Bitcoin sceptics often argue that bitcoin lacks intrinsic value, stating that investments like real estate, with their tangible cash flows, are superior.

The myth of intrinsic value

The idea that value is inherently embedded in objects is a misconception, influenced by the labor theory of value (LTV). This flawed concept misinterprets how value is perceived in the economy. The belief extends to real estate, with the notion that its ability to generate cash flow imbues it with intrinsic value, which is fundamentally flawed.

Subjectivity of value

In a free market, value is subjective, determined by individual perception rather than inherent qualities. Understanding the subjective valuation is crucial for grasping the true essence of bitcoin's value, deeply rooted in collective demand and limited availability.

Bitcoin's value proposition

The value of bitcoin comes from the protection the Bitcoin network provides to the stored value and its scarcity. This scarcity, highlighted by a limited supply and a disinflationary issuance schedule, drives demand for bitcoin.

Real Estate’s value proposition

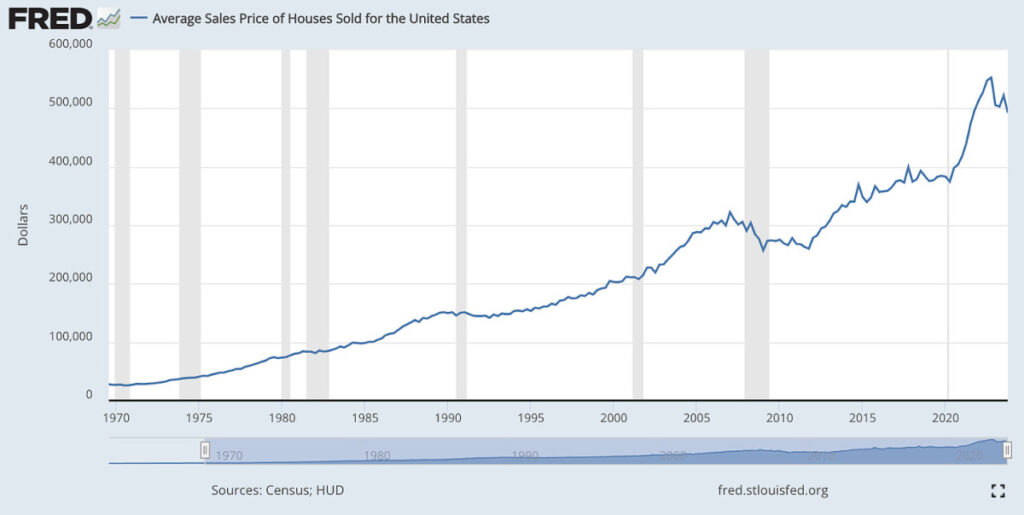

In real estate transactions, investors often assume profits come from price appreciation rather than cash flow. Real estate's high valuation is less about immediate income and more about scarcity and inflation hedging.

Real Estate vs. Bitcoin

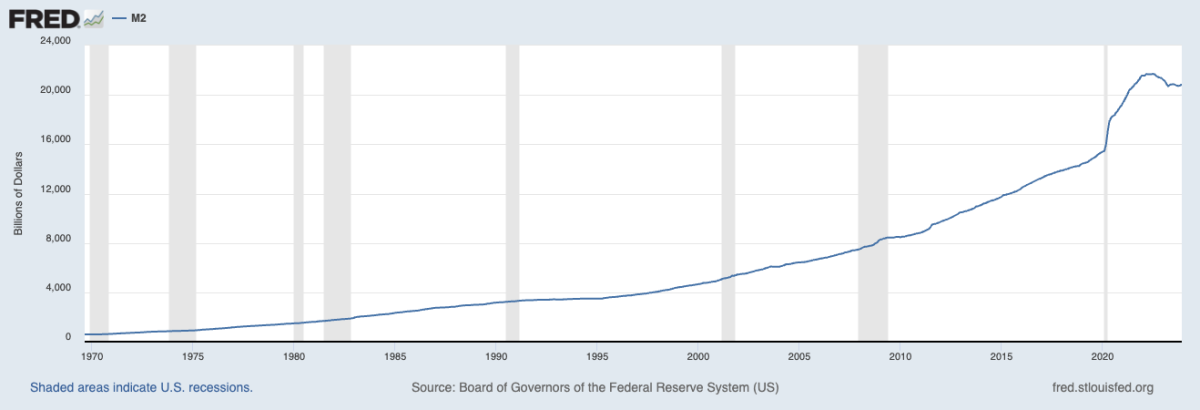

The excessive demand for real estate is due to monetary inflation, leading people to invest in scarce assets like real estate. Bitcoin's unique advantages, such as being rarer, cheaper to maintain, and more liquid, position it as a powerful contender in wealth preservation.

