If you own gold in an IRA, you might be wondering if you owe the IRS on the value of that asset. In general, you don't owe taxes on the growth of your IRA, as long as you store it in an IRS-approved depository. If you have a small amount of gold in your IRA, you may only owe taxes on the distributions you make.

IRA gold owes no tax on growth or distributions

If you're looking for tax advantages with your retirement account, consider investing in gold. While gold IRAs aren't subject to the collectible tax rate of 28%, your account will be subject to your marginal tax rate, which can be much higher if you're in a high tax bracket. Investing in gold is also a good way to diversify your portfolio later in life. But you must be aware of the risks of predatory gold IRA account providers.

A gold IRA holds physical gold or other precious metals that are stored in a vault. An investor can also keep track of the value of gold online or by purchasing futures contracts. This can help them speculate on currency values.

IRA gold owes irs taxes

Investing in gold with an Individual Retirement Account (IRA) is a great way to diversify your portfolio and hedge against inflation. However, you'll have to remember that you'll still have to pay taxes on your profits if you sell your gold. That's because the Internal Revenue Service tracks IRA withdrawals and penalties. You can face thousands of dollars in penalties if you don't pay your taxes.

Gold is subject to taxation by the IRS and any gains you make on it will be subject to taxation. The most common way to avoid paying taxes on your gold investments is to purchase gold yourself, but this is not an ideal way to protect your financial future. Not only will you be paying taxes on your gold investments, but you'll also have to deal with penalties and tax penalties if you don't sell them at the right age.

IRA gold owes irs insurance

There are many things you need to consider when choosing a gold IRA company. You need to choose a company with good customer service and competitive rates, as well as a license and insurance. Ideally, you want to use an all-in-one service. There are many online reviews that will help you choose the right company for you. You should also check the company's reputation through consumer groups and organizations like the Better Business Bureau.

When choosing an IRA administrator, you should make sure that the company is well-respected and has a good track record. You don't want your account to be held in a company that might go bankrupt or liquidate your assets. This is known as “counterparty risk” and is present with any investment held by a third party. In order to protect your gold assets, you should only choose a reputable and IRS-approved gold IRA administrator.

IRA gold owes irs if you're under 59 1/2

A gold IRA is a type of individual retirement account that lets you invest in gold and silver. It is a great way to diversify your portfolio. To be eligible for a gold IRA, you must be at least 59 1/2 years old and have earned income from a job in the last 10 years.

Depending on the situation, you may be able to take out money from your IRA before you turn 59 1/2. Depending on the type of IRA, you may have to pay a 10% penalty if you withdraw money early. You can either take a lump sum distribution or make periodic withdrawals. With a lump sum distribution, you will take all of your money out at once, while a periodic distribution will give you regular payments over time. The IRS has set limits on how much you can withdraw from all of your IRAs combined.

Frequently Asked Questions

What precious metals can you invest in for retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. You can start by making a list of all your assets. This should include all stocks, bonds, mutual fund, certificates of deposits (CDs), insurance policies, life insurance policies and annuities. Then add up all of these items to determine how much you have available for investment.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. You won't be allowed to deduct tax for future earnings.

You may need additional money if you decide you want more. You can start with a regular brokerage account.

Are gold- and silver-IRAs a good idea.

This could be a great way to simultaneously invest in gold and silver. There are many other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We are always available to assist you!

What are the pros & con's of a golden IRA?

The gold IRA is a great way to diversify your portfolio, but you don't have access the traditional banking services. It allows you to invest in precious metals such as gold, silver, and platinum without paying taxes on any gains until they're withdrawn from the account.

However, early withdrawals of funds will incur ordinary income tax. These funds are not held in the country so creditors cannot seize them if you default on your loan.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

Can I put gold in my IRA?

The answer is yes You can add gold to your retirement plan. Because gold doesn't lose its value over time, it is an excellent investment. It protects against inflation. You don't even have to pay taxes.

It's important to understand the differences between gold and other investments before investing in it. You can't purchase shares in gold companies, unlike stocks and bonds. They are also not available for sale.

Instead, convert your precious metals to cash. This means that you'll have to get rid of it. It is not possible to keep it.

This is what makes gold unique from other investments. As with other investments you can always make a profit and sell them later. This is not true for gold.

Worse, the gold cannot be used as collateral for loans. You may have to part with some of your gold if you take out mortgages.

