As the launch of Hong Kong’s Bitcoin ETF draws near, unexpected players have entered the scene: major traditional asset managers from Mainland China.

Interest from Mainland China

The development of Hong Kong’s new ETF has garnered significant attention in the global digital asset landscape. Unlike the conventional Bitcoin spot ETF model popular in the United States, Hong Kong's ETF features an in-kind generation protocol. This unique approach has sparked curiosity and positioned East Asia as a key region for ETF adoption. The approval of Hong Kong's futures ETF saw its assets under management surpass $100 million in February, outperforming spot ETFs in other countries. The region's substantial capital and international financial connections make it an ideal testing ground for this market.

New Players Enter the Arena

By late March 2024, various Hong Kong-based capital firms had shown interest in launching their ETFs, with a few submitting formal applications. The landscape changed dramatically on April 8th when major players from Mainland China, including Harvest Fund and Southern Fund with over $230 billion and $280 billion in assets under management respectively, filed applications through HK-based subsidiaries. China Asset Management, boasting $270 billion in AUM, also entered a partnership with existing Bitcoin ETF providers in the city.

Regulatory Dynamics and Market Impact

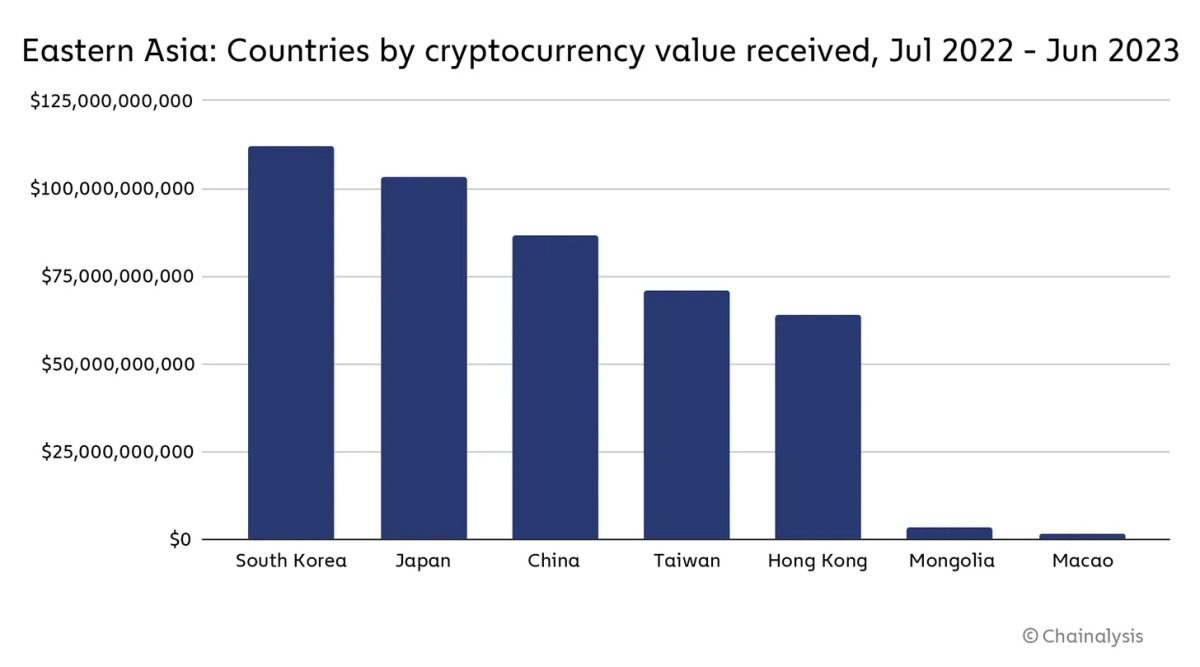

Despite signs of waning ETF interest in the US, the entry of Mainland Chinese firms into the Hong Kong market presents a new dimension. While US giants like BlackRock and Fidelity dominate the ETF sector, the participation of multibillion-dollar Chinese firms signifies a significant development. Questions arise about the collaboration between Mainland entities and Hong Kong's regulatory framework, especially considering China's historical stance on Bitcoin. However, reports of substantial Bitcoin transactions in China challenge the notion of a blanket ban.

