The Impact of Cash Creation on Bitcoin ETFs

The Securities and Exchange Commission (SEC) has recently met with potential issuers of spot Bitcoin exchange-traded funds (ETFs) to discuss their applications. As a result of these meetings, issuers have adopted a cash creation methodology instead of the traditional "in kind" transfers used by other ETFs. This change has sparked various opinions, but the overall impact is expected to be minimal for investors, significant for issuers, and raises concerns about the SEC's decision-making process.

Understanding the Structure of Exchange Traded Funds

Before diving into the implications of cash creation, it is essential to understand the basic structure of ETFs. ETF issuers work with Authorized Participants (APs) who have the authority to exchange a predetermined amount of the fund's assets (such as stocks, bonds, or commodities) or a specific amount of cash, or a combination of both, in exchange for a fixed number of ETF shares. Typically, "in kind" creation involves exchanging 100 Bitcoin for 100,000 ETF shares. However, with cash creation, the issuer will need to publish the real-time cash amount needed to acquire 100 Bitcoin as the price of Bitcoin fluctuates. The issuer is then responsible for purchasing or selling the required Bitcoin to ensure compliance with the fund's covenants.

This mechanism is applicable to all ETFs, debunking claims that cash creation means the fund won't be backed 100% by Bitcoin. While there may be a short delay in acquiring the necessary Bitcoin, the longer the delay, the higher the risk for the issuer. If the issuer needs to pay more than the quoted price, the fund will have a negative cash balance, impacting its Net Asset Value and performance. On the other hand, if the issuer can buy Bitcoin for less than the cash deposited by APs, the fund will have a positive cash balance, potentially improving its performance.

Challenges and Considerations for Issuers

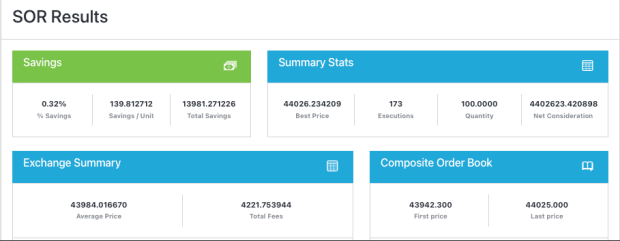

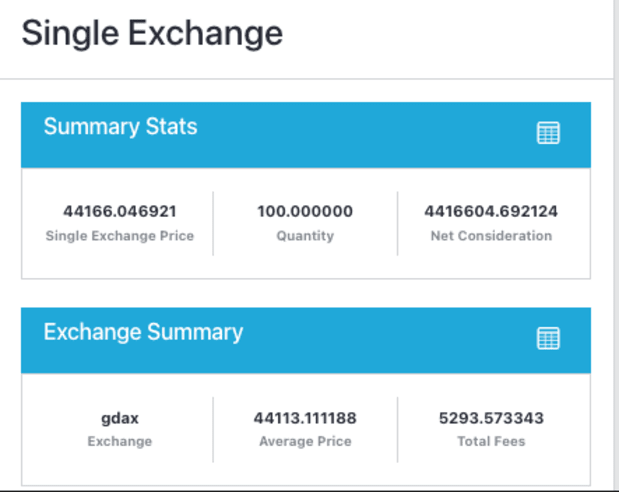

Issuers face the challenge of balancing the goal of quoting a tight spread between creation and redemption cash amounts with their ability to trade at or better than the quoted amounts. This requires access to advanced technology. For instance, quoting based on liquidity solely on Coinbase may yield different results compared to using multiple regulated exchanges. The technology hurdle is evident, as issuers need to navigate numerous market and price level combinations to achieve optimum trading results.

It is unlikely that major issuers will choose to trade on a single exchange, but there may be variations in pricing and costs between issuers based on their chosen trading methods. Those with access to superior trading technology will be able to offer tighter spreads and superior performance.

The SEC's Decision and the Role of APs

The SEC's decision to enforce cash creation/redemption instead of "in kind" transfers is primarily driven by the fact that APs, as regulated broker-dealers, are not authorized to trade spot Bitcoin directly. If the process involved "in kind" transfers, regulated broker-dealers would need approval from the SEC. This explanation is more plausible than various conspiracy theories that lack credibility.

Conclusion

Spot Bitcoin ETFs are a significant development for the Bitcoin industry, but investors should be mindful of the details. Researching how each issuer quotes and trades the creation and redemption process is crucial for predicting performance. Other considerations, such as custodial processes and fees, should not overshadow the importance of understanding the issuer's trading strategy. Ignoring this aspect could lead to costly decisions for investors.

This guest post was written by David Weisberger. The opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Which type of IRA could be used for precious metals

A Individual Retirement Account (IRA), is an investment vehicle offered by most financial institutions and employers. A IRA is a way to make money and allow it to grow tax-deferred, until you withdraw it.

An IRA allows for you to save taxes while still paying taxes when you retire. This means you can save money and pay taxes later on the money that you have deposited to your retirement account.

An IRA is a great investment because your earnings and contributions are tax-free. You can withdraw funds at any time. Early withdrawals are subject to penalties.

You can also make additional contributions to your IRA after age 50 without penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

Refunds received before the age of 591/2 are subject to a penalty of 5% from the IRS. There is a 3.4% penalty for withdrawals between the ages 70 1/2 and 59 1/2.

Withdrawal amounts exceeding $10,000 per year are subject to a 6.2% IRS penalty.

What precious metals can you invest in for retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. To find out how much money you have, take a inventory of everything that you own. You should list all savings accounts, stocks and bonds, mutual funds certificates of deposit (CDs), annuities, life insurance policies, annuities 401(k), real estate investments, and any other assets like precious metals. Then add up all of these items to determine how much you have available for investment.

If you are under 59 1/2 you should consider opening a Roth IRA Account. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. However, you can't take tax deductions from future earnings.

If you decide you need more money, you will likely need to open another investment account. You can start with a regular brokerage account.

Is it possible to make money with a gold IRA.

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

If you don't know, you shouldn't start trading until you are sure you have enough information to trade successfully.

Also, you should find the broker that provides the best service possible for your account type.

There are many account options available, including Roth IRAs (standard IRAs) and Roth IRAs (Roth IRAs).

If you have any other investments such stocks or bonds, you may want to consider a rollover.

What precious metals are permitted in an IRA

The most common precious metallic used in IRA accounts, is gold. You can also invest in gold bullion bars and coins.

Precious and precious metals are considered safe investments, as they don’t lose their value over the course of time. Precious metals are also great for diversifying an investment portfolio.

Precious metals include palladium and platinum. These three metals are similar in their properties. Each metal has its own use.

One example is platinum, which is used to create jewelry. To create catalysts, palladium is used. To produce coins, silver can be used.

Think about how much you can afford to purchase your gold, before you make a decision on the precious metal. It may be more cost-effective to purchase gold at lower prices per ounce.

It is also important to consider whether you would like to keep your investment confidential. If you do, you should choose palladium.

Palladium is more valuable than gold. It is also more rare. It's likely that you will have to pay more.

Another important factor when choosing between gold and silver is their storage fees. You store gold by weight. For larger quantities of gold, you will be charged a higher storage fee.

Silver is stored according to its volume. You'll be charged less for smaller amounts.

Keep in mind all IRS rules when you store precious metals inside an IRA. This includes keeping track of transactions and reporting them to the IRS.

How to open a Precious Metal IRA

A self-directed Roth Individual Retirement Account is the best way to open a IRA for precious metals.

This account is more advantageous than other types of IRAs, because you don’t have to pay taxes on any interest earned from your investments until they are withdrawn.

It is attractive for people who want to save money, but need a tax break.

There are many other options than investing in gold and silver. You can put your money in almost any item that meets the IRS guidelines.

Although most people think of gold and silver when they hear the term “precious metal,” there are many kinds of precious metals.

There are many examples: palladium; platinum; rhodium; osmium; iridium; ruthenium.

There are many ways to invest in precious materials. These include purchasing bullion coins and bars, as well as shares in mining companies.

Bullion Coins & Bars

Buying bullion coins and bars is one of the easiest ways to invest in precious metals. Bullion refers to physical ounces (or grams) of gold and/or silver.

Bullion bars and bullion coin are real pieces of metal.

While you might not feel any change when you buy bullion coin bars or coins from a retailer, you will experience some benefits over time.

You will receive a tangible piece if history, for example. Every coin and every bar has a unique story.

You'll often find that the face value of a coin is far lower than its nominal value. For example, in 1986 the American Eagle Silver Coin sold for $1.00 an ounce. The price of an American Eagle is now closer to $40.00 a ounce.

Bullion's price has risen dramatically since its inception, so many investors would rather invest in bullion coins than futures.

Mining Companies

For those who want to purchase precious metals, another option is investing in shares of mining companies. You're investing in the company’s ability to produce precious metals.

