Exciting news for crypto enthusiasts! Bitcoin has skyrocketed to over $117,500, bouncing back from a recent dip to $114,278. This surge follows President Donald Trump's groundbreaking executive order, allowing cryptocurrencies like Bitcoin to enter 401(k) retirement accounts.

The Executive Order Impact

Opening New Investment Avenues

The recent executive order is a game-changer. It directs the Department of Labor to reevaluate fiduciary guidelines, paving the way for diversified funds with alternative investments. This move aims to modernize retirement investment options, benefitting millions of Americans.

Collaboration for Change

Regulatory Updates in Progress

The order mandates collaboration among various federal agencies to assess the need for regulatory adjustments. The SEC, in particular, is tasked with revising rules to facilitate broader access to cryptocurrencies. This signifies a significant step toward enhancing retirement portfolios.

Industry Expert Insights

The Dawn of Institutional Interest

Industry experts like Galaxy Digital CEO Mike Novogratz are optimistic. He foresees a surge of investment capital flowing into Bitcoin and crypto assets. This move is expected to bring substantial value to the crypto market, with huge potential gains for investors.

Ryan Rasmussen from Bitwise predicts that if crypto captures a percentage of the $8 trillion 401(k) market, the impact could be monumental. The figures speak for themselves, showcasing the immense growth potential for Bitcoin in the financial landscape.

