure if you plan to invest them in a precious metal retirement account. Gold coins, in particular, are widely available and can be found in pawn shops, through TV ads, and at online dealers. They are considered a good option for beginners due to their liquidity and smaller storage requirements.

Rounds and Collector’s Items

Rounds are gold, silver, and platinum coins produced by private mints. Unlike bullion coins, rounds are not recognized as legal tender by governments and do not have a face value.

While some collectors buy rounds to complete personal collections, they can be challenging to resell on conventional markets. There is also a higher risk of purchasing counterfeit gold rounds since some may lack identifying markers for purity and origin. Hence, rounds are not typically considered the best precious metal to invest in for portfolio growth.

Rare Coins

Rare coins are stable investments for several reasons. They tend to have high gold and silver purity, and their rarity can increase their value. This makes them an attractive option for investors looking to hedge against price dips in gold or silver.

Unlike bullion bars and coins, rare coins are not subject to confiscation under any United States law or provision, offering an added advantage to investors. However, it's important to research and verify the authenticity of rare coins before making a purchase.

Market Characteristics

Precious metals offer numerous attractive characteristics for investors looking to maintain a stable portfolio, even during economic downturns. Here are some key points to consider when buying and selling physical commodities like gold, silver, and platinum:

- Portfolio Diversification: By trading precious metals, you can diversify your portfolio with physical assets. It is advisable to invest in different types of precious metals, both in small and large quantities, to hedge against inflation. Having a mix of precious metals, stocks, and bonds makes your portfolio more resilient against stock market downturns.

- Predictable Pricing: The market price of high-value precious metals tends to be relatively stable, resisting significant fluctuations during short-term recessions, global conflicts, and stock market crises. Gold, for instance, showed a steady increase in price between January 2019 and February 2021 despite the height of the COVID-19 pandemic.

- Tax Reporting: The federal government has specific tax reporting requirements for bullion bars and coins. It is essential to stay updated on these regulations to ensure compliance when trading.

- Interest Rates: Certain precious metals, like gold and copper, are vital for the production of modern electronics. As of 2023, the interest rates on these commodities are rising due to increased industrial demand.

You cannot purchase precious metals directly from the U.S. Mint without proper authorization. However, there are various other avenues where you can buy gold and other precious metals, including online retailers, local coin shops, collector’s marketplaces, auction houses, and derivative markets.

Investment Considerations

Before choosing the best precious metal to invest in for your savings, there are several essential investment tips to consider:

Budget

Investing in precious metals requires financial commitment. Gold and platinum are the most expensive options in the conventional market, making it advisable for investors with limited budgets to start small.

Silver and copper are historically safe and affordable investments, making them a good choice for diversifying portfolios. Capital gains from these assets can be used to fund investments in more expensive precious metals in the future.

Timing

Timing is crucial when it comes to buying and selling precious metals. To maximize returns, it's recommended to monitor market changes and fluctuations. Hiring a financial advisor or precious metal custodian can be helpful in identifying the right time to buy low and sell high.

Storage and Transportation

Once you've purchased precious metals, you need a secure place for storage. Reputable dealers often provide options for safe shipping and transportation, regardless of the quantity of metal you own. However, if you choose to store coins at home, make sure to keep them in a secure, fire-proof container or vault to prevent damage and theft.

Gold as an Investment

Gold is widely regarded as the best precious metal to invest in, whether you're looking to fund a precious metals IRA or sell gold locally.

With its global acceptance and tradability, gold is a highly sought-after investment. It retains its value well and is backed by many global currencies. Gold can be purchased in the form of bullion coins and bars, and there are also investment options available through gold exchange-traded funds (ETFs).

While gold offers impressive returns and long-term stability, it's important to note that it may take several years before you see substantial profit from your investment.

Silver as an Investment

Silver is an excellent alternative investment to gold. It is more affordable and can yield substantial returns over time. Many investors choose silver for its accessibility and its industrial applications, as it is essential in the production of electronics.