You will then be entitled to dividends which are based upon the company’s profit. These dividends will then go towards paying out shareholders.

In addition, you will benefit from the growth potential of the company. The share prices of the company should rise as more people buy the product.

This is why it's important that you diversify your portfolio. Stocks can fluctuate in prices so it's important to diversify. This allows you to spread your risk among multiple companies.

But, remember that mining companies, like all stock market investments, are susceptible to financial loss.

If gold prices plummet significantly, ownership of your shares could be worthless.

The Bottom Line

Precious metals such silver and gold provide an economic refuge from uncertainty.

Silver and gold, however, can experience wild swings in their prices. If you are interested in long-term investing in precious metals, open a precious Metals IRA account at a reputable firm.

You can enjoy tax benefits while still owning tangible assets.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

investopedia.com

regalassets.com

How To

IRA-Approved Precious Metals

IRA-approved metals are great investments. Many options are available that can diversify your portfolio while protecting against inflation. These include silver coins, gold bars, and silver coins.

Precious metal investment products come in two main forms. Physical bullion products such as bars and coins are considered physical assets because they exist in tangible form. Exchange-traded funds (ETFs), on the other side, are financial instruments which track the price movements for an underlying asset like gold. ETFs can be purchased directly from the company issuing them, and trade in the same way as stocks on stock exchanges.

There are many types of precious metals that you can purchase. While gold and silver are used in jewelry making and decoration, platinum and palladium are most commonly associated with luxury products. Palladium is more stable than platinum and therefore better suited for industrial purposes. Silver is also useful for industrial purposes, although it is usually preferred for decorative applications.

Due to the expense of mining and refining natural materials, physical bullion is more expensive. They are safer than paper currencies, and offer buyers greater security. Consumers may lose faith in the currency and seek out alternatives if the U.S. dollar falls in purchasing power. Contrary to this, physical bullion does not rely on trust among countries or between companies. They are instead backed by central banks and governments, which gives customers security.

Prices for gold fluctuate depending on demand and supply. If demand rises, the price will increase. Conversely, if supply exceeds demands, the price will drop. This dynamic creates opportunities for investors to profit from fluctuations in the price of gold. These fluctuations are good for investors who have physical bullion products as they get a better return on their investment.

Contrary to traditional investments, precious metals can not be affected by economic recessions and interest rate changes. As long as demand remains strong, the price of gold will continue to rise. This is why precious metals are considered safe havens when times are uncertain.

The most sought-after precious metals are:

- Gold – This is the oldest kind of precious metal. It is often called “yellow gold”. Gold is a common name, but it's a rare element that can be found underground. Most of the world's gold reserves are in South Africa, Australia, Peru, Canada, Russia, and China.

- Silver – After gold, silver is the second most precious precious metal. Silver, like gold, is extracted from natural deposits. However, silver is more commonly extracted from ore than from rock formations. Because of its durability and malleability, as well as resistance to tarnishing, silver is widely used in commerce and industry. The United States accounts for more than 98% global silver production.

- Platinum – Platinum ranks third in the most valuable precious metals. It can be used to make high-end medical equipment, fuel cells, and catalytic converters. Platinum is also used in dentistry to make dental crowns, fillings, and bridges.

- Palladium – Palladium ranks fourth in the list of most valuable precious metals. Its popularity is growing rapidly among manufacturers because of its strength and stability. Palladium is also used in electronics, automobiles, aerospace, and military technology.

- Rhodium – Rhodium is the fifth most valuable precious metal. Although rhodium is extremely rare, it is highly sought after because of its use in automobile catalysts.

- Ruthenium-Ruthenium is the sixth-most valuable precious metal. While there are only limited supplies of platinum and palladium, ruthenium is plentiful. It is used in steel making, aircraft engines, and chemical manufacturing.

- Iridium – Iridium is the seventh-most valuable precious metal. Iridium has a significant role in satellite technology. It is used for the construction of satellites with orbital capabilities that transmit television signals and other communications.

- Osmium: Osmium is eighth most valuable precious metallic. Osmium can withstand extreme temperatures and is commonly used in nuclear reactors. It's also used in jewelry, medicine and cutting tools.

- Rhenium – Rhenium is the 9th most valuable precious metal. Rhenium is used in refining oil and gas, semiconductors, and rocketry.

- Iodine- Iodine ranks as the tenth most precious precious metal. Iodine is used in photography, radiography, and pharmaceuticals.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]