Institutional Adoption on the Rise

Breaking Adoption Records

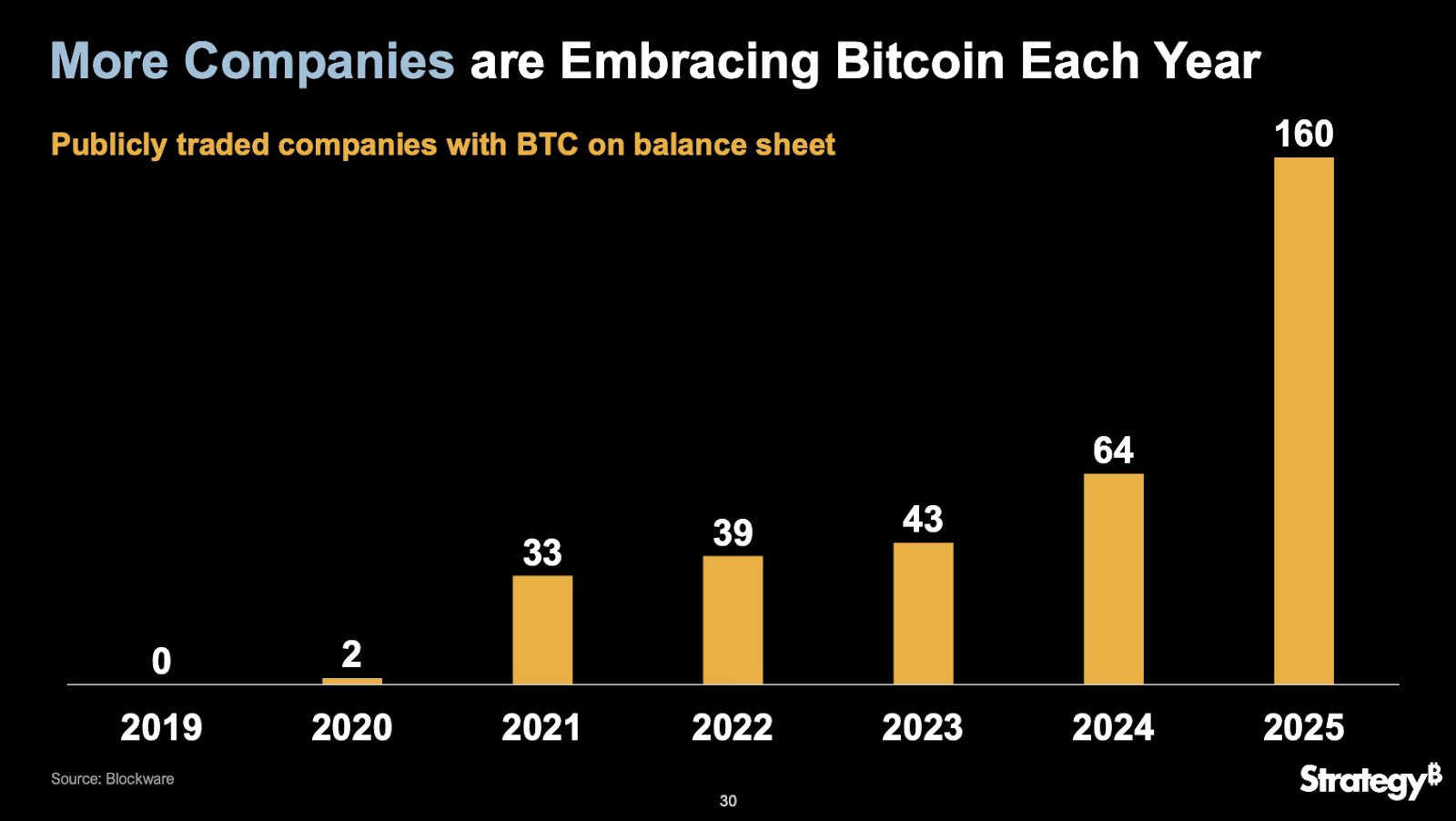

Institutional interest in Bitcoin has been on the rise. In recent years, institutions have significantly increased their Bitcoin holdings, outpacing the supply generated by miners. This trend underscores the growing confidence in Bitcoin as a valuable asset class.

The number of publicly traded companies holding Bitcoin has surged, indicating a broader acceptance of cryptocurrencies in traditional financial portfolios. This shift towards digital assets is reshaping the investment landscape and opening up new opportunities for investors.

Conclusion: Embracing the Future

With Trump’s executive order reshaping the investment landscape, the future looks bright for Bitcoin and cryptocurrencies. The wave of institutional interest combined with regulatory enhancements is propelling Bitcoin to new heights. Embrace the evolving financial landscape and explore the potential benefits of including cryptocurrencies in your investment portfolio.

This transformative moment in the financial world is brought to you by Bitcoin Magazine.

Frequently Asked Questions

How do you choose an IRA.

Understanding the type of account you have is the first step towards finding an IRA that suits your needs. This is whether you want a Roth IRA, a traditional IRA, or both. You will also need to know how much you can invest.

The next step is to choose the best provider for you. Some providers offer both accounts while others are specialized in one.

The fees associated with each option should be considered. There are many fees that vary between providers. They may include annual maintenance fees or other charges. One example is that some providers charge a monthly subscription based upon the number of shares you hold. Some providers charge only once a quarter.

How much should your IRA include precious metals

You can protect yourself against inflation by investing your money in precious metals, such as silver and gold. This is not only an investment for retirement, but it can also help you prepare for any economic downturn.

Although silver and gold prices have increased in recent years, they can still be considered safe investments as they don't fluctuate nearly as much as stocks. These materials are in constant demand.

Gold and silver prices are usually stable and predictable. They are most likely to rise when the economy grows and fall during recessions. This makes them great long-term investors and money-savers.

Your total portfolio should be 10 percent in precious metals. If you wish to diversify further, this percentage could be higher.

What is a Precious Metal IRA (IRA)?

Precious metals are an excellent investment for retirement accounts. They have been around since biblical times and continue to hold value today. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

In addition, some countries allow citizens to store their money in foreign currencies. You can buy Canadian gold bars and keep them at home. Then, you can buy gold bars in Canada and sell them for Canadian dollars when your family is home.

This is a great way to invest in precious metals. It's especially useful for anyone who lives outside North America.

How can I withdraw from an IRA with Precious Metals?

If your account is with a precious metal IRA firm such as Goldco International Inc., you may want to consider withdrawing funds. This will ensure that your metals are worth more than if they were in an account with a precious metal IRA company like Goldco International Inc.

Here are the steps to help you withdraw money from your precious-metal IRA.

First, verify that your precious metal IRA allows withdrawals. Some companies allow this option, while others don't.

Second, find out if you are eligible for tax-deferred gains from selling your metals. Most IRA providers offer this benefit. However, some don't.

Third, verify with your precious Metal IRA provider if you are charged any fees for taking these steps. You may have to pay an additional fee for the withdrawal.