Since silver prices are more volatile compared to gold, it may be wise to consider using silver as an auxiliary investment to more stable options. Starting with silver coins and gradually moving up to silver bars can be a viable strategy.

Platinum as an Investment

Platinum is an essential metal in industries such as oil, electronics, and automotive. Similar to gold and silver, platinum holds its value during economic downturns. Even small investments can result in sizable returns in the future. However, it's important to note that platinum prices can fluctuate more than gold and silver prices, especially when trading large quantities.

Bullion platinum bars are the most common form of investment in platinum. Additionally, platinum jewelry and rare coins are popular options available through online retailers.

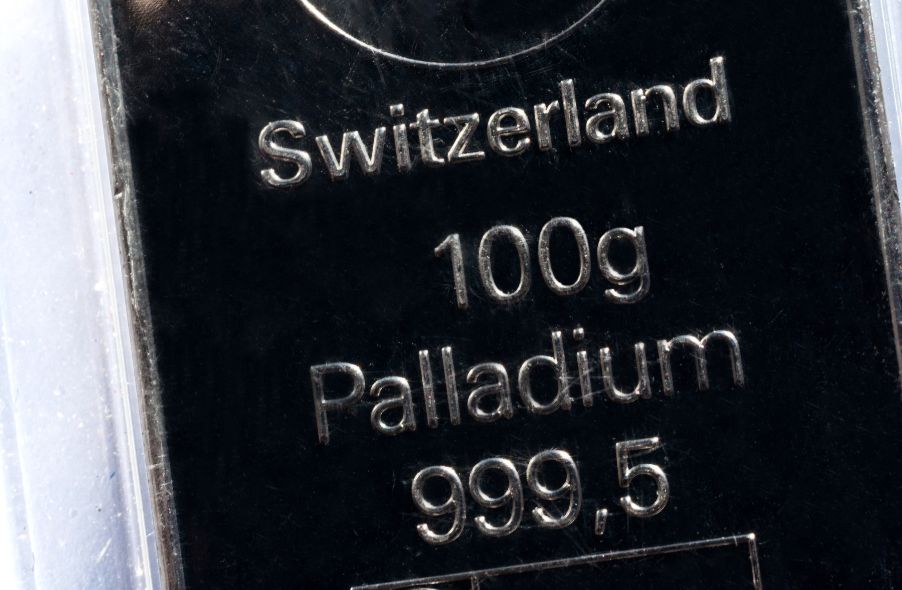

Palladium as an Investment

Palladium is often overlooked by new investors, but it is a valuable asset worth considering. It is used in catalytic converters, factories, and hydroelectric treatment facilities, making it a vital metal in various industries. The majority of the world's palladium supply comes from the United States, Russia, and South Africa.

Many investors consider palladium to be a sister metal to platinum. It offers low volatility and promising return potential, making it an ideal addition to a diversified portfolio. Keeping an eye on palladium prices can be beneficial as your investment budget grows.

However, it's worth noting that palladium markets faced challenges due to striking mine workers and increased demand during the early 2020s, resulting in some decline. Monitoring the price of palladium is essential for informed decision-making.

Copper as an Investment

Compared to other precious metals, copper has a relatively low price. However, its value remains relatively high due to its importance in construction, automotive, and electrical industries. Copper is widely used to insulate cables and manufacture computer chips, among other applications.

Investing in copper is considered relatively low-risk. However, new copper mines opening worldwide may lead to market disruptions and significant price fluctuations.

Rhodium as an Investment

Rhodium may not be the first metal that comes to mind when thinking about the best precious metals to invest in, but it is still worth considering. Rhodium is essential in the modern car manufacturing industry and other sectors of the economy. It has a high melting point, making it difficult to shape and counterfeit outside of licensed facilities.

Shopping for rhodium can be challenging outside of niche marketplaces. Partnering with a trusted broker can help you explore the available options in your area.

