The Anticipation of a Bitcoin ETF

Bitcoin has experienced a remarkable surge of over 150% in 2023, capturing the attention of Wall Street. This surge has prompted firms to rush towards launching the first-ever Bitcoin exchange-traded fund (ETF).

All eyes are now focused on the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin ETF, scheduled for January 10.

If history is any indication, this ruling will significantly impact Bitcoin's price, although the outcome remains uncertain.

Proponents' Argument for a Bitcoin ETF

Advocates of a Bitcoin ETF believe that its approval by the SEC would unlock a flood of institutional and retail investments, propelling Bitcoin's price to new heights.

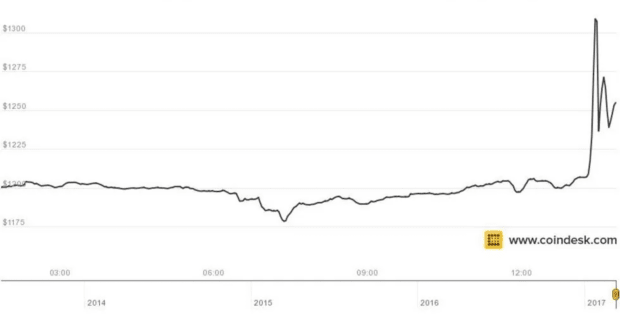

Looking back, past expectations surrounding ETFs have influenced Bitcoin's price. In 2017, the price of Bitcoin skyrocketed to over $1,400, driven by the anticipation of the first Bitcoin ETF. This was a significant increase from the previous year's lows in the $600 range.

Investors at the time believed that a Bitcoin ETF would pave the way for institutional money to enter the market, resulting in a buying frenzy. However, the SEC ultimately rejected the proposal, causing a sharp decline in Bitcoin's price, which quickly fell below $1,000.

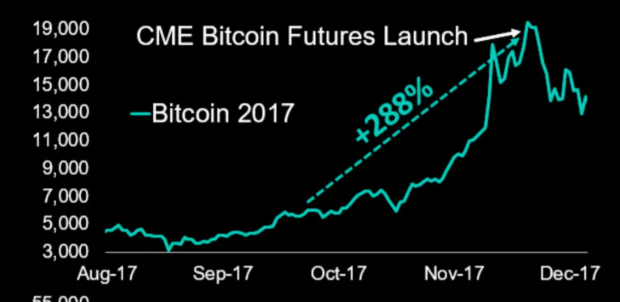

However, the arrival of Bitcoin futures in 2017 brought renewed attention, with the market surging above $20,000 that year.

Fast forward to 2021, when Bitcoin rallied once again to all-time highs, surpassing $60,000. This rally was partly fueled by the successful launch of Bitcoin futures ETFs in Canada and Europe, enabling investors to gain exposure to Bitcoin without directly holding the cryptocurrency. The anticipation of a similar product in the U.S. contributed to bullish sentiment.

In a recent incident, fake news of an ETF approval caused Bitcoin's price to surge by several thousand dollars within minutes, suggesting that an approved ETF could lead to upside volatility.

Potential Challenges and Concerns

On the other hand, there are concerns that the approval of a Bitcoin ETF could trigger a price correction. Some market experts fear that the ETF could become a target for short sellers, leading to increased volatility. Additionally, the ETF approval may attract greater regulatory scrutiny and potentially result in increased taxation, reporting requirements, and restrictions on Bitcoin's use, which could dampen investor enthusiasm.

Furthermore, some argue that the market may have already priced in the possibility of a Bitcoin ETF approval. Any decision to deny it might lead to disappointment and a sell-off similar to the one witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

Considering Multiple Factors

The crypto community eagerly awaits the SEC's final decision, but it is crucial to remember that it is just one of many factors influencing Bitcoin's price. Market sentiment, macroeconomic conditions, and geopolitical events will also play significant roles in shaping the future of the coin.

The Crossroads for Bitcoin's Price

In conclusion, Bitcoin's price stands at a critical juncture as investors anxiously await the SEC's decision on the Bitcoin ETF. While past instances have demonstrated the substantial impact of ETF expectations on Bitcoin's price, it is essential to consider the broader market dynamics. Whether Bitcoin's price rises or falls after the SEC ruling will depend on various factors, including how the market interprets and reacts to the decision.

As the crypto world holds its breath, the future of Bitcoin remains uncertain, but it undeniably marks a pivotal moment for the world's only decentralized cryptocurrency.

Frequently Asked Questions

How do you withdraw from an IRA that holds precious metals?

You may consider withdrawing your funds if you have an account with a precious metal IRA company such as Goldco International Inc. You can sell your metals at a higher price if they are still in the account than if you left them there.

Here is how to withdraw precious metal IRA funds.

First, determine whether the precious metal IRA provider allows withdrawals. Some companies offer this option while others do not.

Second, determine whether you can take advantage of tax-deferred gains by selling your metals. Many IRA providers provide this benefit. However, some don't.

Third, verify with your precious Metal IRA provider if you are charged any fees for taking these steps. The withdrawal may cost extra.

Fourth, make sure you keep track for at least three consecutive years of the precious metal IRA investments after you have sold them. To put it another way, you should wait until January 1st every year to calculate capital gains from your investment portfolio. Next, fill out Form 8949 to determine the amount you gained.

You must file Form 8949 and also report any sale of precious metals to IRS. This will ensure you pay taxes on all the profits that your sales generate.

Finally, consult a trusted accountant or attorney before selling your precious metals. They will ensure you are following all the procedures and avoid making costly mistakes.

Do you need to open a Precious Metal IRA

It all depends on your investment goals and risk tolerance.

An account should be opened if you are planning to use the money in retirement.

The reason is that precious metals are likely to appreciate over time. They also offer diversification benefits.

Additionally, silver and Gold prices tends to move together. This makes them an excellent choice for investors in both assets.

If you're not planning on using your money for retirement or don't want to take any risks, you probably shouldn't invest in precious metal IRAs.

What is the best precious-metal to invest?

The investment of gold is high-returning and has high capital appreciation. It can also protect against inflation and other risks. As people become worried about inflation, the value of gold tends rise.

Gold futures are a great idea. These contracts ensure that you receive a set amount of gold at a fixed rate.

However, futures on gold aren't for everyone. Some prefer to have physical gold.

They can easily exchange their gold with other people. They can also easily sell it whenever they like.

Some people choose to not pay taxes on gold. To do that, they buy gold directly from the government.

You will need to visit several post offices to complete this process. First convert any existing gold into bars or coins.

Then you will need a stamp to attach the coins or bars. Finally, send the coins or bars to the US Mint. There they will melt the coins or bars into new ones.

These new bars and coins have the original stamps stamped on them. These new coins and bars are legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

Decide what precious metal do you want to invest?

Statistics

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

kitco.com

regalassets.com

investopedia.com

wsj.com

How To

How to Buy Gold To Your Gold IRA

A term that describes precious metals is gold, silver and palladium. It refers only to elements with atomic number 79-110 (excluding helium). These elements are considered valuable because they are rare and beautiful. Precious metals that are most commonly used include silver and gold. Precious metals can be used to make money, jewelry, industrial products, and art objects.

Due to supply and demand, the price of gold fluctuates every day. The demand for precious materials has increased dramatically over the last decade as investors seek to find safe havens in volatile economies. This increased demand has caused prices to rise significantly. Some are concerned about the increased cost of production and have resisted investing in precious materials.

Gold is a good investment because it's rare and durable. Like many investments, gold doesn't lose value. You can also sell or buy gold without paying any taxes. There are two ways you can invest in gold. You can either purchase gold bars and coins or invest in futures gold contracts.

The physical gold bars and coins provide immediate liquidity. They are easy to store and trade. But they don't offer much protection against inflation. If you want to protect yourself from rising prices, consider purchasing gold bullion. Bullion is physical gold, which comes in many sizes and shapes. While some billions are sold in one-ounce portions, others come in larger pieces such as kilobars. Bullion is stored in vaults that are protected against theft and fire.

Buy gold futures to own shares and not actual gold. Futures let you speculate about how gold's price might change. You can purchase gold futures to get exposure to the gold price, but not the actual commodity.

For example, if I wanted to speculate on whether the price of gold would go up or down, I could purchase a gold contract. My position after the contract expires will be either “long” (or “short”) A long contract is one in which I believe that the price of gold will rise. I'm willing now to pay someone else money, but I promise I'll get more money at the end. A shorter contract will mean that I expect the price to fall. I'm happy to accept the money right now in exchange of the promise that I'll make more money later.

I'll be paid the amount of gold and interest specified in the contract when it expires. This way I have exposure to the gold's price without having to actually hold it.

Precious metals are great investments because they're extremely hard to counterfeit. Precious metals can't be counterfeited like paper currency. However, new bills can be printed to make them look more authentic. Precious metals have held their value over the years because of this.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]