Are you ready to dive into the future of Bitcoin mining? Block Inc., led by Jack Dorsey, has unveiled the Proto Rig, a groundbreaking modular Bitcoin miner that's set to shake up the industry. Say goodbye to the days of Bitmain's dominance, because the Proto Rig is here to challenge the status quo with its innovative design and functionality.

The Birth of Proto Rig: Redefining Mining Hardware

Disrupting the Market

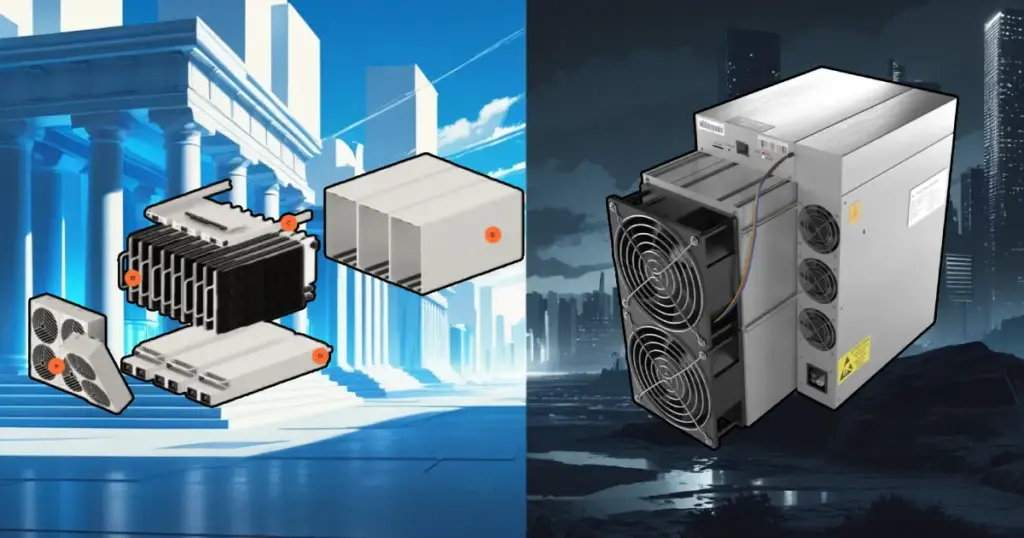

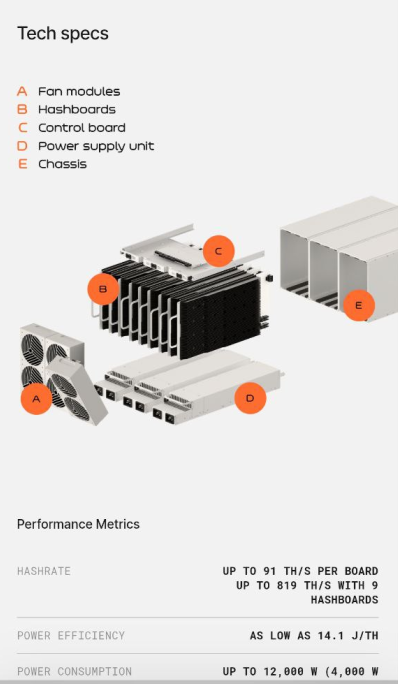

Let's talk about the game-changing Proto Rig. This innovative miner is not just about faster chips or energy efficiency; it's about a complete overhaul of the mining hardware landscape. With a focus on durability, cost-effectiveness, and easy maintenance, the Proto Rig introduces a modular design that allows for quick upgrades and part replacements, setting a new standard in the industry.

The Vision Behind Proto Rig

Perry Hothi, from Block's mining division, sheds light on the philosophy behind Proto Rig. It's not just about being competitive; it's about being profitable. By shifting the conversation from chip specs to overall rig design, Proto Rig aims to leverage decades of data center expertise to optimize mining operations for maximum efficiency and reliability.

Unveiling the Modularity of Proto Rig

The Power of Modularity

Picture a Lego set for miners – that's the Proto Rig for you. Designed with modular pieces, the Proto Rig offers flexibility and scalability like never before. From customizable chip configurations to clear error signals, this miner is a dream come true for both industrial and home miners looking to level up their game.

Delivering More with Less

Despite its compact size, the Proto Rig packs a punch. With the ability to deliver superior performance compared to traditional models, this miner is a game-changer in terms of efficiency and space utilization. Whether you're a big player or a home miner, the Proto Rig promises to cater to your needs with its customizable options.

Embracing StratumV2 for Decentralization

A New Era of Decentralization

Proto Rig isn't just about hardware; it's also about software innovation. By integrating StratumV2 into its system, Proto Rig aims to decentralize block template production, safeguarding the core principles of Bitcoin's censorship resistance. This move towards greater decentralization is a significant step forward for the mining community.

