Introduction

Recently, multiple sources have confirmed that Onyx Protocol, a decentralized finance (defi) platform, has fallen victim to a security breach, resulting in a loss of $2.1 million. This incident has raised concerns about the safety and security of defi platforms in the ever-evolving and competitive digital world.

The Attack

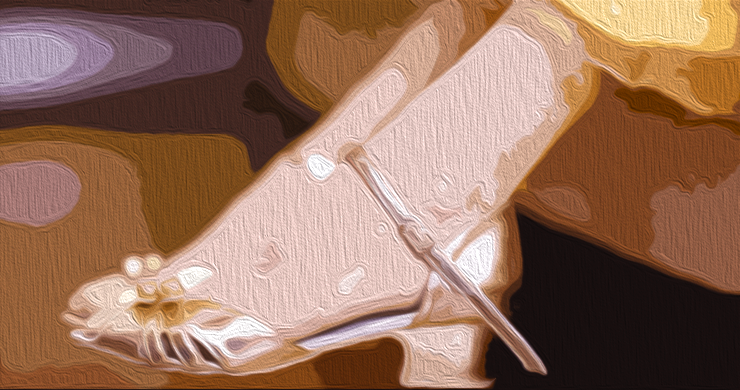

On November 1, 2023, Peckshield's blockchain analysis and security team exposed a suspicious transaction involving Onyx Protocol on social media channel X. The attackers exploited a "precision loss" bug and utilized a flash loan to drain a significant amount of ETH and ERC20 tokens from the platform.

The Aftermath

Despite the severity of the attack, the platform's native currency, onyxcoin (XCN), has only experienced a slight decline of 0.8% since the event. This relatively small decrease stands in contrast to the significant impact on crypto assets witnessed in previous defi hacks.

However, the breach has had a substantial effect on Onyx Protocol's total value locked (TVL) in the decentralized finance project. The TVL has plummeted from $2.88 million to $557,253, marking a dramatic drop in a single day.

Stolen Funds and Tornado Cash

Following the attack, a fraction of the stolen crypto assets, which originally belonged to the cross-token liquidity market, were swiftly transferred to the ether mixing service Tornado Cash. This service allows for the conversion of stolen funds into ethereum (ETH), making it difficult to trace the funds and identify the attackers.

Conclusion

The Onyx Protocol security breach highlights the vulnerabilities that exist in the defi ecosystem. It serves as a reminder for both platform developers and users to prioritize security measures and implement robust protocols to safeguard against such attacks. As the defi landscape continues to evolve, it is crucial to remain vigilant and proactive in enhancing security measures to protect user funds and maintain trust within the ecosystem.

What are your thoughts on the Onyx Protocol hack? Please share your opinions and insights in the comments section below.

Frequently Asked Questions

Are silver and gold IRAs a good idea for you?

This could be a good option for anyone looking to quickly invest in both silver or gold. But there are other options. If you have any questions regarding these types of investments, please feel free to contact us anytime. We are always here to help!

Can I have gold in my IRA.

The answer is yes You can add gold into your retirement plan. Because it doesn't lose any value over time, gold is a great investment. It is also resistant to inflation. It doesn't come with taxes.

It's important to understand the differences between gold and other investments before investing in it. You cannot purchase shares of gold companies like bonds and stocks. They are also not available for sale.

Instead, you must convert your gold to cash. This means that you must get rid of your gold. You can't just hold onto it.

This makes gold different than other investments. Like other investments, you can always dispose of them later. That's not true with gold.

Even worse, gold cannot be used to secure loans. If you get a mortgage, for example, you might have to give up some of the gold you own in order to pay off the loan.

What does this all mean? It's not possible to keep your gold for ever. You'll have to turn it into cash at some point.

You don't have to worry about this now. Open an IRA account. Then, you can invest in gold.

Can you make a profit on a Gold IRA?

You must first understand the market and then know which products are available to make money.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

Also, you should find the broker that provides the best service possible for your account type.

You can choose from a variety of accounts, including Roth IRAs or standard IRAs.

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

regalassets.com

investopedia.com

takemetothesite.com

wsj.com

How To

How to Decide if a Gold IRA Is Right for You

Individual Retirement account (IRA), is the most widely used type of retirement plan. IRAs are available through employers, banks, mutual funds, and financial planners. Individuals are allowed to contribute up to $5,000 each year to IRAs without having to pay tax consequences. This amount can go into any IRA. There are limits to how much money you may put into certain IRAs. For example, if your age is less than 591/2 years old, you can't contribute to a Roth IRA. Under 50-year-olds must wait until they reach 70 1/2 years of age before you can make contributions. Some people may also be eligible for matching contributions if they work for their employer.

There are two main types: Roth and traditional IRAs. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Roth IRA contributions can be made without tax, but they will still be subject to taxes if you withdraw from it. Some people may choose to use both. Each type has its advantages and disadvantages. What should you look at before deciding which type is best for you? Three things to bear in mind before you decide which type of IRA is best for you:

Traditional IRA Pros

- Contribution options vary by company

- Employer match possible

- It is possible to save more than $5.000 per person

- Tax-deferred growth until withdrawal

- You may have income restrictions

- Maximum contribution limit for married couples is $5500 annually ($6,500 jointly).

- The minimum investment is $1,000

- You must start receiving mandatory distributions after age 70 1/2

- You must be at the least five years of age to open an IRA

- Transfer assets between IRAs cannot be done

Roth IRA pros

- Contributions are free of taxes

- Earnings grow tax-free

- No minimum distributions

- Stocks, bonds, and mutual fund investments are the only options.

- There is no maximum contribution limit

- There are no limitations on the ability to transfer assets between IRAs

- An IRA can only be opened by those 55 and older

When opening a new IRA it's important to realize that not all companies offer identical IRAs. Some companies offer the option of a Roth IRA, while others provide a choice between a Roth IRA and a traditional IRA. Some companies will allow you to combine both. You should also note that different types of IRAs may have different requirements. A Roth IRA does not have a minimum investment requirement. Traditional IRAs require a minimum of $1,000.

The Bottom Line

When you are choosing an IRA, it is crucial to consider whether you will pay taxes now or in the future. If you plan to retire in the next ten years, a traditional IRA might be the best choice. If you are not able to retire within ten years, a Roth IRA may work better for you. However, it's always a good idea for you to talk with a professional regarding your retirement plans. An expert can advise you on the best options and how to navigate the market.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]