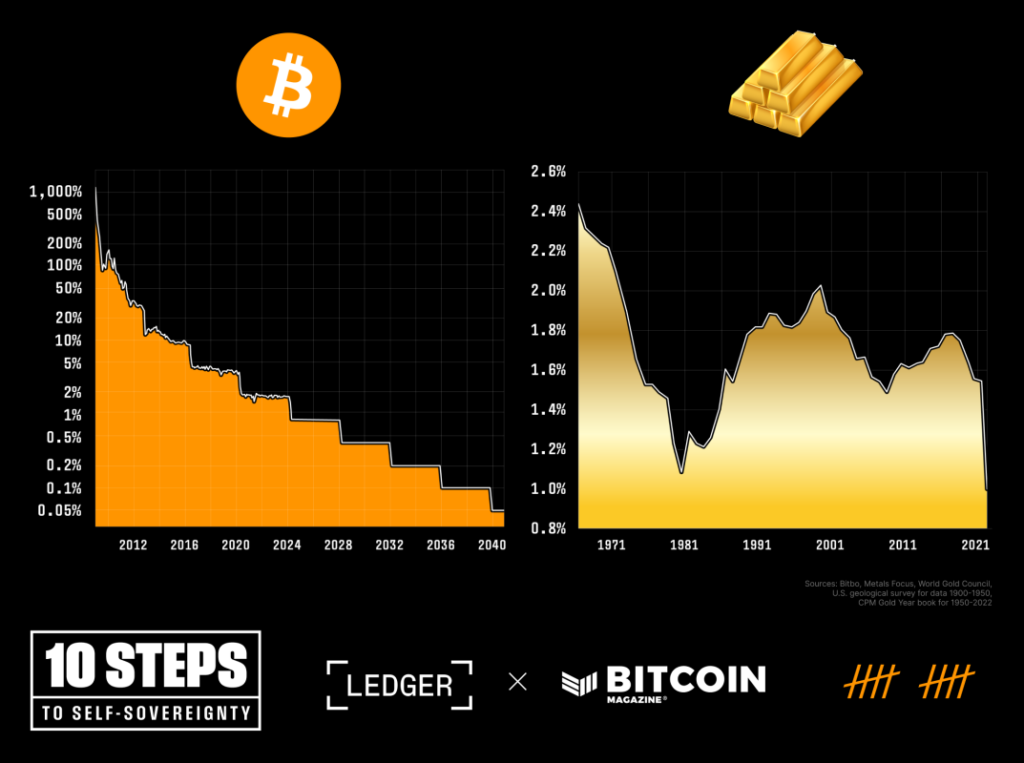

Bitcoin, the pioneer of cryptocurrencies, is on the verge of a monumental shift that will redefine its scarcity. The upcoming Bitcoin halving event will make Bitcoin scarcer than gold, the traditional store of value. This transformation marks a significant milestone in the world of digital assets.

Bitcoin Halving: A Game-Changer

At Bitcoin block height 840,000, the annual supply of Bitcoin will be halved, reducing its annual inflation rate from 1.7% to 0.85%. In contrast, gold's annual supply increases by 1-2% annually, subject to technological advancements and economic conditions. This impending scarcity places Bitcoin in a league of its own, surpassing the limitations of traditional assets.

The Evolution of Bitcoin Halving

Bitcoin has undergone three halving events since its inception:

- November 28, 2012: Block subsidy reduced from 50 BTC to 25 BTC per block.

- July 9, 2016: Second halving decreased block subsidy from 25 BTC to 12.5 BTC per block.

- May 20, 2020: Third halving lowered block subsidy from 12.5 BTC to 6.25 BTC per block.

Bitcoin Halving: The Future Outlook

The fourth Bitcoin halving is scheduled for April 20, 2024 EDT, where the block subsidy will decrease from 6.25 to 3.125 BTC. This reduction will bring the total Bitcoin supply closer to its maximum limit of 21 million. The evolving landscape of Bitcoin's scarcity sets a new standard for digital assets.

Gold's Enduring Value

Gold has served as a benchmark for store-of-value assets, with the concept of the "gold-to-suit ratio" tracing back to Ancient Rome. Despite its historical significance, challenges such as verification costs and storage complexities have hindered gold's utility as a practical medium of exchange.

Bitcoin: The Digital Safe Haven

Initially viewed as a speculative asset, Bitcoin has transitioned into a reliable store of value. With its finite supply, digital nature, and decentralized framework, Bitcoin offers unparalleled monetary qualities. Its market capitalization growth reflects the increasing recognition of its worth in the financial landscape.

Bitcoin vs. Gold: Monetary Attributes

Bitcoin's digital scarcity, durability, and immutability redefine the concept of money in the digital era. Its resistance to inflation, robust ledger system, and secure transactions position Bitcoin as a superior alternative to traditional assets like gold.

