In the midst of significant changes in the cryptocurrency market, the landscape of investments is undergoing a profound transformation. The emergence of Spot Bitcoin ETFs signifies Bitcoin's integration into mainstream finance, bringing it closer to traditional investment instruments. This article delves into the surface of this transformation and explores the evolving relationships between Bitcoin, stocks, and Gold. The discussion aims to uncover whether the traditional financial market is steering Bitcoin away from its decentralized roots or if there is still room for the cryptocurrency to preserve its unique trajectory.

Bitcoin's Superior Performance and Market Dynamics

Based on data from Kaiko, Bitcoin has demonstrated superior risk-adjusted returns compared to conventional assets. While Nvidia led in terms of risk-adjusted returns, Bitcoin closely followed, surpassing major assets like the S&P 500 and Gold with a remarkable surge of over 160% in risk-adjusted terms.

The IMF Crypto Cycle and US Monetary Policy study revealed that 80% of the fluctuations in crypto prices and its growing correlation with equity markets coincided with the entry of institutional investors into the crypto sphere since 2020. Institutional trading volumes on crypto exchanges witnessed a staggering increase of over 1,700% during the second quarters of 2020 and 2021. The study emphasized the impact of US monetary policy on the crypto cycle, highlighting the influence of the US Federal Reserve's policies on crypto markets due to their strong reliance on the USD.

Institutional Adoption and Future Trends

According to the 2023 Institutional Investor Digital Assets Outlook Survey, 64% of investors are planning to increase their exposure to the crypto sector within three years, allocating up to 5% of their assets under management to cryptocurrencies. The survey also noted a rise in initial investments by institutions over the past year, with some institutions expanding their existing crypto portfolios. While asset managers showed a significant increase in crypto investments, asset owners seemed more conservative in ramping up their stakes.

Despite Bitcoin's origin as a decentralized and egalitarian currency, recent studies suggest a growing concentration of ownership among a few major players in the market.

Shifting Correlations and Market Dynamics

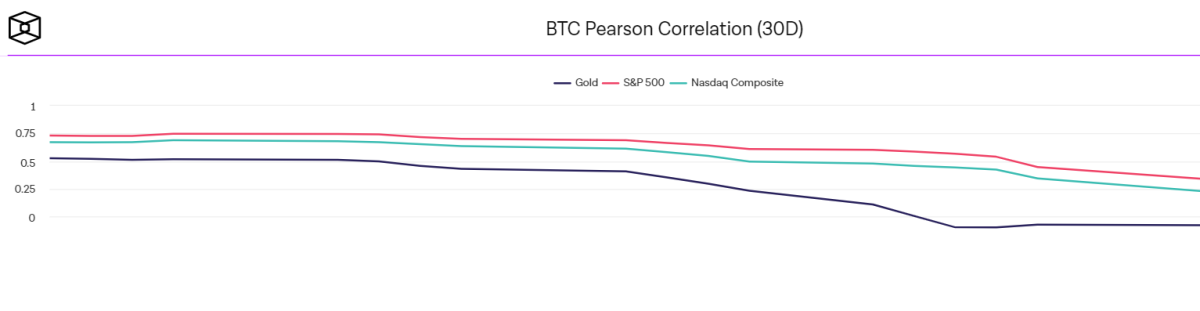

Bitcoin's correlation with traditional assets like the S&P 500 and Nasdaq has strengthened, indicating a closer alignment with traditional financial markets. In contrast, its correlation with Gold has exhibited fluctuations, challenging the notion of Bitcoin as a safe haven asset. The changing correlations suggest a shift in investor perceptions towards Bitcoin.

As the correlation between Bitcoin and traditional equity markets increases, signaling a move towards riskier assets, the cryptocurrency is perceived more as a risk-on investment rather than a safe haven. The involvement of institutional and retail investors in both equity and cryptocurrency markets could lead to synchronized price movements across these asset classes.

Implications of ETF Integration and Institutional Participation

The approval of Spot Bitcoin ETFs has attracted significant interest from institutional investors, potentially reshaping Bitcoin's market dynamics. As Bitcoin moves closer to ETFs, it may start to resemble traditional stocks, given the significant influence of these funds in the stock market. However, this shift towards centralized investment structures could pose risks to Bitcoin's fundamental principles of decentralization and independence from traditional financial systems.

Concluding Remarks

As Bitcoin navigates the evolving landscape of institutional investments and ETF integration, it faces a critical juncture in balancing its growth potential with its core values of decentralization. While the influx of institutional players presents new opportunities, it also poses challenges to Bitcoin's original ethos. It is essential to monitor how these developments shape Bitcoin's future trajectory in the financial markets.

This article is contributed by Maria Carola. The opinions expressed are solely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

How much of your IRA should include precious metals?

You can protect yourself against inflation by investing your money in precious metals, such as silver and gold. It's not just an investment for retirement; it also helps you prepare for any economic downturn.