Investment Methods

There are several ways to invest in precious metals. A popular option is a precious metal IRA, which allows you to grow your returns for retirement.

Alternatively, you can trade these commodities through gold-backed certificates, ETFs, or stocks. These methods eliminate the need for storing physical gold. However, owning physical gold provides additional security and stability for your savings during economic disasters.

Partnering with a gold IRA expert is the best way to ensure that you make the right financial decisions for your investments. At Learn About Gold, we can answer your questions and connect you with reputable gold IRA companies. Explore our blogs to learn more about gold, silver, and platinum investments.

Contact Learn About Gold for more information on the best precious metal to invest in based on your budget. Feel free to reach out to us with any questions or concerns.

Frequently Asked Questions

What are the pros & con's of a golden IRA?

An excellent investment vehicle is a gold IRA. This is for people who wish to diversify but do not have access to traditional banking services. It allows you to invest in precious metals such as gold, silver, and platinum without paying taxes on any gains until they're withdrawn from the account.

However, if you withdraw money before the due date, you will be subject to ordinary income tax. The funds are not located in the country and can be easily seized by creditors if your loan defaults.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

Is it a good idea to open a Precious Metal IRA

It all depends on your investment goals and risk tolerance.

You should start an account if you intend to retire with the money.

Precious metals will appreciate over time. They can also be used to diversify.

Furthermore, the prices of gold and silver tend to move together. This makes them an excellent choice for investors in both assets.

You shouldn't invest precious metal IRAs if you don't plan on retiring or aren't willing to take risks.

Which type of IRA can be used to store precious metals?

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. An IRA lets you contribute money that will grow tax-deferred to the time it is withdrawn.

An IRA allows you to save taxes and pay them later when you retire. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. When you do, there are penalties for early withdrawal.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you take out of your IRA during retirement you will owe income and a 10% federal penal.

Refunds received before the age of 591/2 are subject to a penalty of 5% from the IRS. Withdrawals between ages 59 1/2 and 70 1/2 are subject to a 3.4% IRS penalty.

There is a 6.2% penalty for withdrawals over $10,000 per calendar year.

Can I place gold in my IRA account?

Yes, it is possible! You can add gold into your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It is also resistant to inflation. And you don't have to pay taxes on it either.

Before investing in gold, you need to know that it's not like other investments. Unlike stocks or bonds, you can't buy shares of gold companies. Nor can you sell them.

Instead, convert your precious metals to cash. This means that it will be necessary to dispose of the gold. It's not enough to hold on to it.

This makes gold different than other investments. As with other investments you can always make a profit and sell them later. But that's not the case with gold.

Worse, the gold cannot be used as collateral for loans. If you get a mortgage, for example, you might have to give up some of the gold you own in order to pay off the loan.

What does that mean? It's not possible to keep your gold for ever. It will eventually have to be converted into cash.

You don't have to worry about this now. All you have to do is open an IRA account. Then you can invest your money in gold.

What is the difference between a gold and silver IRA?

An IRA for gold and/or silver allows you to invest without tax in precious metals such as silver and gold. These precious metals are an attractive investment for anyone looking to diversify their portfolios.

If you are above 59 1/2 years old, you do not have income tax to pay on the interest earned. Capital gains tax is not required for any appreciation in account value. There are limits on the amount of money that you can place into this account. Minimum amount allowed is $10,000 You cannot invest at all if you are under age 59 1/2. Maximum annual contribution: $5,500

Your beneficiaries could receive less if you die before your retirement. Your estate should contain sufficient assets to cover your account's remaining balance after paying any other expenses.

Some banks offer a silver and gold IRA option. Others require you open a regular broker account, through which shares or certificates can be purchased.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

kitco.com

regalassets.com

takemetothesite.com

wsj.com

How To

Precious Metals Approved by the IRA

IRA-approved valuable metals can be great investments. Diversifying your portfolio can protect you from inflation with a variety of options, including silver coins and gold bars.