Embracing Bitcoin's Scarcity

As Bitcoin's scarcity overtakes that of gold post-halving, the digital currency's role as a store of value is solidified. Market participants are poised to witness a paradigm shift in the perception of digital assets, with Bitcoin leading the charge towards a new era of financial security.

In conclusion, Bitcoin's impending scarcity surpassing that of gold signifies a transformative moment in the digital economy. With its decentralized nature and capped supply, Bitcoin is set to redefine the future of finance and establish itself as the ultimate store of value in the digital age.

Frequently Asked Questions

What precious metals can be allowed in an IRA?

Gold is the most widely used precious metal for IRA account accounts. Investments in gold bullion coins or bars can be made as well.

Precious metals are considered safe investments because they don't lose value over time. They are also an excellent way to diversify your investment portfolio.

Precious metals include palladium and platinum. These metals all share similar properties. Each metal has its own unique uses.

In jewelry making, for instance, platinum is used. The catalysts are made from palladium. It is used for producing coins.

Think about how much you can afford to purchase your gold, before you make a decision on the precious metal. A lower-cost ounce of gold might be a better option.

You also need to think about whether your investment is private. If you do, you should choose palladium.

Palladium has a higher value than gold. But it's also less common. So you'll likely have to pay more for it.

Another important factor when choosing between gold and silver is their storage fees. Storage fees for gold are determined by its weight. So you'll pay a higher fee for storing larger amounts of gold.

Silver is stored according to its volume. You'll pay less if you store smaller quantities of silver.

Keep in mind all IRS rules when you store precious metals inside an IRA. You must keep track of all transactions and report them to the IRS.

Which type of IRA could be used for precious metals

An Individual Retirement Account (IRA) is an investment vehicle most employers and financial institutions offer. An IRA lets you contribute money that will grow tax-deferred to the time it is withdrawn.

An IRA allows for you to save taxes while still paying taxes when you retire. This means that you can deposit more money into your retirement plan than have to pay taxes on it tomorrow.

An IRA's beauty is that earnings and contributions grow tax-free up to the time you withdraw them. If you do withdraw the funds earlier than that, you will be subject to penalties.

You can also contribute to your IRA beyond age 50 without penalty. If you take out of your IRA during retirement you will owe income and a 10% federal penal.

Refunds received before the age of 591/2 are subject to a penalty of 5% from the IRS. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

A 6.2% IRS penalty applies to withdrawals exceeding $10,000 per annum.

Can I place gold in my IRA account?

The answer is yes It is possible to add gold to your retirement plans. Gold is an excellent investment because it doesn't lose value over time. It is also immune to inflation. It doesn't come with taxes.

You need to understand that gold is not like other investments before you invest in it. You cannot purchase shares of gold companies like bonds and stocks. They can't be sold.

Instead, convert your gold to money. This means you will need to get rid. You can't just hold onto it.

This makes gold an attractive investment. Like other investments, you can always dispose of them later. That's not true with gold.

You can't even use your gold as collateral to get loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

What does all this mean? Your gold can't be kept forever. You will have to sell it at some point.

But there's no reason to worry about that now. To open an IRA, all you need is to create one. You can then invest in gold.

Can I have physical possession of gold within my IRA?

Many people want to know if gold can be physically owned in an IRA. This is a legitimate concern because it is illegal.

But if you carefully examine the law, there's nothing stopping you from owning gold in your IRA.

Problem is, most people don’t realize how much they can save by putting gold in an IRA and not keeping it in their home.

It's very easy to dispose of gold coins, but much harder to make an IRA. If you decide to keep your gold in your own home, you'll pay taxes on it twice. Two taxes will be charged: one to the IRS, one to the state you live in.

It is possible to lose your gold and pay twice as much tax. Why would you want it to stay in your home?

You might argue that you need the security of knowing that your gold is safe in your home. To protect yourself from theft, store your gold somewhere that is more secure.

If you are planning to visit frequently, your gold should not be left at home. Theft can easily take your gold when you're not home.

It is better to keep your gold in an insured vault. Your gold will be safe from fire, flood and earthquake as well as robbery.

You won't be responsible for paying any property tax if you store your gold in a vault. Instead, you will have to pay income tax for any gains you make selling your gold.

A IRA can be a great option if you want to avoid paying tax on your gold. You don't pay income tax on the interest you earn with an IRA.

Since you aren't required to pay capital gains tax on your gold, you'll have access to the full value of your investment whenever you want to cash it out.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

The bottom line? You can own your gold in an IRA. Fear of losing it is the only thing that will hold you back.

How Do You Make a Withdrawal from a Precious Metal IRA?

You may consider withdrawing your funds if you have an account with a precious metal IRA company such as Goldco International Inc. You can sell your metals at a higher price if they are still in the account than if you left them there.

This article will help you understand how to withdraw funds from an IRA that holds precious metals.

First, find out whether your precious metal IRA provider allows withdrawals. Some companies allow this option, while others don't.

Second, consider whether your sale of metals can allow you to take advantage tax-deferred profits. This benefit is offered by most IRA providers. But, not all IRA providers offer this benefit.

To find out if fees apply, thirdly check with your precious-metal IRA provider. You may have to pay an additional fee for the withdrawal.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. In other words, wait until January 1st each year to calculate capital gains on your investment portfolio. Next, fill out Form 8949 to determine the amount you gained.

In addition to filing Form8949, you must also notify the IRS about the sale or purchase of precious metals. This will ensure you pay taxes on all the profits that your sales generate.

Before selling precious metals, it is a good idea to consult an attorney or trusted accountant. They can assist you in following the correct procedures and avoiding costly mistakes.

How much of your portfolio should be in precious metals?

Protect yourself against inflation by investing in physical gold. Because you are buying into the future value of precious metals and not the current price, when you invest in them, it is a way to protect yourself from inflation. You can expect your investment to increase in value with the rise of metal prices.

Gains will be taxed if you keep your investments for at minimum five years. After that time, capital gains taxes will be due. Our website has more information about how to purchase gold coins.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

regalassets.com

investopedia.com

takemetothesite.com

wsj.com

How To

IRA-Approved Precious Metals

IRA-approved precious materials are excellent investments whether you're looking for ways to save money for retirement or to invest in your next business venture. There are many options available to diversify and protect your portfolio from gold bars through silver coins.

There are two types of precious metal investment products. Bars and coins, which are physical bullion products, can be considered tangible assets as they are in tangible form. Exchange-traded funds (ETFs), on the other side, are financial instruments which track the price movements for an underlying asset like gold. ETFs trade just like stocks, and investors can purchase shares from the company that is issuing them.

There are many types of precious metals that you can purchase. Silver and gold are commonly used for jewellery making and decoration. However, platinum and palladium tend to be associated with luxury goods. Palladium has a tendency to retain its value longer than platinum making it an ideal choice for industrial uses. Silver is also useful for industrial purposes, although it is usually preferred for decorative applications.

Due to the higher cost of mining and refining materials, physical bullion items tend to be more expensive. They are safer than paper currencies, and offer buyers greater security. In particular, when the U.S. dollar is less powerful than it once was, consumers might lose confidence in the currency. Physical bullion products, on the other hand, do not depend on trust between companies or countries. Instead, they are backed by governments and central banks, giving customers peace of mind.

Gold prices fluctuate based on supply and demand. If demand rises, the price will increase. Conversely, if supply exceeds demands, the price will drop. This dynamic allows investors to profit when the gold price fluctuates. This fluctuation is good news for investors who own physical bullion items as they earn a higher return.

Precious metals can't be affected by economic recessions. As long as the demand for gold remains strong, it will continue to rise. Precious metals, which are safe havens for times of uncertainty, are therefore considered to be safe havens.

These precious metals are the most in demand:

- Gold – The oldest form of precious metal, gold is also known as “yellow” metal. While gold is a well-known element, it is very rare to find underground. Most of the world's gold reserves are in South Africa, Australia, Peru, Canada, Russia, and China.

- Silver – Silver is the second most valuable precious metal after gold. Like gold, silver is mined from natural deposits. Silver, unlike gold, is often extracted from ore instead of rock formations. Due to its durability and conductivity as well as its resistance to tarnishing it is widely used for commerce and industry. The United States makes more than 98% all of the global silver production.

- Platinum – Platinum is the third-most valuable precious metal. It can be used for industrial purposes, such as in fuel cells and catalytic converters. Platinum is also used in dentistry to make dental crowns, fillings, and bridges.

- Palladium – Palladium ranks fourth in the list of most valuable precious metals. Manufacturers are gaining more interest in palladium due to its strength & stability. You can also use palladium in electronics, automotives, and military technology.

- Rhodium- Rhodium, the fifth most precious precious metal, is also known as Rhodium. Rhodium is very rare but is highly sought for its use in automotive catalysts.

- Ruthenium: Ruthenium is sixth most valuable precious metallic. Although palladium is scarce and platinum is rare, there are plenty of ruthenium. It is used to make steel and engines for aircraft, as well chemical manufacturing.

- Iridium- Iridium, the seventh most precious precious metal, is also known as Iridium. Iridium has a significant role in satellite technology. It is used to construct orbiting satellites that transmit television signals, telephone calls, and other communications.

- Osmium: Osmium is eighth most valuable precious metallic. Osmium has a high resistance to extreme temperatures, which is why it is used frequently in nuclear reactors. It's also used in jewelry, medicine and cutting tools.

- Rhenium – Rhenium has been ranked as the ninth most valuable precious metallic. Rhenium can be used to refine oil and gas, make semiconductors and rocketry.

- Iodine – Iodine is the tenth-most valuable precious metal. Iodine is used in photography, radiography, and pharmaceuticals.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]