Empowering Miners with Open-Source Software

Fleet: The Future of Mining Management

Proto's commitment goes beyond hardware with the release of Fleet, an open-source mining management software. By streamlining operations, enhancing security, and offering AI-powered features, Fleet sets a new standard for user experience in the mining industry. Get ready to revolutionize how you manage your mining operations!

Unlocking the Future with Proto Rig: Pricing and Availability

Join the Revolution

Excited to get your hands on the Proto Rig? While pricing details are still under wraps, the Proto Rig is already making its way to customers. Reach out to the sales team to explore configuration options and availability. Don't miss out on this opportunity to be part of the future of Bitcoin mining!

Frequently Asked Questions

Can you make money on a gold IRA?

You must first understand the market and then know which products are available to make money.

Trading is not a good idea if you don’t know what you need.

You should also find a broker who offers the best service for your account type.

Many different accounts are available, including standard IRAs and Roth IRAs.

If you have other investments such as bonds or stocks, you might also consider a rollover.

What is a Precious Metal IRA?

Precious metals make a great investment in retirement accounts. They have held their value since biblical times. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

Certain countries permit citizens to hold their money in foreign currencies. You can buy gold bars in Canada, and then keep them at the home. You can also sell these gold bars for Canadian dollar when you visit family.

This is a great way to invest in precious metals. It's especially useful if you live outside of North America.

What is the best precious-metal to invest?

The investment of gold is high-returning and has high capital appreciation. It also protects against inflation and other risks. As people worry about inflation, the price of gold tends increase.

It is a smart move to purchase gold futures. These contracts ensure that you receive a set amount of gold at a fixed rate.

However, gold futures aren't suitable for everyone. Some people prefer to own physical gold instead.

They can also trade their gold easily with others. They can also make a profit by selling their gold at any time they desire.

Some people would rather not pay tax on their gold. To do that, they buy gold directly from the government.

You will need to visit several post offices to complete this process. First convert any existing gold into bars or coins.

Finally, you'll need to get a stamp to put on the bars or coins. Finally, you send them to the US Mint. They melt the bars and coins into new coins.

The original stamps are used to stamp the new coins and bars. That means that they're legal tender.

If you buy gold from the US Mint directly, you won’t have to pay tax.

Decide what precious metal do you want to invest?

How to open a Precious Metal IRA

An IRA to hold precious metals can be opened by opening a Roth Individual Retirement Account (IRA) that is self-directed.

This type account is better than others because you don’t have any tax on the interest that you earn from investments until you remove them.

This makes it attractive to those who want a tax break but still want to save some money.

You do not have to only invest in gold and silver. You can invest in whatever you like, provided it conforms to IRS guidelines.

Most people associate “precious” metal with gold or silver, but there are many different types of precious metals.

These include palladium, platinum, rhodium,osmium,iridium, andruthenium.

You can invest in precious and base metals in many different ways. Two of the most popular ways to invest in precious metals are buying bullion coin and bar coins, and also purchasing shares in mining corporations.

Bullion Coins or Bars

The easiest way to invest in precious materials is to buy bullion coins or bars. Bullion is a general term that describes physical ounces, or physical gold and silver.

When you buy bullion coins and bars, you receive actual pieces of the metal itself.

While you might not feel any change when you buy bullion coin bars or coins from a retailer, you will experience some benefits over time.

For example, you will get a tangible piece of history. Each coin and bar is unique.

If you compare the nominal value to face value, you will often find that it is worth much less than its nominal. In 1986, the American Eagle Silver Coin was $1.00 per ounce. The price of an American Eagle is now closer to $40.00 a ounce.

Since the value of bullion has increased dramatically since its introduction, many investors prefer buying bullion coins and bullion bars rather than futures contracts.

Mining Companies

Investing in shares of mining companies is another great option for those looking to buy precious metals. You are investing in the ability of mining companies to produce gold or silver.

You will get dividends based off the company's profits in return. These dividends will then go towards paying out shareholders.

You will also benefit from the company's growth potential. The demand for the product will also cause an increase in share prices.

Because these stocks fluctuate in price, it's important to diversify your portfolio. This involves spreading your risk over multiple companies.

It is important to keep in mind that mining companies can lose their financial investments just as stock markets investors.

If gold prices drop dramatically, your ownership share could be worthless.

The Bottom Line

Precious Metals such as gold or silver offer a safe haven in times of economic uncertainty.

However, both gold and silver are subject to wild swings in price. You might be interested in long-term investments in precious metals. Consider opening a precious metals IRA with a reputable company.

By doing this, you can reap the tax benefits and still have physical assets.

Is a gold IRA worth interest?

It depends on how many dollars you put into it. If your income is $100,000, then yes. You can't if you have less than $100,000

The amount of money that you put into an IRA is what determines whether it earns or not interest.

If you are putting in more than $100,000 annually for retirement savings, you should open a regular brokerage account.

There you will earn more interest, but also be exposed to higher risk investments. You don't want your entire portfolio to go bankrupt if the stock markets crash.

An IRA may be better for you if your annual income is less than $100,000. At least until the market recovers.

Can I have gold in my IRA.

Yes, it is possible! It is possible to add gold to your retirement plans. Gold is a great investment as it doesn't lose money over time. It also protects against inflation. It doesn't come with taxes.

Before you decide to invest in gold, it is important to understand that it isn't like other investments. You cannot buy shares of companies that are gold, like stocks and bonds. These shares can also be not sold.

Instead, you should convert your gold to cash. This means you will need to get rid. It's not enough to hold on to it.

This makes gold different than other investments. As with other investments you can always make a profit and sell them later. This is not true for gold.

The worst part is that you cannot use your gold to secure loans. To cover a mortgage, you may need to give up some gold.

What does this all mean? It's not possible to keep your gold for ever. You will have to sell it at some point.

However, there is no need to panic about it. Open an IRA account. Then, you are able to invest in gold.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

en.wikipedia.org

investopedia.com

regalassets.com

takemetothesite.com

How To

Precious metals approved by the IRA

IRA-approved metals are great investments. Diversifying your portfolio can protect you from inflation with a variety of options, including silver coins and gold bars.

Precious metal investments products can be purchased in two forms. Because they are tangible, physical bullion products like bars and coins can be considered assets. Exchange-traded funds (ETFs), on the other side, are financial instruments which track the price movements for an underlying asset like gold. ETFs trade just like stocks, and investors can purchase shares from the company that is issuing them.

There are many types of precious metals that you can purchase. Gold and silver are often used for jewelry making and decorating, while platinum and palladium are more commonly associated with luxury items. Palladium is more stable than platinum and therefore better suited for industrial purposes. While silver is used in industry, decorative uses are preferred over it.

Due to the higher cost of mining and refining materials, physical bullion items tend to be more expensive. However, they are generally safer than paper currencies and provide buyers with greater security. For example, consumers may lose confidence in the currency and look for alternatives when the U.S. dollar loses purchasing power. Physical bullion products, on the other hand, do not depend on trust between companies or countries. They are backed instead by central banks or governments, providing customers with peace of mind.

The supply and demand for gold affect the price of gold. The price of gold will rise if there is more demand. Conversely, a decrease in supply can cause the price to fall. This dynamic opens up opportunities for investors who want to profit from fluctuations of the price gold. Physical bullion investors benefit because they have a greater return on their capital.

Unlike traditional investments, precious metals cannot be affected by economic recessions or interest rate changes. As long as the demand for gold remains strong, it will continue to rise. Because of this, precious metals are considered safe havens during times of uncertainty.

The most sought-after precious metals are:

- Gold – The oldest form of precious metal, gold is also known as “yellow” metal. Although gold is a common household name, it is a very rare element found naturally underground. Most of the world's gold reserves are in South Africa, Australia, Peru, Canada, Russia, and China.

- Silver – Silver, which is second in value after gold, is silver. Silver, like gold, is extracted from natural deposits. However, silver is usually extracted from ore and not from rock formations. Because of its durability and malleability, as well as resistance to tarnishing, silver is widely used in commerce and industry. The United States produces over 98% of all global silver production.

- Platinum – The third most precious precious metal is platinum. It can be used in many industrial applications, including fuel cells, catalysts, and high-end medical devices. It is used in dentistry for dental crowns, fillings and bridges.

- Palladium: Palladium is the 4th most valuable precious metallic. Its popularity is growing rapidly among manufacturers because of its strength and stability. Palladium is also used in electronics, automobiles, aerospace, and military technology.

- Rhodium: Rhodium ranks fifth in the most valuable precious metals. Rhodium is a rare metal, but it is highly sought-after because of its use as a catalyst for automobile engines.

- Ruthenium, the sixth most precious precious metal, is Ruthenium. Although there is a limited supply of palladium and platinum, ruthenium can be found in abundance. It is used to make steel and engines for aircraft, as well chemical manufacturing.

- Iridium: Iridium (the seventh most valuable precious metallic) is the seventh. Iridium plays an important role in satellite technology. It is used for the construction of satellites with orbital capabilities that transmit television signals and other communications.

- Osmium – Osmium, the eighth most precious precious metal, is also known as Osmium. Osmium's ability to withstand extreme temperatures makes it a common metal in nuclear reactors. Osmium is used in medicine, cutting tools, jewelry, as well as medicine.

- Rhenium – Rhenium is the ninth most valuable precious metal. Rhenium can also be used in rocketry, oil refinement, and semiconductor manufacturing.

- Iodine – Iodine is the tenth-most valuable precious metal. Iodine has been used in radiography, pharmaceuticals, and photography.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]