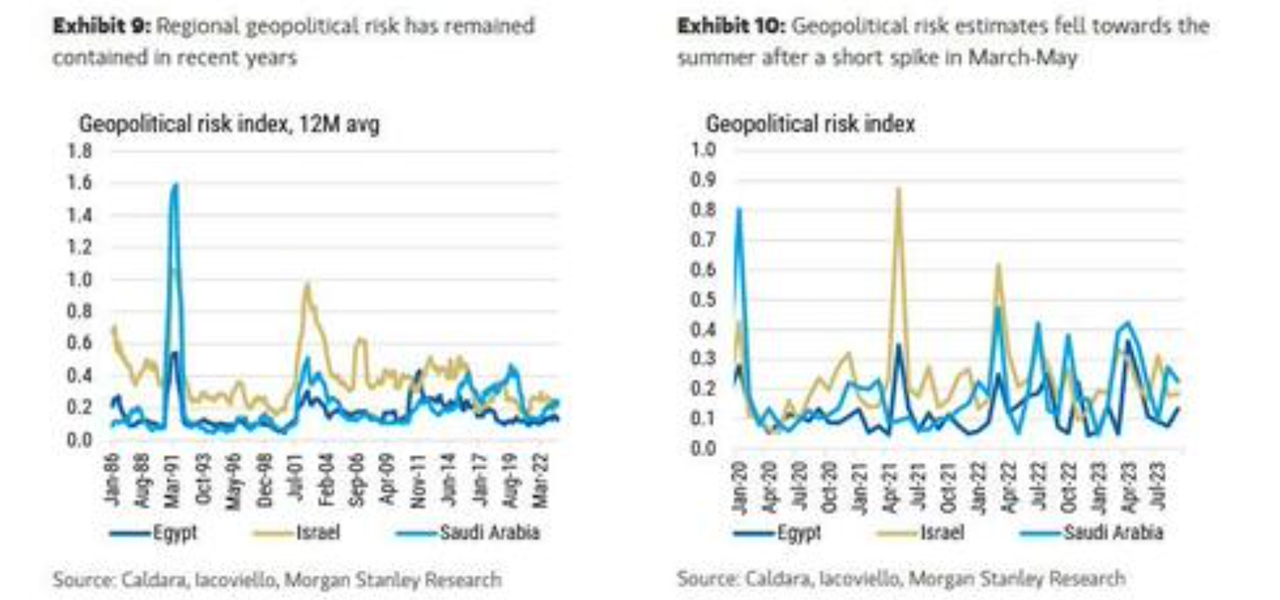

Leading American investment banks are advocating prudence and adaptability as the crisis triggered by an unexpected attack by Hamas on Israel earlier this month continues to unfold. Analyst notes from JPMorgan and Morgan Stanley offer a glimpse into Wall Street's interpretation of the unfolding events and their potential implications for global markets.

Morgan Stanley's Analyst Highlights Cautious Stance Amid Rising Geopolitical Threats

Michael Zezas, the global head of fixed income research at Morgan Stanley, acknowledged in a client's note that while analysts have been rife with speculation about the likelihood of the conflict escalating and involving other countries, there's no clear trajectory from this point. He recommended embracing the uncertainty as a means to gain clarity, noting that geopolitical threats have been escalating worldwide as governments implement policies to deter the empowerment of rivals.

Zezas suggested that the militant strike showcases and heightens this uncertainty, raising the possibility of several countries with significant economic roles getting involved. He emphasized that containment is achievable through various means. Zezas identified three reliable market implications in an environment where uncertainty continues to rise as governments respond to protect their interests.

These include the rise of corporate spending driven by national security as a theme, and the possibility that Middle Eastern emerging market sovereign credit may be undervalued for risks. While oil prices may see an increase, the strategist cautioned against assuming that rates will react in the same way. He concluded that a price shock from oil supply disruptions could potentially strain regional finances, even without direct actions against production.

JPMorgan's Analyst Observes Markets Tend to Withstand Geopolitical Crises with 'Limited' Long-Term Effects

Madison Faller, JPMorgan’s global investment strategist, also advised monitoring potential escalation and impacts on natural resources as the most apparent market linkage. She noted that neither side plays a significant role in oil production, and a balanced supply/demand equation has so far softened price movements. However, Faller pointed out that today's moderate disruption tolerance could change if major routes like the Strait of Hormuz were affected.

Faller suggested that markets have weathered geopolitical crises in the past, and their long-term effects are historically limited. She proposed concentrating on fundamentals such as inflation, rates, fiscal efforts, and corporate strength. Coupled with reasonable valuations, Faller sees opportunities in equities and high yields as a means of compensation for uncertainty. Her overarching counsel was to stay invested according to objectives, as diversified portfolios have proven beneficial through numerous challenges.

Market Reactions Amid Escalating Middle East Tensions

With the escalating Middle East tensions last week, both stock markets and cryptocurrencies saw a decline, while precious metals, particularly gold and silver, experienced a surge. Gold jumped over 3% on Friday, with silver climbing more than 4% against the U.S. dollar. As bond prices increased, the U.S. Treasury 10-year yield experienced a decrease. Additionally, oil recorded its most substantial weekly rise since the start of 2023. Simultaneously, shares in defense companies, including L3Harris Technologies, Lockheed Martin, and Northrop Grumman, saw a sharp increase in value over the week.

What are your thoughts on the market analysts' views on the conflict in the Middle East and its implications on global markets? We invite you to share your perspectives and opinions about this subject below.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

To answer this question, we must first understand what precious metals are. Precious metals refer to elements with a very high value relative other commodities. They are therefore very attractive for investment and trading. Gold is today the most popular precious metal.

However, many other types of precious metals exist, including silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is not affected by inflation or deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. Since these are scarce, they become more expensive and decrease in value.

Diversifying across precious metals is a great way to maximize your investment returns. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Should You Open a Precious Metal IRA?

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. You cannot recover any money you have invested. This includes investments that have been damaged by fire, flooding, theft, and so on.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items can be lost because they have real value and have been around for thousands years. You would probably get more if you sold them today than you paid when they were first created.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. You should also consider using a third party custodian to protect your assets and give you access at any time.

When you open an account, keep in mind that you won't receive any returns until your retirement. Do not forget about the future!

Is buying gold a good retirement plan?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bars are the most popular way to invest in gold. However, there are many other ways to invest in gold. It's best to thoroughly research all options before you make a decision.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you are looking for cash flow from your investment, buying gold stocks will work well.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical gold bullion coins anytime. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. When you die, your gold assets won't be subjected to taxes.

Your gold is passed to your heirs without capital gains tax. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a gold IRA, you will first need to create an individual retirement account (IRA). Once you've completed this step, an IRA administrator will be appointed to your account. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit required is $1,000 You'll get a higher rate of interest if you deposit more.

You will pay taxes when you withdraw your gold from your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

You may not be required to pay taxes if you take out only a small amount. There are some exceptions, though. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

It is best to not take out more than 50% annually of your total IRA assets. If you do, you could face severe financial consequences.

Can I keep physical gold in an IRA?

Not only is gold paper currency, but it's also money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans now invest in precious metals. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Another reason is that gold has historically outperformed other assets in financial panic periods. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Even if your stock portfolio is down, your shares are still yours. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, the liquidity that gold provides is unmatched. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. The liquidity of gold makes it a good investment. This allows for you to benefit from the short-term fluctuations of the gold market.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor