An Overview of NFT Sales in 2023

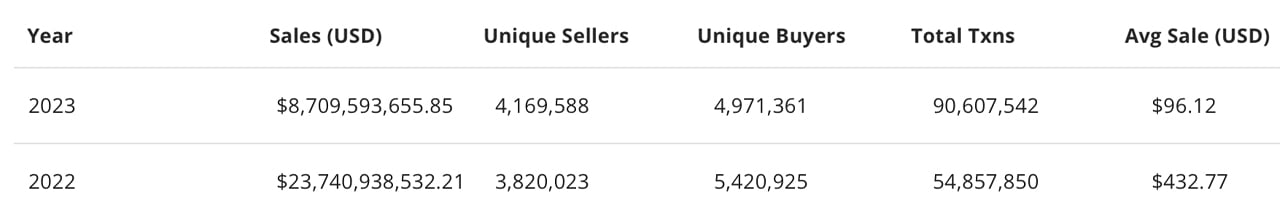

Recent statistics on non-fungible tokens (NFTs) reveal a significant decline in sales in 2023. The total sales for the year amounted to $8.70 billion, marking a 63.35% decrease compared to the previous year's sales.

A Drop in Annual Sales Despite an Uptick in Demand

Although there was a surge in demand towards the end of 2023, the annual total still reflected a substantial drop from the $23.74 billion in NFT sales recorded in 2022. The $8.70 billion in sales is the lowest since 2019's $3.75 billion. However, the number of NFT transactions in 2023 reached 90,607,554, surpassing the 54,857,850 transactions recorded in 2022.

Sellers and Buyers in the NFT Market

In 2023, there were 4.16 million sellers and 4.97 million buyers of NFTs. While the number of sellers increased compared to 2022, it did not surpass the 5,420,925 buyers recorded in the previous year. Notably, Bitcoin and Solana experienced a significant increase in NFT sales towards the end of 2023, with Bitcoin outperforming Ethereum in November and December.

Bitcoin's Rise in NFT Sales

Bitcoin-focused NFT sales climbed to the fourth rank in the overall market, with a total of $1.83 billion in sales. Ethereum continued to lead with an impressive $42.12 billion, followed by Solana at $4.62 billion and the Ronin blockchain, known for hosting Axie Infinity, at $4.25 billion. Despite the surge in BTC-related NFTs, the Axie Infinity collection maintained its position as the top seller overall.

Notable Collections and Their Base Values

Axie Infinity, Bored Ape Yacht Club (BAYC), and Cryptopunks are among the notable collections in the NFT market. However, in the past year, both BAYC and Cryptopunks experienced a significant decrease in their base values. On January 1, 2023, the BAYC floor value was 69.49 ether, equivalent to approximately $84K. As of January 1, 2024, the BAYC floor has dropped to 26.17 ETH, with an ether price of $2,325 per coin, resulting in a value of around $60K.

A Resilient and Evolving NFT Market

Despite the dip in overall NFT sales, the increased activity and diversification of platforms and collections indicate a resilient and evolving sector. The changing demographics of buyers and sellers, along with the rise of Bitcoin-centric NFTs, suggest a market that is far from stagnant. While Ethereum continues to dominate, the emergence of new contenders signals a broadening horizon for the NFT ecosystem.

What are your thoughts on the 63% decrease in NFT sales in 2023 compared to the previous year? Share your opinions in the comments section below.

Frequently Asked Questions

Is the government allowed to take your gold

Your gold is yours, so the government cannot confiscate it. You worked hard to earn it. It belongs exclusively to you. This rule may not apply to all cases. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. You can also lose precious metals if you owe taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

You should consult a financial planner or accountant to see what options are available to you.

How does a Gold IRA account work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

Physical gold bullion coin can be purchased at any time. To invest in gold, you don't need to wait for retirement.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings will not be subject to tax when you are gone.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done that, you'll receive an IRA custody. This company acts as an intermediary between you and IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. Minimum deposit required is $1,000 However, you'll receive a higher interest rate if you put in more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

A small percentage may mean that you don't have to pay taxes. However, there are some exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. You'll be facing severe financial consequences if you do.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. For a small start, $5k to $10k is a good range. As you grow, you can move into an office and rent out desks. Renting out desks and other equipment is a great way to save money on rent. Only one month's rent is required.

It's also important to determine what type business you'll run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. Therefore, you might only get paid one time every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Can I hold physical gold in my IRA?

Gold is money and not just paper currency. It's an asset that people have used for thousands of years as a store of value, a way to keep wealth safe from inflation and economic uncertainty. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Even if your stock portfolio is down, your shares are still yours. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you to profit from short-term fluctuations on the gold market.

Is gold buying a good retirement option?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bars are the most popular way to invest in gold. There are many ways to invest your gold. It's best to thoroughly research all options before you make a decision.

If you don’t need a safe place for your wealth, then buying shares of mining companies or companies that extract it might be a better alternative. Owning gold stocks should work well if you need cash flow from your investment.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs can include stocks of precious metals refiners and gold miners.

Should You Invest in gold for Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure of which option to invest in, consider both.

In addition to being a safe investment, gold also offers potential returns. Retirement investors will find gold a worthy investment.

Most investments have fixed returns, but gold's volatility is what makes it unique. Because of this, gold's value can fluctuate over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is much easier to store than bonds and stocks. It can be easily transported.

You can always access your gold if it is stored in a secure place. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Also, don't buy too much at once. Start small, buying only a few ounces. You can add more as you need.

It's not about getting rich fast. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

Tips for Investing with Gold

Investing in Gold remains one of the most preferred investment strategies. This is because there are many benefits if you choose to invest in gold. There are many ways you can invest in gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, make sure you check if your country allows you own gold. If so, then you can proceed. You might also consider buying gold in foreign countries.

- You should also know the type of gold coin that you desire. You can choose between yellow gold and white gold as well as rose gold.

- You should also consider the price of gold. It is best to begin small and work your ways up. When purchasing gold, diversify your portfolio. Diversify your investments in stocks, bonds or real estate.

- Don't forget to keep in mind that gold prices often change. Be aware of the current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]

Related posts:

Bitcoin Reigns Supreme in NFT Market With Record-Breaking $853 Million in December Sales

Bitcoin Reigns Supreme in NFT Market With Record-Breaking $853 Million in December Sales

Weekly NFT Sales Reach $311 Million With Bitcoin Leading, Ethereum and Polygon See Impressive Growth

Weekly NFT Sales Reach $311 Million With Bitcoin Leading, Ethereum and Polygon See Impressive Growth

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

The Rise of NFT Sales in Early December: Bitcoin Takes the Lead

The Rise of NFT Sales in Early December: Bitcoin Takes the Lead