There are two types of precious metal investment products. Bars and coins, which are physical bullion products, can be considered tangible assets as they are in tangible form. On the other hand, exchange-traded funds (ETFs) are financial instruments that track the price movements of an underlying asset, such as gold. ETFs trade like stocks on stock exchanges, which means investors can buy shares of them directly from the company issuing them.

There are many kinds of precious metals you can buy. Silver and gold are commonly used for jewellery making and decoration. However, platinum and palladium tend to be associated with luxury goods. Palladium holds its value better than that of platinum which makes it ideal to be used in industrial applications. Silver is also useful for industrial purposes, although it is usually preferred for decorative applications.

Physical bullion products tend to be more expensive due to the cost of mining and refining raw materials. They are safer than paper currencies, and offer buyers greater security. One example is that consumers could lose trust in the currency, and may look for other currencies if the U.S. Dollar loses its purchasing power. In contrast, physical bullion products do not rely on trust between countries or companies. They are instead backed by central banks and governments, which gives customers security.

According to supply and demand, gold prices can fluctuate. The price of gold will rise if there is more demand. Conversely, a decrease in supply can cause the price to fall. Investors can profit from fluctuating gold prices by taking advantage of this dynamic. Physical bullion investors benefit because they have a greater return on their capital.

Unlike traditional investments, precious metals cannot be affected by economic recessions or interest rate changes. As long demand is strong, gold prices will continue to climb. This is why precious metals are considered safe havens when times are uncertain.

The most widely used precious metals include:

- Gold – It is the oldest form of precious metallic and is sometimes called “yellow material”. Gold is a household name but it is rare underground element. Most of the world’s gold reserves can be found in South Africa and Peru, Canada, Russia and China.

- Silver – After gold, silver is the second most precious precious metal. Silver is mined from the earth's natural resources. Silver, unlike gold, is often extracted from ore instead of rock formations. Due to its durability and conductivity as well as its resistance to tarnishing it is widely used for commerce and industry. The United States accounts for more than 98% global silver production.

- Platinum – Platinum ranks third in the most valuable precious metals. It can be used to make high-end medical equipment, fuel cells, and catalytic converters. Platinum is also used in dentistry to make dental crowns, fillings, and bridges.

- Palladium – Palladium is the fourth most valuable precious metal. Because of its strength as well as stability, its popularity is increasing rapidly among manufacturers. It is used in electronics and aerospace technology, as well as military technology.

- Rhodium – Rhodium has been ranked fifth among precious metals. Rhodium is a rare metal, but it is highly sought-after because of its use as a catalyst for automobile engines.

- Ruthenium-Ruthenium is the sixth-most valuable precious metal. While there are only limited supplies of platinum and palladium, ruthenium is plentiful. It is used for steel manufacturing, chemical manufacturing, and aircraft engines.

- Iridium – Iridium ranks seventh in the list of most valuable precious metals. Iridium is an important component in satellite technology. It is used to construct orbiting satellites that transmit television signals, telephone calls, and other communications.

- Osmium – Osmium, the eighth most precious precious metal, is also known as Osmium. Osmium can withstand extreme temperatures and is commonly used in nuclear reactors. Osmium is used in medicine, cutting tools, jewelry, as well as medicine.

- Rhenium: Rhenium ranks as the ninth-most valuable precious metal. Rhenium can be used to refine oil and gas, make semiconductors and rocketry.

- Iodine- Iodine ranks as the tenth most precious precious metal. Iodine is used for photography, radiography and pharmaceuticals.

—————————————————————————————————————————————————————————————-

By: Learn About Gold

Title: The Best Precious Metal to Invest In: A Complete Guide

Sourced From: learnaboutgold.com/blog/the-best-precious-metal-to-invest-in/

Published Date: Sun, 24 Sep 2023 22:53:18 +0000