Conclusion

The narrative of cash flow and intrinsic value is being reevaluated with Bitcoin's emergence. As we navigate this shift, lessons learned from comparing real estate and bitcoin will shape our approach to investment and wealth preservation.

Appendix—To calculate the Compound Annual Growth Rate (CAGR) for both Money Supply (M2) and housing prices, the formula CAGR = (Ending Value/Beginning Value)^(1/Number of Years) was used.

For Money Supply (M2) from January 1971 to December 2023, the CAGR was 6.9532%. For housing prices over the same period, the CAGR was 5.7195%.

This guest post was written by Leon Wankum. Opinions expressed are their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Is it possible to hold precious metals in an IRA

The answer to this question depends on whether the IRA owner wants to diversify his holdings into gold and silver or keep them for safekeeping.

He has two options if he wishes to diversify. He could buy physical bars of gold and/or silver from a dealer or sell these items back to the dealer at the end of the year. But, what if he doesn't want to sell his precious metal investments? In this case, he should hold onto the investments as they are perfect for storing inside an IRA account.

Are gold IRAs a good investment?

You should buy shares in companies that produce gold. You should buy shares in these companies to make money from investing in gold and other precious metals such as silver.

Two drawbacks exist when you own shares directly.

The first is that you could lose money if your stock is held on for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. This could mean that you lose money rather than making it.

You may also miss potential profits if the market recovers before you sell. So you may need to be patient and let the market recover before you profit from your gold holdings.

You can still enjoy the benefits of physical gold if your investments are separate from your finances. A gold IRA will help protect your portfolio from inflation and diversify it.

Visit our website for more information on gold investing.

Can I put gold in my IRA?

Yes, it is possible! You can add gold into your retirement plan. Because it doesn't lose any value over time, gold is a great investment. It is also resistant to inflation. You don't even have to pay taxes.

You need to understand that gold is not like other investments before you invest in it. Unlike stocks or bonds, you can't buy shares of gold companies. They can't be sold.

Instead, convert your gold to money. This means that you must get rid of your gold. You cannot just keep it.

This makes gold different than other investments. With other investments, you can always sell them later. With gold, this isn't true.

The worst part is that you cannot use your gold to secure loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

So what does this mean? It's not possible to keep your gold for ever. You will have to sell it at some point.

You don't have to worry about this now. You only need to open an IRA account. After that, you can start investing in gold.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

investopedia.com

takemetothesite.com

wsj.com

kitco.com

How To

How to Buy Gold To Your Gold IRA

The term precious metal refers to gold, silver, palladium and rhodium. It refers only to elements with atomic number 79-110 (excluding helium). These elements are considered valuable because they are rare and beautiful. Precious metals that are most commonly used include silver and gold. Precious Metals are often used for money, jewelry and industrial goods.

Supply and demand affect the gold price daily. There has been a significant demand for precious metals over the past decade as investors look for safe havens in unstable economies. This increased demand has caused prices to rise significantly. But, investors in precious metals are becoming more cautious due to rising production costs.

Gold is a reliable investment due to its rarity and durability. Like many investments, gold doesn't lose value. Plus, you can buy and sell gold without paying taxes on your profits. There are two ways to invest in gold. You can either purchase gold bars and coins or invest in futures gold contracts.

Physical gold coins and bars provide immediate liquidity. They are easy to trade and keep. However, they are not very inflation-proof. To protect yourself from rising gold prices, you can consider buying gold bullion. Bullion is physical gold that comes in different sizes and shapes. While some billions are sold in one-ounce portions, others come in larger pieces such as kilobars. Bullion is stored in vaults that are protected against theft and fire.

If you prefer owning shares of gold rather than holding actual gold, you should consider buying gold futures. Futures let you speculate about how gold's price might change. Buying gold futures exposes you to gold's price without owning the physical commodity itself.

For example, if I wanted to speculate on whether the price of gold would go up or down, I could purchase a gold contract. My position will change when the contract expires. It can be either “longer” or “shorter.” If I have a long contract, it means that I believe gold's price will rise. In exchange, I'll give money now and promise to get more when the contract ends. A shorter contract would mean that I believe the gold price will fall. I'm happy to accept the money right now in exchange of the promise that I'll make more money later.

I'll get the contract's specified amount of gold plus interest when it expires. That way, I've gained exposure to the price of the gold without actually having to hold the gold myself.

Precious metals are a great investment as they are hard to counterfeit. While paper currencies can be easily counterfeited by printing new bills, precious metals cannot. Precious metals have remained stable over time because of this.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]