Fourth, it is important to keep track of your precious-metal IRA investments for at most three years after you have sold them. For capital gains to be calculated, wait until January 1, each year. Next, fill out Form 8949 to determine the amount you gained.

The IRS requires that you report your sale of precious metals. This ensures you pay tax on any profits from your sales.

Consult a trusted attorney and accountant before selling your precious materials. They can assist you in following the correct procedures and avoiding costly mistakes.

What kind of IRA can you use to hold precious metals in?

A Individual Retirement Account (IRA), is an investment vehicle offered by most financial institutions and employers. Through an IRA, you may contribute money to an account that grows tax-deferred until withdrawn.

You can save taxes and pay them later with an IRA. This means that you can deposit more money into your retirement plan than have to pay taxes on it tomorrow.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. If you do withdraw the funds earlier than that, you will be subject to penalties.

You can also make additional contributions to your IRA after age 50 without penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

Withdrawals before age 59 1/2 will be subject to a 5% IRS penal. Between the ages of 591/2 and 70 1/2, withdrawals are subject to a 3.4% IRS penal.

The IRS will penalize withdrawals of more than $10,000 annually.

How much are gold IRA fees?

The average annual fee of an individual retirement account is $1,000. There are many types of IRAs available, including traditional, Roth, SEP and SIMPLE IRAs. Each type comes with its own set rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. The amount of time you intend to keep the money must be considered. If you have a long-term goal of holding on to your money, you'll be able to save more money if you open a Traditional IRA.

A traditional IRA allows for contributions up to $5500 ($6,500 if older than 50). A Roth IRA lets you contribute unlimited amounts each year. The difference between them is simple: With a traditional IRA, you can withdraw the money after you retire without paying taxes. You'll owe tax on any Roth IRA withdrawals.

What Precious Metals Can You Invest in for Retirement?

First, you need to understand what you have and where you are spending your money. To find out how much money you have, take a inventory of everything that you own. This includes all savings accounts and stocks, bonds or mutual funds. It also should include certificates of Deposit (CDs), life insurance policies. Annuities, 401k plans, real-estate investments, and other assets like precious metals. To determine how much money is available to invest, add all these items.

If you are under 59 1/2 you should consider opening a Roth IRA Account. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. You won't be allowed to deduct tax for future earnings.

You will need another investment account if you decide that you require more money. Start with a regular brokerage account.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

wsj.com

kitco.com

investopedia.com

en.wikipedia.org

How To

How to change your IRA to a gold IRA

Are you looking to transfer your retirement savings out of a traditional IRA in favor of a gold IRA. This article can help you do exactly that. Here are some tips to help you switch.

The process of transferring money out of one type of IRA (traditional) and into another (gold) is called “rolling over.” Rolling over an account has tax benefits. Some prefer to invest directly in physical assets like precious and rare metals.

There are two types IRAs – Traditional IRAs (or Roth IRAs). The difference is simple. Traditional IRAs allow investors the ability to deduct taxes whenever they withdraw their earnings. Roth IRAs are not. If you invest $5,000 in a Traditional IRA now, then you'll be able only to withdraw $4,000. However, if you put the same amount into a Roth IRA you would be able keep every penny.

These are some things to consider if you plan to convert from a Traditional IRA to a Gold IRA.

First, decide whether to transfer funds from an old account to your new account or to rollover your current balance. When transferring money, you'll pay income tax at your regular rate on any earnings that exceed $10,000. You can rollover your IRA to avoid paying income tax until you are 59 1/2.

Once you have made up your mind, it is time to open a brand new account. You'll likely be required to provide proof of identities, such as a Social Security card, passport, and birth certificate. Once you are done, you will fill out paperwork proving ownership of your IRA. Once you have filled out the forms, your bank will receive them. They will verify your identity as well as give instructions on how to send wire transfers and checks.

The fun part is here. The fun part is when you deposit cash into the account, and then wait for the IRS approval. You will be notified by mail that your request has been approved.

That's it! Now, all you have left to do is relax and watch your wealth grow. You can also close your IRA and transfer the balance to a new one if you change your mind.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]