Rich Dad Poor Dad Author Urges Investors to Buy Bitcoin and Precious Metals

Renowned author Robert Kiyosaki, best known for his book Rich Dad Poor Dad, has once again expressed his worries about the significant increase in the U.S. national debt. Kiyosaki, who has been a strong advocate for bitcoin, advised investors to consider purchasing the cryptocurrency as well as gold and silver. In fact, he recently followed his own advice and increased his personal bitcoin holdings. Other critics of the U.S. government's fiscal policies have also raised concerns about the growing national debt, as it has the potential to weaken the U.S. economy and the value of the U.S. dollar.

Robert Kiyosaki's Concerns and Ongoing Support for Bitcoin

Kiyosaki, the co-author of the bestselling book Rich Dad Poor Dad, continues to emphasize his bullish stance on bitcoin and his concerns about the U.S. economy and the dollar. Rich Dad Poor Dad, published in 1997 and co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for over six years and has sold more than 32 million copies worldwide in over 51 languages across 109 countries.

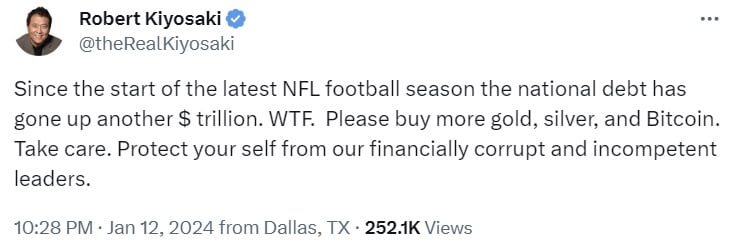

Kiyosaki took to social media to express his frustration, stating that the national debt has increased by an additional trillion dollars since the start of the National Football League (NFL) season. He strongly recommended that investors protect themselves from financial corruption and the incompetence of leaders by investing in gold, silver, and bitcoin. According to the Treasury Department, the current national debt stands at $34.06 trillion, marking a $1.02 trillion increase since September 18 of the previous year.

Growing Concerns Among Experts

Kiyosaki is not the only one sounding the alarm about the U.S. national debt. Economist and gold enthusiast Peter Schiff expressed his thoughts on January 2, stating, "It's only the 2nd day of Jan. and the national debt already blew past $34 trillion. I think 2024 will set a record for the largest one-year increase in the U.S. national debt in history. The only question is will there be a sovereign debt or dollar crisis before the year ends." Schiff also highlighted the rapid pace at which the national debt is growing, emphasizing the potential consequences if a recession were to occur.

In November of the previous year, Moody's downgraded the U.S. credit rating to "negative," citing mounting deficits and debt burdens. U.S. Senator Rand Paul echoed these concerns, warning that excessive government spending jeopardizes the stability of the dollar. He stated, "The greatest threat to [our national security] is the national debt. We borrowed a trillion dollars in the last three months." Billionaire investor Jeffrey Gundlach, also known as the "Bond King," expressed similar worries in October of the previous year, cautioning that the massive budget deficit and rising interest rates on the national debt should be a cause for concern.

Share Your Thoughts

What are your thoughts on Robert Kiyosaki's concerns about the rapid increase in the U.S. national debt? Let us know in the comments section below.

Frequently Asked Questions

Is gold a good investment IRA?

If you are looking for a way to save money, gold is a great investment. You can diversify your portfolio with gold. There's more to gold that meets the eye.

It has been used throughout the history of currency and remains a popular payment method. It is sometimes called the “oldest currency in the world”.

But gold is mined from the earth, unlike paper currencies that governments create. That makes it very valuable because it's rare and hard to create.

The price of gold fluctuates based on supply and demand. The strength of the economy means people spend more, and so, there is less demand for gold. The value of gold rises as a consequence.

On the other hand, people will save cash when the economy slows and not spend it. This increases the production of gold, which in turn drives down its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

In addition to earning interest on your investments, this will allow you to grow your wealth. In addition, you won’t lose any money if gold falls in value.

What are the benefits of a gold IRA

There are many benefits to a gold IRA. You can diversify your portfolio with this investment vehicle. You have control over how much money goes into each account.

You have the option of rolling over funds from other retirement account into a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are readily available at most banks and brokerages. Withdrawals can be made instantly without the need to pay fees or penalties.

That said, there are drawbacks too. Gold has historically been volatile. It is important to understand why you are investing in gold. Is it for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only after you have this information will you make an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce isn't enough to cover all of your needs. Depending on your plans for using your gold, you may need multiple ounces.

A small amount is sufficient if you plan to sell your gold. Even one ounce is enough. You won't be capable of buying anything else with these funds.

Can the government take your gold

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It belongs to you. There may be exceptions to this rule. Your gold could be taken away if your crime was fraud against federal government. If you owe taxes, your precious metals could be taken away. However, even if taxes are not paid, gold is still your property.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts