Are you ready to revolutionize your corporate treasury strategy and shield your reserves from unseen risks? Bitcoin holds the key to transforming your financial security by eliminating counterparty vulnerabilities and ushering in a new era of self-sovereignty. Let's delve into how Bitcoin can redefine your treasury's resilience and future-proof your capital.

Revealing Vulnerabilities in Traditional Reserves

The Fragile Foundation of Corporate Treasury Reserves

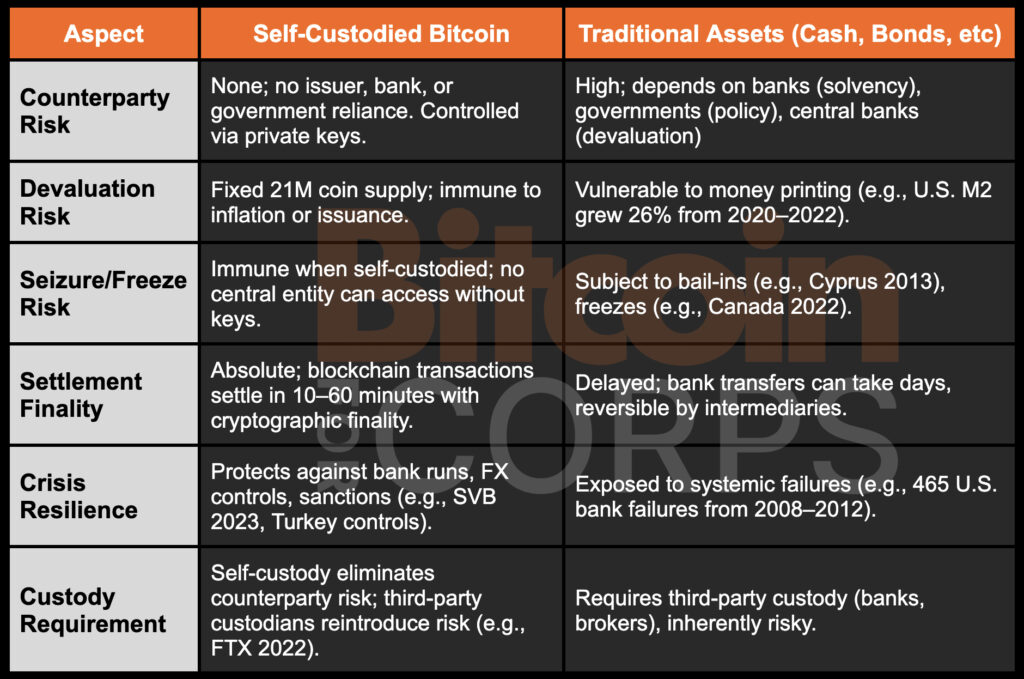

When it comes to safeguarding corporate liquidity, traditional assets like cash and bonds leave treasuries exposed to unseen systemic risks. Explore how Bitcoin's self-custody solution can mitigate these vulnerabilities and fortify your financial foundation.

Bitcoin: Empowering Corporate Financial Independence

Unleashing Financial Sovereignty Through Bitcoin

Discover how self-custodied Bitcoin empowers corporations to break free from the shackles of counterparty risks associated with bonds and fiat reserves. Embrace financial autonomy like never before with Bitcoin at the helm of your treasury strategy.

Navigating Through Crisis: Bitcoin as a Lifeline

Lessons from Crisis Scenarios Reinforce the Need for Bitcoin

Learn from past crises like the Cyprus Bail-In and Canada Trucker Protests to understand why self-custodied Bitcoin is the ultimate shield against liquidity freezes and capital controls. Explore how Bitcoin can be your lifeline in times of financial turmoil.

Bitcoin: A Strategic Risk Management Tool

Maximizing Bitcoin's Potential as a Risk Mitigator

Unlock the full potential of Bitcoin as a risk mitigation asset that offers long-term value preservation and disaster resilience. Dive into the strategic advantages of integrating self-custodied Bitcoin into your corporate treasury arsenal.

Empowering Your Treasury with Bitcoin: Operational Insights

Streamlining Bitcoin Integration for Optimal Security

From custody strategies to evolving standards and strategic deployment, learn how to seamlessly integrate self-custodied Bitcoin into your corporate treasury operations. Embrace Bitcoin as a strategic asset while upholding operational excellence.

Embrace the Future: Embrace Self-Custodied Bitcoin

Redefining Financial Sovereignty Through Bitcoin Adoption

It's time to revolutionize your corporate treasury strategy by embracing the transformative power of self-custodied Bitcoin. Future-proof your balance sheets and embark on a journey towards unparalleled financial sovereignty.

Discover more insights on leveraging Bitcoin for corporate treasury success in the original article here at Bitcoin Magazine.

Frequently Asked Questions

What is a Precious Metal IRA, and how can you get one?

Precious metals make a great investment in retirement accounts. They have held their value since biblical times. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

Certain countries permit citizens to hold their money in foreign currencies. You can buy gold bars in Canada and keep them at home. Then, you can buy gold bars in Canada and sell them for Canadian dollars when your family is home.

This is a quick and easy way of investing in precious metals. This is especially helpful if you don't live in North America.

Are precious-metal IRAs a good option?

How willing you are to risk your IRA account losing value will decide the answer. You can use them if your cash balance is $10,000, as long you don't expect it to grow quickly. They may not be the best investment option for you if your goal is to save money over many decades and to invest in assets with a high likelihood of increasing in value (gold). These investments can also be subject to fees that could reduce any gains.

Can I physically possess gold in my IRA account?

Many people ask themselves whether it is possible to physically own gold in an IRA. This is a legitimate concern because it is illegal.

However, if you examine the law carefully, you will see that there are no restrictions on gold ownership in an IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It's simple to throw out gold coins but difficult to put them into an IRA. You'll have to pay twice taxes if you keep your gold in your home. You will pay taxes twice: once to the IRS and one for the state in which you live.

You can also lose your gold and have to pay twice the taxes. Why would you want it to stay in your home?

It might seem that you want the security of knowing your gold is safe inside your home. However, to guard yourself against theft, it is worth considering storing your gold in a more secure location.

If you plan on visiting often, you shouldn't leave your precious gold at home. Theft can easily take your gold when you're not home.

It is better to keep your gold in an insured vault. Then, your gold will be protected from fire, flood, earthquake, and robbery.

A vault can also be beneficial because you don't need to pay property tax. You will have to pay income taxes on any gains from the sale of your gold.

You may be interested in an IRA if you don't want to pay taxes on your gold. With an IRA, you won't have to pay income tax even though you earn interest on your gold.

Capital gains tax doesn't apply to gold. That means you have the right to cash your investment at whatever time you choose.

Because IRAs have federal regulation, it won't be difficult to transfer your gold to another bank if there is a move.

The bottom line is: You can own gold in an IRA. Fear of losing it is the only thing that will hold you back.

Are gold IRAs a good place to invest?

You can invest in gold by purchasing shares in companies that mine it. This is a good way to make money when you invest in gold and other precious metals like silver.

But, owning shares in direct form has two downsides:

First, you can lose money by holding onto your stock for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. You could lose your money, rather than make it.

Second, you could miss out on potential profit if you wait for the market to recover before you sell. You may have to wait for the market to recover before you can make a profit on your gold holdings.

If you prefer to keep your investments apart from your finances, physical gold is still an option. A gold IRA can help diversify your portfolio and protect against inflation.

Visit our website to find out more about investing in gold.

What are the fees associated with an IRA for gold?

The average annual fee of an individual retirement account is $1,000. There are many types and types of IRAs. These include traditional, Roth or SEP-IRAs as well as SIMPLE IRAs. Each type comes with its own set rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. Also, consider how long the money will be kept. If you have a long-term goal of holding on to your money, you'll be able to save more money if you open a Traditional IRA.

A traditional IRA lets you contribute up to $5,500 each year ($6,500 if your age is 50+). A Roth IRA allows you to contribute unlimited amounts every year. The difference between them? With a traditional IRA, the money can be withdrawn at your retirement without tax. You'll owe tax on any Roth IRA withdrawals.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

kitco.com

regalassets.com

investopedia.com

wsj.com

How To

How to make your IRA a gold IRA

You want to convert your retirement savings from a traditional IRA to a gold IRA. This article will guide you through the process. This is how you can make the switch.

“Rolling Over” refers to the process of transferring money between two types of IRAs (traditional and gold). Rolling over an IRA account can provide tax advantages. Others prefer to invest in tangible assets, such as precious metals.

There are two types IRAs – Traditional IRAs and Roth IRAs. The difference between these two accounts is simple: Traditional IRAs allow investors to deduct taxes when they withdraw their earnings, while Roth IRAs don't. If you invest $5,000 in a Traditional IRA now, then you'll be able only to withdraw $4,000. You would still be able to keep all your money if you had the same amount invested in a Roth IRA.

This is what you need to know if you want to convert an IRA from a conventional to a IRA to a IRA with gold.

You must first decide whether you want to transfer funds from one account to another or roll over your current balance to a new account. When transferring money, you'll pay income tax at your regular rate on any earnings that exceed $10,000. If you decide to roll over your IRA you will not be subject to income tax on these earnings until you turn 59 1/2.

Once you have made up your mind, it is time to open a brand new account. You will likely need to show proof of identity, such as a passport, Social Security card, or birth certificate. After that, you'll need to sign paperwork proving you own an IRA. After you have completed the forms, submit them to your bank. They will verify your identity as well as give instructions on how to send wire transfers and checks.

Now comes the fun part. The fun part is when you deposit cash into the account, and then wait for the IRS approval. After approval is granted, you will receive a letter saying that you are now allowed to withdraw funds.

That's it! All you need to do now is watch your money grow. You can also close your IRA and transfer the balance to a new one if you change your mind.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]