What does this all mean? You can't keep your gold indefinitely. You'll eventually need to convert it into cash.

However, there is no need to panic about it. All you have to do is open an IRA account. Then you can invest your money in gold.

Can a gold IRA make you money?

Yes, but not as often as you think. It all depends on your willingness to take on risk. If you are comfortable investing $10,000 annually for 20 years, you could potentially have $1 million at retirement age. If you try to put all your eggs into one basket, you will lose everything.

You need to diversify your investments. Inflation makes gold a good investment. You want to invest in an asset class that rises along with inflation. Stocks do this well because they rise when companies increase profits. Bonds also do this well. They pay interest each and every year. They are great in times of economic growth.

What happens if there is no inflation? In deflationary periods stocks and bonds both fall in value. Investors should avoid investing all of their savings into one investment like a stock mutual funds or bond.

Instead, they should consider investing in a mixture of different types and funds. They could, for example, invest in stocks and bonds. Or they could invest in both cash and bonds.

This gives them exposure to both sides. Inflation and deflation. They will continue to see a rise over time.

Can you make a profit on a Gold IRA?

If you want to make money on an investment, you need to do two things firstly, understand how the market operates, and secondly, know what kind of products are available.

If you don’t know anything, it is best to wait until you have enough information so that you can trade effectively.

Find a broker that offers the best service to your account type.

There are many account options available, including Roth IRAs (standard IRAs) and Roth IRAs (Roth IRAs).

If you have other investments such as bonds or stocks, you might also consider a rollover.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

investopedia.com

wsj.com

en.wikipedia.org

takemetothesite.com

How To

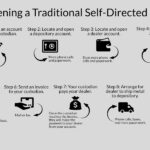

How to Open a Precious Metal IRA

Precious metals are a highly sought-after investment vehicle. Precious metals have a higher return than traditional investments like bonds or stocks, which is why they are so sought-after. But, it is important to do your research and plan carefully before investing in precious metals. Here are the basics to help you open your precious metal IRA account.

There are two main types of precious metal accounts: physical precious metals accounts and paper gold and silver certificates (GSCs). Each type has advantages and drawbacks. GSCs and physical precious metals accounts can offer diversification, but they are difficult to trade and easy to access. To learn more about these options, keep reading below.

Physical precious metals accounts consist of coins, bars, and bullion. While this option provides diversification benefits, it also comes with some drawbacks. The costs involved in buying, storing and selling precious metals can be quite high. Moreover, their large size can be difficult to transport them from one location to another.

However, paper silver and gold certificates are relatively cheap. They are also easily available and can be traded online. These make them ideal for people who don’t want to invest directly in precious metals. But they don't offer as much diversification as their physical counterparts. These assets are also supported by government agencies, such as the U.S. Mint. Inflation rates could cause their value to drop.

You should choose the account that best suits your financial needs before you open a precious-metal IRA. Before doing so, consider the following factors:

- Your tolerance level

- Your preferred asset allocation strategy

- How long do you have to spend?

- It is up to you whether you intend on using the funds short-term for trading purposes.

- Which type of tax treatment would you prefer

- What precious metal(s), would you like to invest?

- How liquid can your portfolio have to be

- Your retirement age

- Where to store precious metals

- Your income level

- Current savings rate

- Your future goals

- Your net worth

- Any other special circumstances that may impact your decision

- Your financial overall situation

- Preference between paper and physical assets

- You are willing to take chances

- Your ability to handle losses

- Your budget constraints

- Financial independence is what you want

- Your investment experience

- Your familiarity with precious and rare metals

- Your knowledge about precious metals

- Your confidence with the economy

- Your personal preferences

Once you have decided which type of precious-metal IRA is best for you, it's time to open an account at a reputable dealer. These companies can also be found online, through word-of mouth or referrals.

Once you have opened your precious-metal IRA, it is time to decide how much you want to deposit. There are different minimum deposits for precious metal IRA accounts. Some require only $100, while others will allow you to invest up to $50,000.

As you can see, your precious metal IRA IRA investment amount is completely up to the individual. A larger initial deposit is better if you are looking to build wealth over a longer period of time. If you are planning to invest small amounts each month, a lower initial investment might be better.

You can buy any type of investment, regardless of the amount of precious metals in your IRA. These are the most commonly used:

- Bullion bars. Rounds, and gold coins.

- Silver – Rounds, and coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Round or bar forms