The Conditions for a Bull Run

Bull runs, like wildfires, require certain conditions to ignite. Just as a wildfire needs a long period of no rain, high temperatures, and high winds, a bull run in the Bitcoin market also relies on specific factors.

Halvings, which occur in the Bitcoin market, can be compared to a period of no rain. They result in a decrease in the supply of new Bitcoin. Additionally, halvings generate increased interest and attention from investors, similar to high temperatures. However, for a bull run to occur, there needs to be a strong catalyst, an ignition event.

In the case of Bitcoin, this ignition event is the changing narrative around its Environmental, Social, and Governance (ESG) impact. The winds of change surrounding the Bitcoin ESG narrative will play a crucial role in sparking the next bull run.

The Problem Faced by ESG Investors

According to a report by PwC, institutional investment focused on ESG is expected to reach $33.9 trillion by 2026. However, there is a significant problem faced by ESG investors. The demand for solid ESG investment opportunities exceeds the available supply. A staggering 30% of investors struggle to find attractive ESG investments.

Bitcoin has emerged as a potential solution to this problem. The turning point in the ESG narrative around Bitcoin occurred in 2023. Five significant events took place within a span of 53 days, including reports from KPMG, peer-reviewed research, and acknowledgments from Cambridge and Bloomberg Intelligence. These reports, produced by reputable researchers and organizations, concluded that Bitcoin is a net positive as an ESG asset.

With this wind of change, Bitcoin is well-positioned to address the issue of supply and demand in the ESG investment space. This has the potential to create the high winds necessary for a bull run in the Bitcoin market.

The Implications of the Changing Narrative

Currently, there is an information asymmetry among ESG investors. The narrative around Bitcoin's ESG impact has changed based on new data, but many investors are not yet aware of these developments. Until they have access to this new information, they will continue to believe the old narrative that Bitcoin is net negative for the environment.

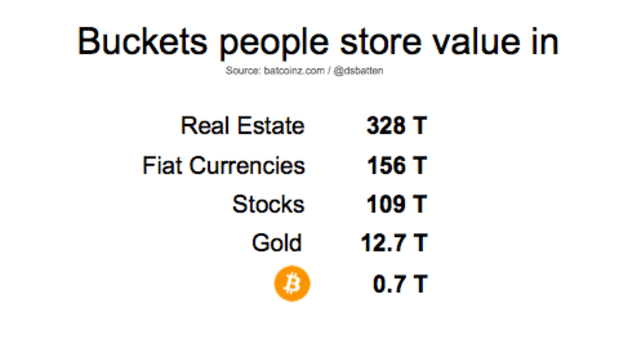

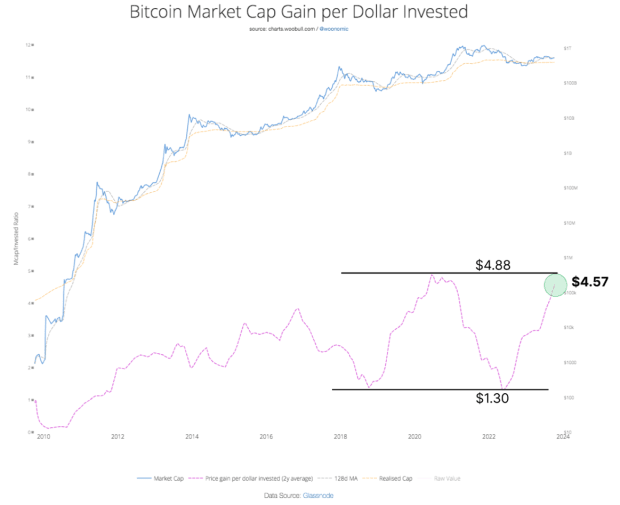

When this information asymmetry is eliminated and the high winds of the new Bitcoin ESG narrative blow away the old beliefs, significant changes can be expected. Willy Woo's analysis suggests that if ESG investors were to allocate just 1% of their 2026 Assets Under Management (AUM) into Bitcoin, its market cap could increase to $2.26 trillion. A 2.5% allocation could result in a market cap of $3.87 trillion.

Even without considering this positive feedback loop, a 2.5% deployment of ESG investor AUM could catalyze a Bitcoin price of around $193,000 during a potential bear market in 2026. These estimates are not predictions but simulations that demonstrate the potential impact of ESG investment on Bitcoin's market cap.

Furthermore, Bitcoin has the unique potential to become the world's first greenhouse-negative industry without offsets. Achieving this would require Bitcoin mining methane mitigation on just 35 mid-sized venting landfills. If this were to occur by 2026, it is highly likely that ESG investors would allocate a greater percentage of their AUM into Bitcoin.

The Ignition Event

The winds of change in the Bitcoin ESG narrative are already swirling. There is growing recognition that Bitcoin can increase renewable energy capacity and reduce methane emissions, which are crucial needs in today's world. In contrast, Ethereum's migration to Proof of Stake means it can no longer contribute to these urgent environmental goals.

In 2022, Bitcoiners were still on the defensive against ESG attacks. However, by 2023, they started taking a proactive approach, sharing fact-based reports and inspiring stories about Bitcoin's positive ESG case. This strategy has been successful, with positive mainstream news coverage outnumbering negative accounts 4:1. The 53 days of narrative flips further strengthened the case for Bitcoin's positive ESG impact.

As the conditions for a bull run align, with the approaching halving and the growing winds of change in the Bitcoin ESG narrative, the stage is set for the ignition event. The deployment of large ESG funds into Bitcoin will serve as the spark that ignites the next bull run.

ESG = Next Great Opportunity for Bitcoin.

Author: Daniel Batten, Founder of CH4Capital

Frequently Asked Questions

What is the difference between a gold and silver IRA?

An IRA for gold and/or silver allows you to invest without tax in precious metals such as silver and gold. They are a good investment option for those who wish to diversify their portfolios.

If you're over 59 1/2, you don't have to pay income taxes on interest earned through these accounts. On any appreciation in value of the account, you don't have to pay capital gain tax. You have to limit the amount you can deposit into this type account. The minimum amount that you can invest is $10,000. If you're under the age of 59 1/2, investing is not allowed. The maximum annual contribution allowed is $5,500

Your beneficiaries could receive less if you die before your retirement. After you have paid all your expenses, your estate should include sufficient assets to cover the balance of your account.

Some banks offer a silver and gold IRA option. Others require you open a regular broker account, through which shares or certificates can be purchased.

What precious metal should I invest in?

The investment of gold is high-returning and has high capital appreciation. It is also immune to inflation and other risk factors. People become more concerned about inflation and the gold price tends to go up.

It's a good idea for you to purchase futures gold. These contracts guarantee you will receive a certain amount of gold at a fixed price.

But gold futures may not be right for everyone. Some people prefer to own physical gold instead.

They can easily trade their gold with others. They can also sell their gold whenever they wish.

Some people would rather not pay tax on their gold. People buy gold directly from the government in order to avoid paying taxes.

This will require several trips to your local Post Office. First convert any gold that is already in circulation into coins or bars.

Then you will need a stamp to attach the coins or bars. Then, send them to the US Mint. The US Mint will melt the coins and bars to make new ones.

The original stamps are used to stamp the new coins and bars. This means they are legal tender.

But if you buy gold directly from the US Mint, you won't have to pay taxes.

Decide what precious metal do you want to invest?

Which type of IRA works best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. You must consider whether you want to maximize tax-deferred growth on your contributions, minimize taxes now and pay penalties later, or just avoid taxes altogether.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. It's also worth considering if your plan is to work after the age of 59 1/2.

If you plan to retire early, the traditional IRA might make more sense because you'll likely owe taxes on the earnings of those funds. The Roth IRA is a better option if you plan to continue working well beyond age 65. It allows you to withdraw any or all of your earnings and not pay taxes.

Are precious metals allowed in an IRA?

The answer to this question depends on whether the IRA owner wants to diversify his holdings into gold and silver or keep them for safekeeping.

Two options are available for him if diversification is something he desires. He could purchase physical bars of gold or silver from a dealer and then sell these items to him at the end. Let's say he doesn’t want to sell back his precious metal investment. In this case, he should hold onto the investments as they are perfect for storing inside an IRA account.

Can I put gold in my IRA?

Yes, it is possible! You can include gold in your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It is also resistant to inflation. It is also exempt from taxes.

It's important to understand the differences between gold and other investments before investing in it. You cannot purchase shares of gold companies like bonds and stocks. These shares can also be not sold.

Instead, convert your precious metals to cash. This means that you'll have to get rid of it. You cannot keep it.

This is what makes gold unique from other investments. With other investments, you can always sell them later. With gold, this isn't true.

You can't even use your gold as collateral to get loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

So what does this mean? You can't just keep your gold forever. You'll eventually need to convert it into cash.

But there's no reason to worry about that now. You only need to open an IRA account. You can then invest in gold.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

forbes.com

kitco.com

takemetothesite.com

wsj.com

How To

How to turn your IRA into a IRA with gold content

So you want to move your retirement savings from a traditional IRA into a gold IRA? This article will guide you through the process. Here are some tips to help you switch.

“Rolling over” refers to the act of transferring money into an alternative type of IRA (traditional), or vice versa (gold). This is done because tax advantages go along with rolling over an account. Others prefer to invest in tangible assets, such as precious metals.

There are two types IRAs: Traditional IRAs or Roth IRAs. The difference is simple. Traditional IRAs allow investors the ability to deduct taxes whenever they withdraw their earnings. Roth IRAs are not. If you invest $5,000 in a Traditional IRA now, then you'll be able only to withdraw $4,000. The Roth IRA would allow you to keep every cent if you invested the same amount.

These are the things you need to know if your goal is to convert from a traditional IRA or a gold IRA.

First, decide whether to transfer funds from an old account to your new account or to rollover your current balance. Transferring money will result in income tax being paid at the normal rate for earnings greater than $10,000. If you decide to roll over your IRA you will not be subject to income tax on these earnings until you turn 59 1/2.

Once you have made up your mind, it is time to open a brand new account. You'll likely be required to provide proof of identities, such as a Social Security card, passport, and birth certificate. You will then need to fill out paperwork proving that you have an IRA. After you have completed the forms, submit them to your bank. You'll be verified and given instructions on where you can send your wire transfers and checks.

Now comes the fun part. Once your IRS approves your request, you'll deposit cash in your new account. After approval, you'll receive a letter stating that funds can be withdrawn.

That's it! Now you can just sit back and enjoy the growth of your money. If you decide to convert your IRA you can close it and transfer the remaining balance into a different IRA.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]