Adapting to Market Shifts

China's evolving approach to Bitcoin, marked by the 2021 mining ban, has reshaped the landscape. While the crackdown aimed to deter average citizens from crypto involvement, legitimate businesses faced challenges. Despite restrictions, Chinese Bitcoiners have found ways to engage in transactions, underscoring the market's resilience. The embrace of ETFs by top Chinese asset managers signals a shift towards integrating with the global Bitcoin ecosystem.

Opportunities and Challenges Ahead

The involvement of major Chinese firms in Hong Kong's Bitcoin ETF venture holds promise for investors and regulators, signaling broader acceptance of digital assets. Hong Kong's innovative ETF model establishes a direct link between esteemed national businesses and the crypto market, potentially influencing China's stance on Bitcoin. The region's commitment to becoming a crypto hub is exemplified by initiatives like HashKey Global's expansion into Bermuda, aiming to rival industry leader Coinbase.

Future Outlook and Implications

The anticipation surrounding Hong Kong's upcoming Bitcoin ETF reflects its potential to reshape the global ETF landscape. A successful ETF launch in Hong Kong could not only boost international ETF adoption but also influence China's cryptocurrency policies. Observers are closely monitoring developments in this space, anticipating a ripple effect on the industry. As Bitcoin gains momentum, the prospects for transformative shifts in China's crypto narrative are on the horizon.

Frequently Asked Questions

Which precious metal is best to invest in?

Investments in gold offer high returns on their capital. It can also protect against inflation and other risks. As inflation worries increase, gold prices tend to rise.

It's a good idea to purchase gold futures. These contracts guarantee that you will receive certain amounts of gold at a given price.

However, gold futures aren't suitable for everyone. Some prefer physical gold.

They can also trade their gold easily with others. They can also sell it whenever they want.

Some people would rather not pay tax on their gold. To do that, they buy gold directly from the government.

This requires that you make multiple trips to the local post office. You must first convert any existing gold into coins or bars.

Next, you will need to stamp the coins or bars. Finally, you send them to the US Mint. The US Mint will melt the coins and bars to make new ones.

These bars and coins are stamped with the original stamps. They are therefore legal tender.

You won't need to pay taxes if gold is purchased directly from the US Mint.

Which precious metal would you prefer to invest in?

How do I choose the right IRA for me?

Understanding your account type will help you find the right IRA. This is whether you want a Roth IRA, a traditional IRA, or both. You also want to know how much money you have available to invest.

The next step is determining which provider fits your situation best. Some providers offer both accounts, while others specialize in just one type.

Finally, you should consider the fees associated with each option. Fees can vary greatly between providers, and may include annual maintenance charges and other fees. Some providers charge a monthly cost based on how many shares you own. Others may only charge one quarter.

What proportion of your portfolio should you have in precious metals

The best way to avoid inflation is to invest in physical gold. This is because you not only get the current price but also the future value when you invest precious metals. As prices rise, so does your investment's value.

You will be eligible for tax benefits if you keep your investments in place for at least five consecutive years. If you decide to sell your investments after that period, you will be subject to capital gains tax. Our website has more information about how to purchase gold coins.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

kitco.com

wsj.com

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

takemetothesite.com

How To

Things to Remember: Best Precious Metals Ira, 2022

Precious Metals Ira ranks high among investors as one of their most popular investment options. This article will help you understand what makes this asset class so attractive and how to make wise decisions when investing in precious metals.

These assets are renowned for their long-term potential growth. The historical data shows incredible returns for gold prices. Over the past 200+ years, gold prices rose from $20 to almost $1900 an ounce. Comparatively, the S&P 500 Index has only grown by approximately 50%.

When economic uncertainty is high, gold can be considered a reliable financial asset. When the stock market suffers bad days, people tend to sell stocks and move into the safety of gold. Inflation is also a hedge, so gold can be used as a security measure. Many economists believe in inflation. They believe that physical gold can be used to protect your savings against future price rises.

You should be careful before you purchase precious metals such as palladium, gold, platinum or silver. First, consider whether you would prefer to invest in bullion or coins. Bullion bars are usually bought in large quantities (like 100 ounces) and stored away until needed. The coins are smaller versions than bullion bars and can be used to purchase small quantities of bullion.

Second, consider where you want to store your precious materials. Some countries are safer then others. For example, you might consider storing precious metals overseas if your home country is the United States. However, if you plan on keeping them in Switzerland you may want to think about why.

The final decision is whether you want to either invest directly in precious or through “precious metallics exchange-traded fund” (ETFs). ETFs, which track the performance different commodities like gold, are financial instruments. You can use these to get exposure to precious metals without having to own them.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]