The prices of gold and silver have increased substantially over the past few decades, but they remain safe investments because they do not fluctuate as frequently as stocks. These materials are always in demand.

Silver and gold prices are typically predictable and stable. They tend to increase when the economy is growing and decrease during recessions. This makes them great money-savers and long-term investments.

Your total portfolio should be 10 percent in precious metals. This percentage can be increased if your portfolio is more diverse.

Which type is best for an IRA?

It is crucial to find the right IRA for your needs. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

If you're saving for retirement and don't have much money invested, the Roth option could make sense. It's also worth considering if your plan is to work after the age of 59 1/2.

If you plan on retiring early, the traditional IRA may be better because you'll likely owe any taxes on the earnings. However, if your goal is to retire early, the traditional IRA might be more sensible. The Roth IRA allows you to withdraw some of your earnings or all without paying taxes.

How does the gold and silver IRA function?

An IRA that is gold or silver allows you the opportunity to invest in precious metals without paying tax on any gains. They make a great investment choice for those looking to diversify.

You do not have to pay income tax on interest earned from these accounts if you are over 59 1/2. Capital gains tax is not required for any appreciation in account value. However, there are limitations on how much money you can put into this type of account. The minimum amount that you can invest is $10,000. You can't invest if you're younger than 59 1/2. The maximum annual contribution is $5,000.

Your beneficiaries might not receive the full amount of your account if your death occurs before you retire. Your estate should contain sufficient assets to cover your account's remaining balance after paying any other expenses.

Some banks offer IRA options in gold and silver, while some require you to open a regular brokerage accounts through which you can purchase shares or certificates.

Can you make money from a gold IRA

You must first understand the market and then know which products are available to make money.

You shouldn't trade if you don't have the right information.

It is important to find a broker who provides the best services for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

A rollover may be an option if you have other investments like stocks or bonds.

Are precious metal IRAs a good investment?

The answer depends on how much you are willing to risk an IRA account losing value. They make sense if you have $10,000 in cash as long as you don't expect them to grow very quickly. These are not the best investments if there is a long-term plan for saving money (like gold) or if you want to invest more in assets that will rise in value over time. These fees can reduce any gains.

Is gold IRAs a good way to invest?

The best way to invest in gold is by buying shares in companies that mine for it. These companies can make you money by investing in precious metals and gold.

There are however two problems with owning shares directly.

If you hold on to your stock for too much time, you risk losing money. Stocks will fall faster than the underlying asset (like a gold mine) when they drop. It could lead to you losing your money, instead of making it.

You may also miss potential profits if the market recovers before you sell. It is possible to wait until the market recovers before selling your gold.

Physical gold can be beneficial if you prefer to keep investments separate from your finances. A gold IRA will help protect your portfolio from inflation and diversify it.

Visit our website for more information on gold investing.

What precious metals do you have that you can invest in for your retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. Take a look at everything you own to determine how much you have left. You should list all savings accounts, stocks and bonds, mutual funds certificates of deposit (CDs), annuities, life insurance policies, annuities 401(k), real estate investments, and any other assets like precious metals. To determine how much money is available to invest, add all these items.

If you are younger than 59 1/2, you might want to open a Roth IRA account. A traditional IRA allows you to deduct contributions from your taxable income, while a Roth IRA doesn't. But, future earnings won't allow you to take tax deductions.

If you decide you need more money, you will likely need to open another investment account. Start with a regular brokerage account.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

takemetothesite.com

kitco.com

regalassets.com

wsj.com

How To

Things to Remember: Best Precious Metals Ira, 2022

Precious Metals Ira ranks high among investors as one of their most popular investment options. This article will provide information on how to understand the appeal of precious metals ira and make sound investment decisions.

The key attraction of these assets lies in their long-term growth potential. Historical data shows that gold prices have experienced incredible returns. Over the past 200+ years, gold prices rose from $20 to almost $1900 an ounce. The S&P 500 Index was only up by 50%.

During economic uncertainty, gold can also be considered a refuge. When the stock market suffers bad days, people tend to sell stocks and move into the safety of gold. Also, gold is considered a hedge against inflation. Many economists believe that there will always exist some level of inflation. As such, physical gold is an excellent way to protect your savings and prevent future price increases.

You should be careful before you purchase precious metals such as palladium, gold, platinum or silver. First, you should know whether you want to invest in bullion bars or coins. Bullion bars can be bought in large quantities (like 100-ounces) and kept aside until required. The coins are smaller versions than bullion bars and can be used to purchase small quantities of bullion.

The second is to think about where you intend to store precious metals. Some countries are more safe than others. You might find it more sensible to store your precious materials overseas if you are a resident of the US. If you are thinking of storing your precious metals in Switzerland, however, you might be wondering why.

The final decision is whether you want to either invest directly in precious or through “precious metallics exchange-traded fund” (ETFs). ETFs, which track the performance different commodities like gold, are financial instruments. These can be used to gain exposure to precious metals, without the need to own them.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]