The Rise of Bitcoin as Digital Base Money

Bitcoin is evolving in fascinating ways, with diverse perspectives on its role in the financial landscape. Some see it as a currency for daily transactions, others as a modern-day version of gold for value storage, and some as a decentralized global platform for securing and validating off-chain transactions. However, Bitcoin is increasingly establishing itself as a digital base money.

Bitcoin vs. Traditional Fiat Currencies

Functioning similar to physical gold in various aspects, such as a bearer asset, inflation hedge, and currency denominations like the dollar, Bitcoin is reshaping the concept of monetary base assets. Its transparent algorithm and fixed supply of 21 million units ensure a non-discretionary monetary policy, contrasting with traditional fiat currencies like the US dollar that rely on centralized authorities for supply management.

The Critique of Centralized Monetary Decision-Making

Nobel laureate Friedrich August von Hayek's criticism of centralized monetary decision-making in his work "The Pretense of Knowledge" sheds light on the transparent and predictable monetary policy of Bitcoin. This stands in contrast to the opaque and potentially unpredictable nature of managing traditional fiat currencies.

The Debate on Leveraging Bitcoin

Within the Bitcoin community, there is widespread skepticism towards leveraging Bitcoin due to concerns about undermining its core principles. Many view leveraging as economically risky and destabilizing, akin to fiat currency practices. The collapse of Bitcoin lending companies like Celsius and BlockFi in 2022 further fueled concerns about the risks associated with leveraging Bitcoin.

Lessons from the Crypto Credit Crunch of 2022

The collapse of major crypto lending companies in 2022 highlighted issues with centralized yield instruments, emphasizing transparency, trust, and risks like liquidity and counterparty risks. The pitfalls of centralization and off-chain risk management processes were underscored, mirroring traditional banking flaws.

Bitcoin-Based Yield Products: The Way Forward

Despite the challenges, the need for Bitcoin-based yield products remains crucial for fostering a robust Bitcoin-centric economy. These products play a vital role in driving adoption and utilization of Bitcoin as digital base money.

Trust Spectrum in Bitcoin-Powered Finance

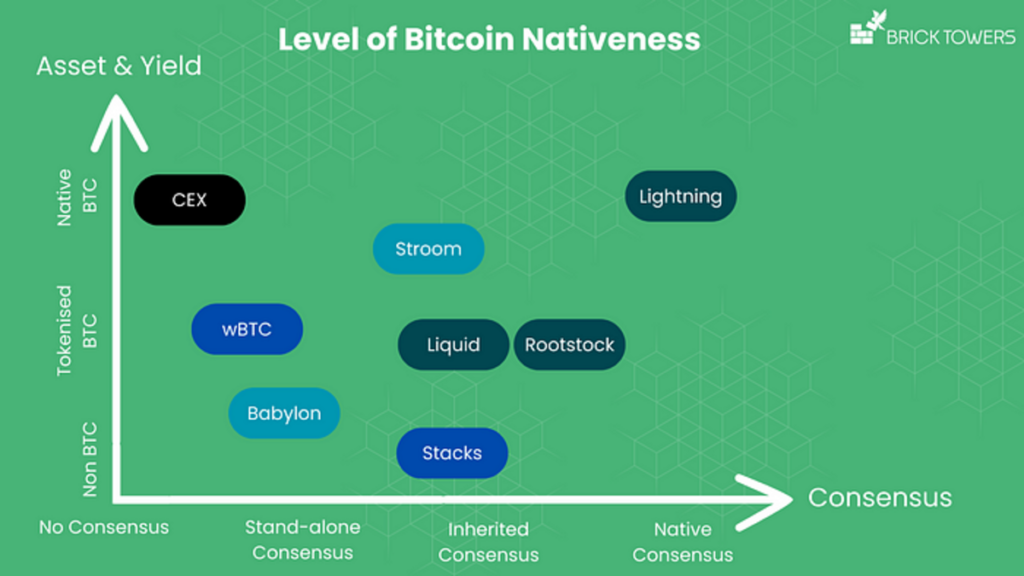

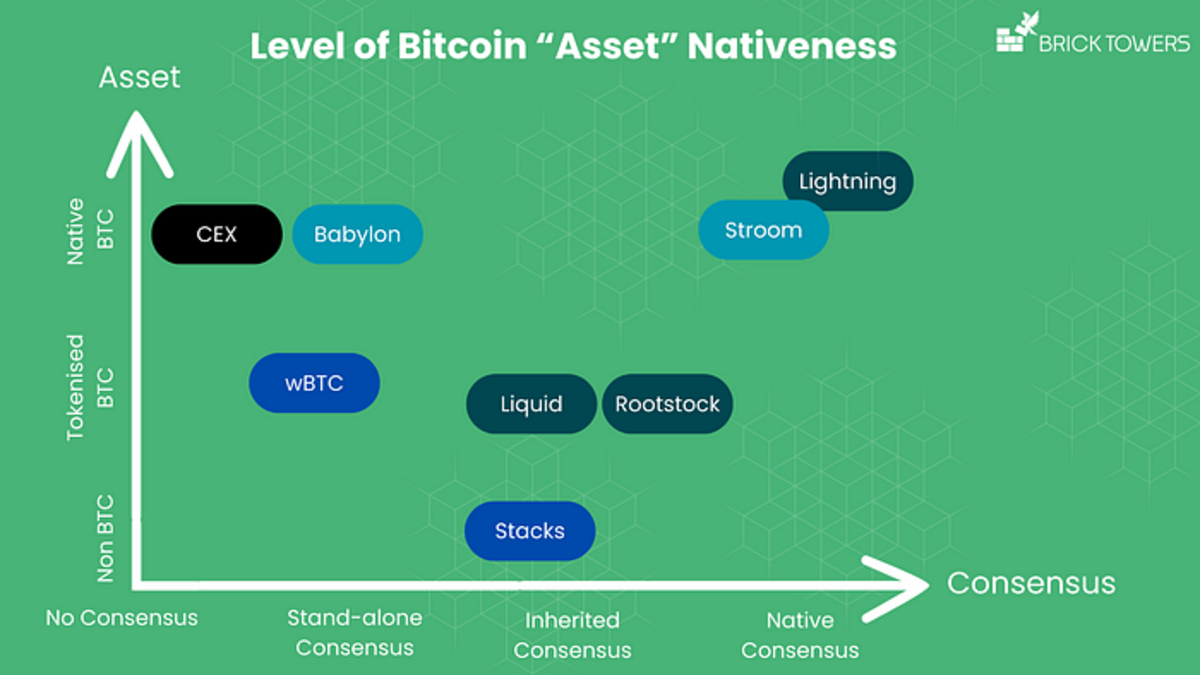

Bitcoin-powered finance will be built in layers, similar to the current financial system. Understanding the trust spectrum and distinguishing different implementations of Bitcoin on various layers is essential for evaluating their alignment with Bitcoin's ethos.

Assessing Bitcoin Yield Products

Categorizing Bitcoin yield products based on consensus, asset, and yield provides a valuable framework for evaluating their alignment with Bitcoin's ethos. The closer a product is to Bitcoin's native consensus, asset, and yield, the more aligned it is with Bitcoin.

Bitcoin's Gold Standard: Native All the Way Through

The ideal Bitcoin-based yield product would combine native Bitcoin consensus, asset, and yield, embodying near-perfect alignment with Bitcoin. Projects like Brick Towers are aiming to provide customers with a trust-minimized and native approach to utilizing Bitcoin for earning yield.

This article, researched and written by Pascal Hügli in collaboration with Brick Towers, delves into the evolution of Bitcoin-based yield products and their role in shaping the future of finance.

Frequently Asked Questions

Can I purchase gold with my self directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contract are financial instruments that depend on the gold price. They allow you to speculate on future prices without owning the metal itself. However, physical bullion is real gold or silver bars you can hold in your hands.

Should You Invest in gold for Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure of which option to invest in, consider both.

In addition to being a safe investment, gold also offers potential returns. It is a good choice for retirees.

Gold is more volatile than most other investments. Because of this, gold's value can fluctuate over time.

This does not mean you shouldn’t invest in gold. You should just factor the fluctuations into any overall portfolio.

Another advantage of gold is its tangible nature. Unlike stocks and bonds, gold is easier to store. It can be easily transported.

You can always access your gold as long as it is kept safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

It's also a good idea to have a portion your savings invested in something which isn't losing value. When the stock market drops, gold usually rises instead.

Another benefit to investing in gold? You can always sell it. As with stocks, your position can be liquidated whenever you require cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start by purchasing a few ounces. Next, add more as required.

Remember, the goal here isn't to get rich quickly. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How to Open a Precious Metal IRA?

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form should be completed within 60 days after opening the account. Once you have completed this form, it is possible to begin investing. You can also contribute directly to your paycheck via payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS says you must be 18 years old and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made on a regular basis. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, you won't be able purchase physical bullion. This means you can't trade shares of stock and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is available from some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. They aren't as liquid as bonds or stocks. It is therefore harder to sell them when required. Second, they are not able to generate dividends as stocks and bonds. You'll lose your money over time, rather than making it.

How much of your portfolio should be in precious metals?

To answer this question, we must first understand what precious metals are. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them highly valuable for both investment and trading. Gold is by far the most common precious metal traded today.

There are many other precious metals, such as silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It also remains relatively unaffected by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. However, the prices of precious metals do not always move in sync with one another. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors prefer safe assets such as Treasury Bonds and demand fewer precious metals. Since these are scarce, they become more expensive and decrease in value.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

What are the pros & cons of a Gold IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are disadvantages to this type investment.

You may lose all your accumulated savings if you take too much out of your IRA. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. Insurance that covers losses upto $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers limit the number of ounces of gold that you can own. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more expensive than gold futures contracts. Futures contracts provide flexibility for purchasing gold. Futures contracts allow you to create a contract with a specified expiration date.

You will also have to decide which type of insurance coverage is best for you. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does include coverage for damage due to natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. Additionally, safekeeping is usually charged by banks at around $25-$40 per monthly.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians are not allowed to sell your assets. Instead, they must retain them for as long and as you require.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. Also, you should specify how much each month you plan to invest.

After filling in the forms, please send them to the provider. After receiving your application, the company will review it and mail you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

What precious metal should I invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. If you want to invest in long-term, steady returns, silver is a better choice.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

finance.yahoo.com

How To

Tips to Invest in Gold

One of the most sought-after investment strategies is investing in gold. There are many benefits to investing in gold. There are several ways to invest in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any type gold, it is important to think about these things.

- First, check to see if your country permits you to possess gold. If so, then you can proceed. Otherwise, you can look into buying gold from abroad.

- The second is to decide which kind of gold coin it is you want. There are many options for gold coins: yellow, white, and rose.

- Third, consider the cost of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversify your investments in stocks, bonds or real estate.

- Don't forget to keep in mind that gold prices often change. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]